|

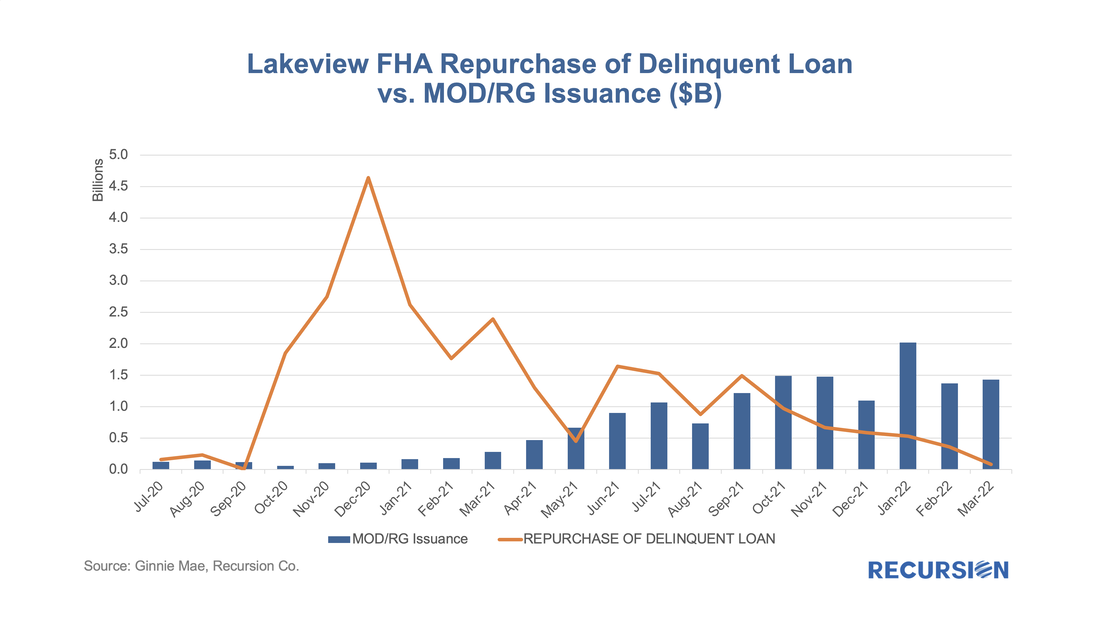

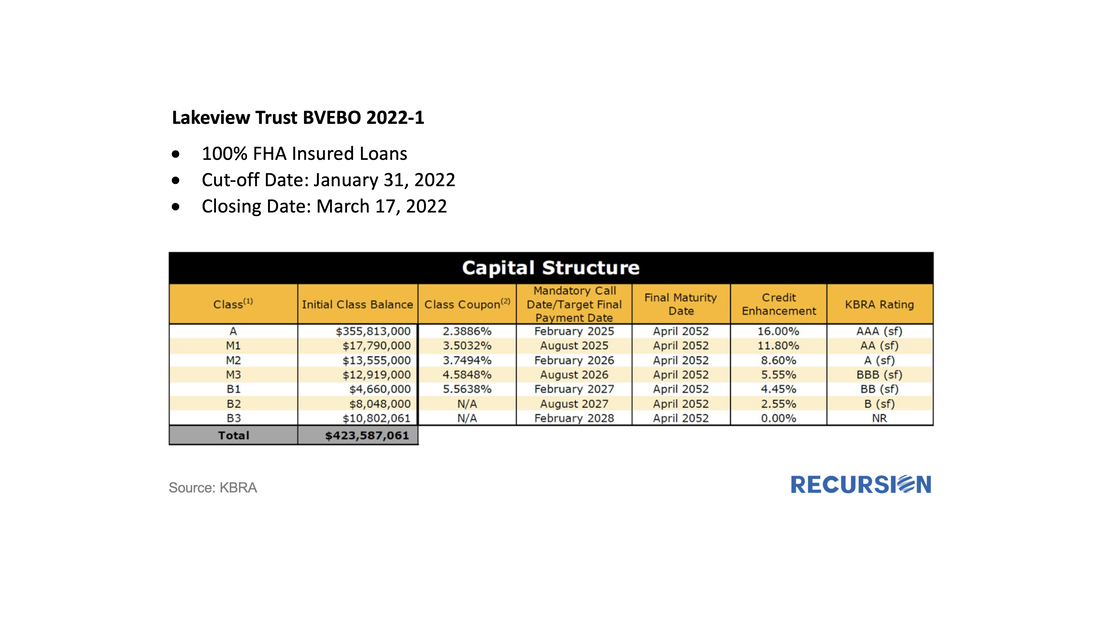

In a recent post[1], we discussed the disposition of loans that are exiting forbearance programs. In the Ginnie Mae programs, many loans bought out of pools have received modifications or other workouts, and then redelivered to Ginnie Mae pools. However, we have historically observed that there are more loans bought out than re-delivered, even considering the time needed for the workout. As it turns out, there are other market-based outlets for these loans, which is more evident at the issuer level than in aggregate. Below find a chart of buyout and securitization activities within Ginnie Mae program for Lakeview, the third-largest Ginnie Mae servicer as of April 2022. Over the period July 2020-March 2022, Lakeview purchased about $27 billion of FHA delinquent loans out of pools and delivered about 2/3 of that amount into FHA MOD/RG pools. While more MOD/RG issuance is likely in the coming months, it turns out there is another channel. Lakeview has decided to securitize about $424 million in repurchased FHA loans, sold as Lakeview Trust 2022-EBO1 (BVEBO 2022-1), where EBO stands for Early Buyout. KBRA provided ratings for the one A tranche (84%), subordinated by 3 Mezzanine tranches and 3 B tranches of this deal. This deal is modest compared to the outstanding volume of loans bought out by Lakeview that have not been resecuritized into Ginnie MOD pools, but it is a demonstration of the innovation that is at the center of the secondary mortgage market. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed