|

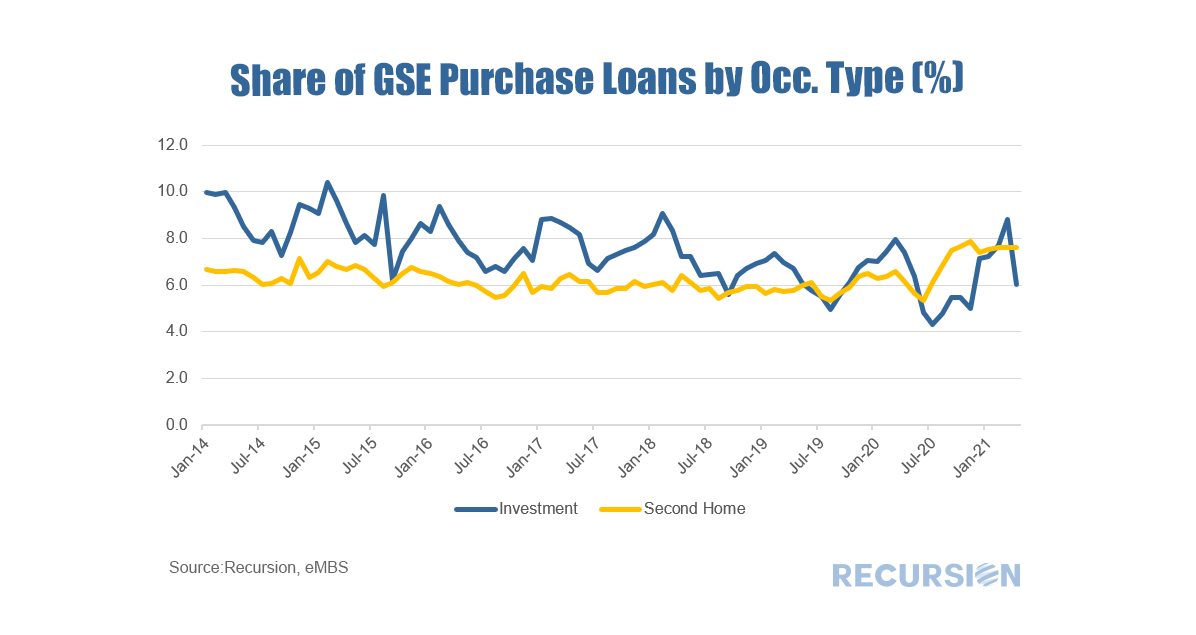

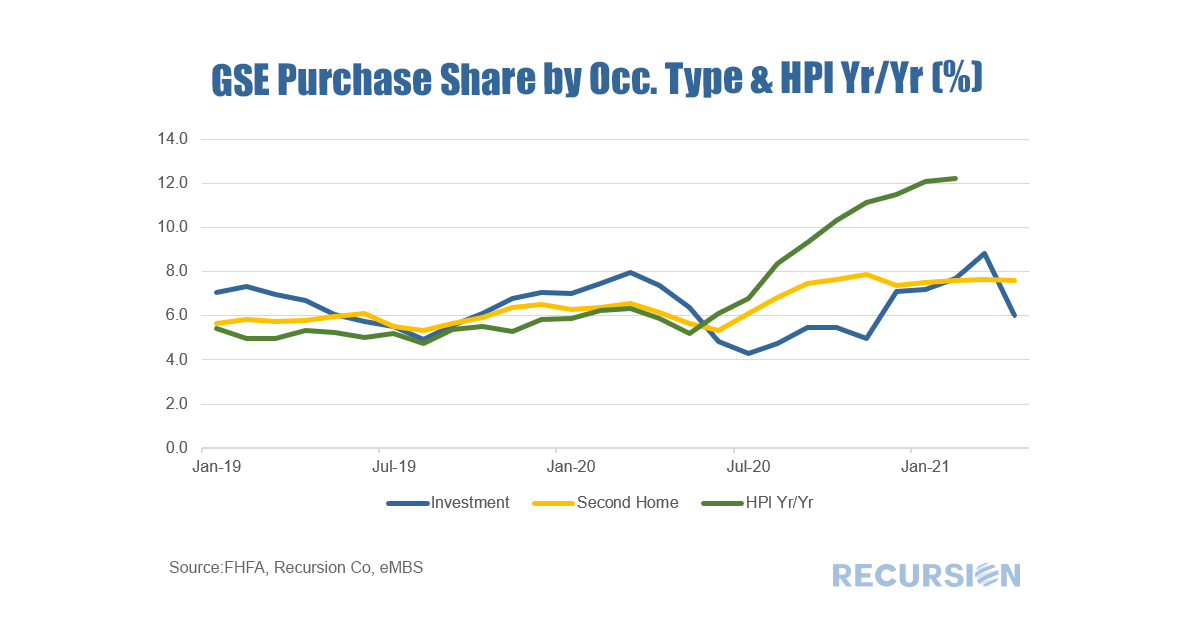

With house prices soaring to new highs on the back of pandemic-related household relocations and sub 3% mortgage rates, the natural question is how far these trends can continue. While we have no crystal ball for calling market tops and bottoms, we feel we can gain some insight into market dynamics by looking into the composition of demand. The GSE’s provide us with the ability to peer into this composition through the “Occupancy Type” flag, which consists of three types: owner-occupied, second homes and investor properties. Here we look at the share of all purchase mortgages from the last two types: A couple of points jump out right away. First, from 2014-2019 the second home share of delivered purchase loans to the GSE’s was pretty steady around 6% of the total market. The share of investor loans in contrast was in trend decline from near 10% to about half that in 2019. This is in line with the trend increase in house prices over that time. Investor shares are seasonal, essentially peaking during the winter months when the owner-occupied market is quietest. Of course, things changed in 2020 and the onset of the Covid-19 Pandemic. Below find the same chart 2019-April 2021 with an overlay of the Yr/Yr change in the purchase-only FHFA house price index: The dynamics here are quite interesting. After a long run of a 6% market share, second homes jumped to an 8% share and held steady, boosted by low rates and a desire among wealthy urban households to have a spare place to go with more room.

The activity of investors is particularly eye-catching. The long-turn downtrend took the investor share of the market to a seven-year low near 4.3% in July 2020 (recall that this data is deliveries, so the home sales behind these occurred largely in May-June that year). Boosted by low rates and a keen sense of market trends, this share more than doubled to 8.8% in March this year. Interestingly, in April the share dropped by 2.8% to 6.0%, the second-biggest monthly decline since 2014 (the share fell by 3.6% in September 2015 to 6.2%). Whether this is the normal seasonal pattern or a new trend developing whereby the smart money is taking profits, remains an open question. The next post will look at the policy implications of these trends. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed