|

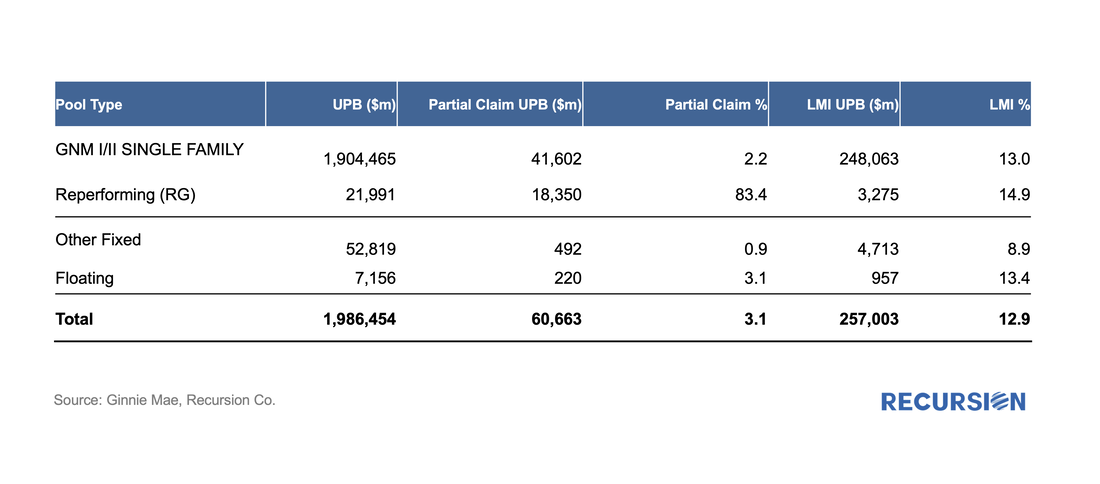

In recent posts, we’ve been tracking the progress of loans coming out of forbearance into various pool types such as Reperforming (RG), Extended Term (ET) and, even Private Label pools[1]. A different perspective can be obtained by looking at the disposition of loans with partial claims. Recall that a partial claim occurs when a borrower with missed payments can resume making payments but does not have the resources to increase payments to compensate for the balance missed. In general, the missed payments are placed into a subordinate lien that comes due when the mortgage is extinguished. It is important to note that a partial claim is not a modification, and a loan with a partial claim does not have to be in a forbearance program. Recently, Ginnie Mae announced that they would disclose the share of loans in pools with partial claims[2]. Below find a summary table of these results reported first ever as of April, 2022 Out of the entire $1.9 trillion universe of Ginnie Single-family pools, just a little over 3% of loans have partial claims. In terms of share, reperforming (RG) pools comprise only 1.2% of the total but contain over 30% of the loans with partial claims (measured by UPB). It appears that some loans that are reperforming but did not apply (or did not succeed in obtaining) a partial claim. About 2.2% of UPB in GNM I/II Single-family pools are loans with partial claims. Loans provided partial claims are not required to be bought out of pools---it can happen in the pools. Finally, the share of floating-rate pools with partial claims is larger than that of fixed rate pools because floating rate loans are not eligible to be securitized into an RG pool. Finally, beginning last summer Ginnie Mae began to disclose data on the share of low-moderate income borrowers in its pools[3]. Interestingly, the pools with the highest share of such loans are the RG pools, which at close to 15% stand about 2% higher than the other pool types. Much more can be done with this, particularly looking at pools by vintage. But the ongoing stream of new disclosures is an important part of assessing the impact of creative policymaking. [1] See https://www.recursionco.com/blog/the-rg-pool-arrives, https://www.recursionco.com/blog/phoning-home-the-new-et-pools-have-landed, https://www.recursionco.com/blog/another-outlet-for-loans-exiting-forbearance [2] https://www.ginniemae.gov/investors/disclosures_and_reports/Pages/BulletinsDispPage.aspx?ParamID=571&Ident=2022-019 [3] https://www.ginniemae.gov/newsroom/HAPS/pages/Post.aspx?PostID=56 Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed