|

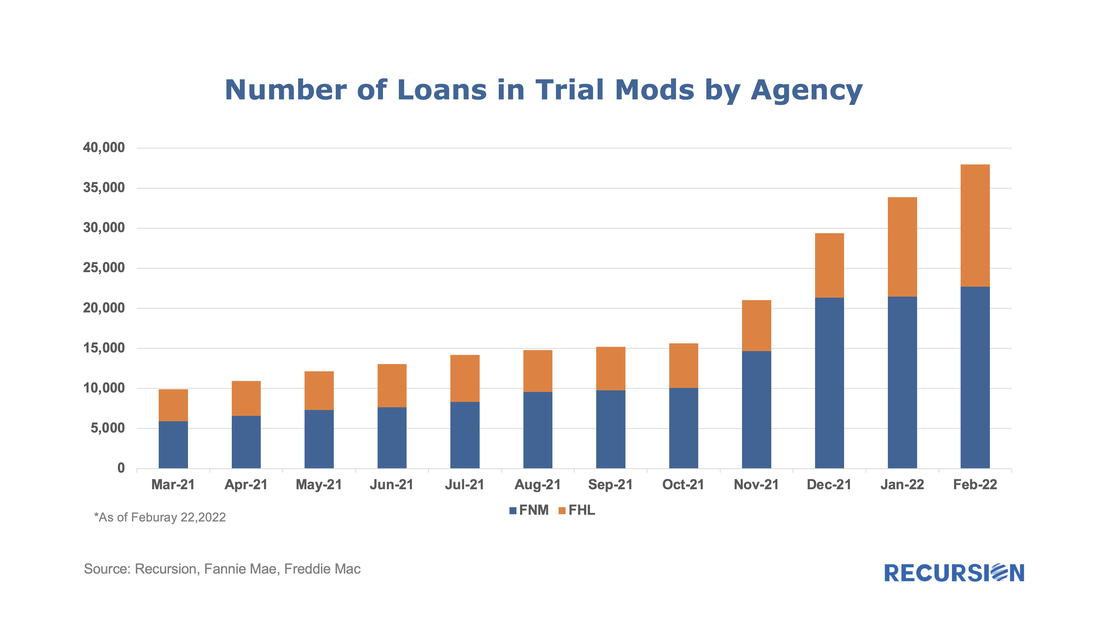

In a recent post, we discussed the utility of secondary market indicators to track the progression of loans that are coming out of forbearance in Government programs[1]. This short note looks at this progression in the conforming loan market. For the Ginnie Mae programs, issuers may buy loans out of pools after they are delinquent more than 90 days and begin a workout process that culminates in one of the options, including loan modification. The situation is quite a bit different for Fannie Mae and Freddie Mac. The main distinction is that on January 1, 2021, the GSEs extended their timeline for buying loans out of pools to 24 consecutive months of missed payments[2]. As the Covid-19 pandemic began in March 2020, we expect to see buyouts being extended as much as to April and May this year. However, we can obtain a view on future loan modifications through the trial mod flag in the borrower assistance plan field in the monthly disclosures the GSEs started to release in March, 2021. In order to obtain a permanent modification, borrowers must first successfully complete a three-month trial modification plan[3]. Below find the progression in the number of loans in such plans since March 2021: As one can see, the number of GSE loans in trial-mod increased from 10K to over 35K since a year ago. Fannie Mae’s utilization rate of trial-mod program is much higher than that of Freddie Mac. Between the Government and Conforming programs, we anticipate an increasing number of borrowers will be entering modification programs in 2022. Such an unprecedented development makes it difficult to assess how mortgage market performance will respond in an economic downturn. [1] See https://www.recursionco.com/blog/agency-based-metrics-for-assessing-the-resolution-of-mortgage-forbearance-and-delinquencies-part-i-government-programs [2] https://capitalmarkets.fanniemae.com/mortgage-backed-securities/single-family-mbs/fannie-mae-extends-timeframe-single-family-mbs-delinquent-loan-buyout-policy#:~:text=Effective%20January%201%2C%202021%2C%20Fannie,to%20twenty%2Dfour%20consecutively%20missed [3] https://my.sf.freddiemac.com/servicing/flex-modification Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed