|

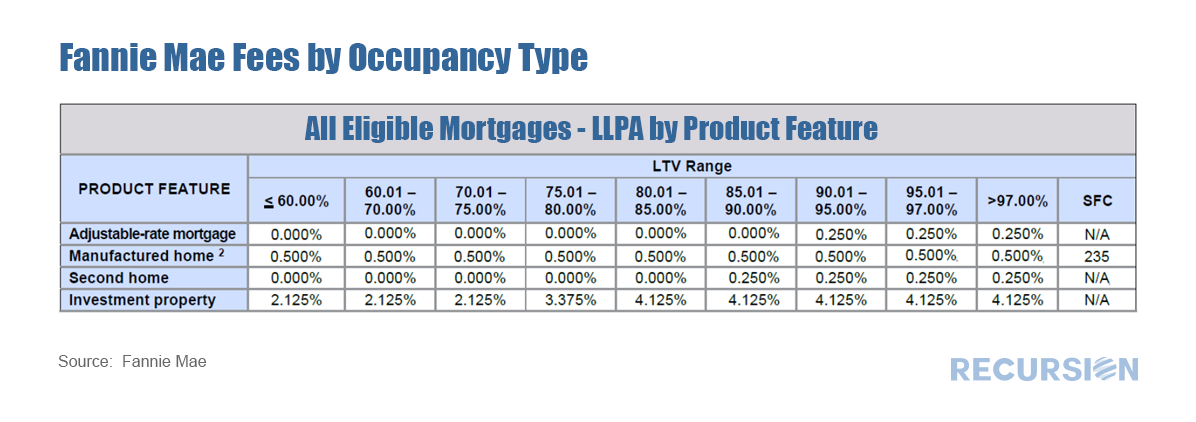

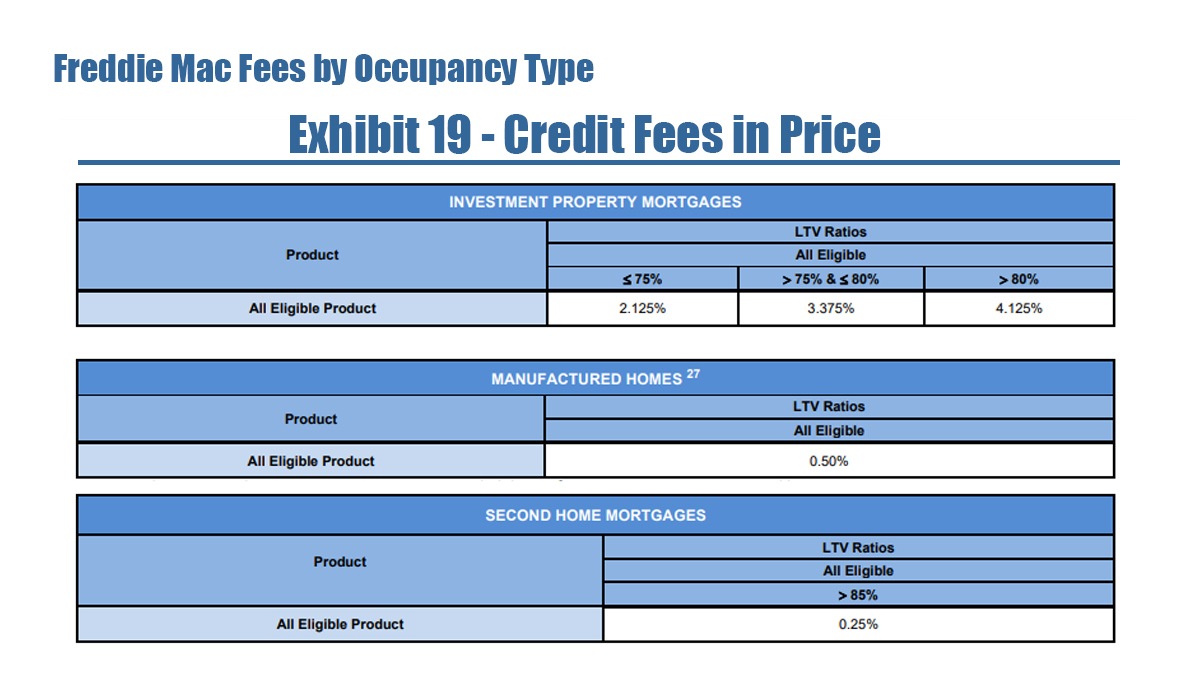

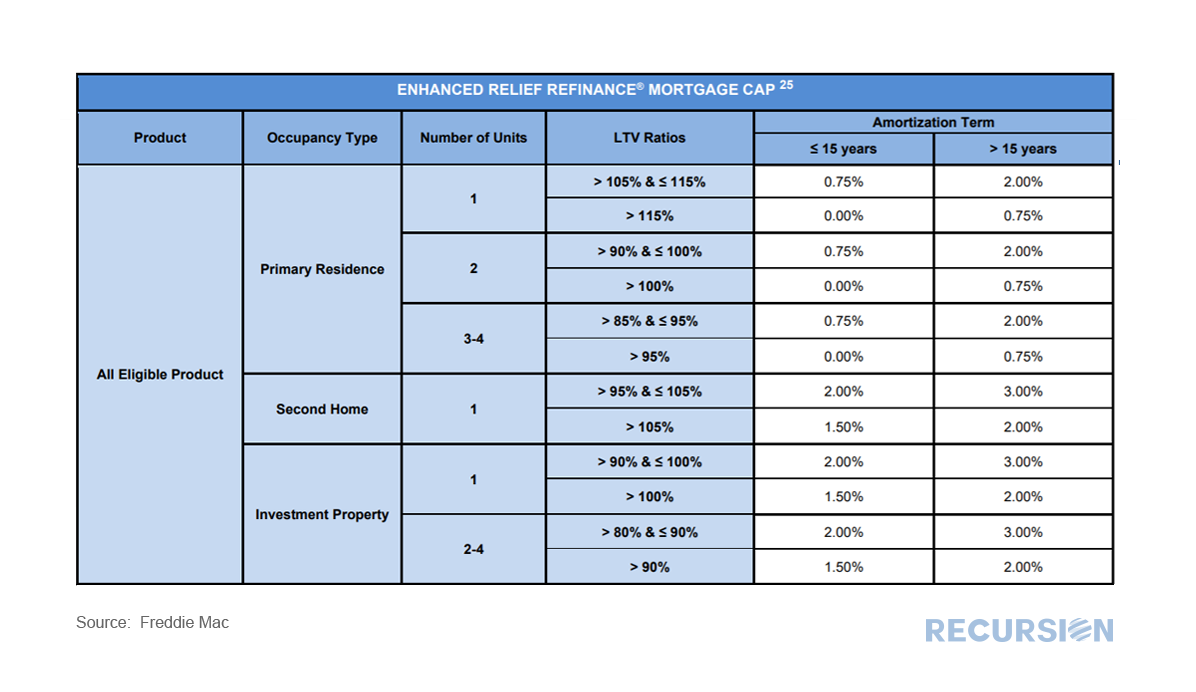

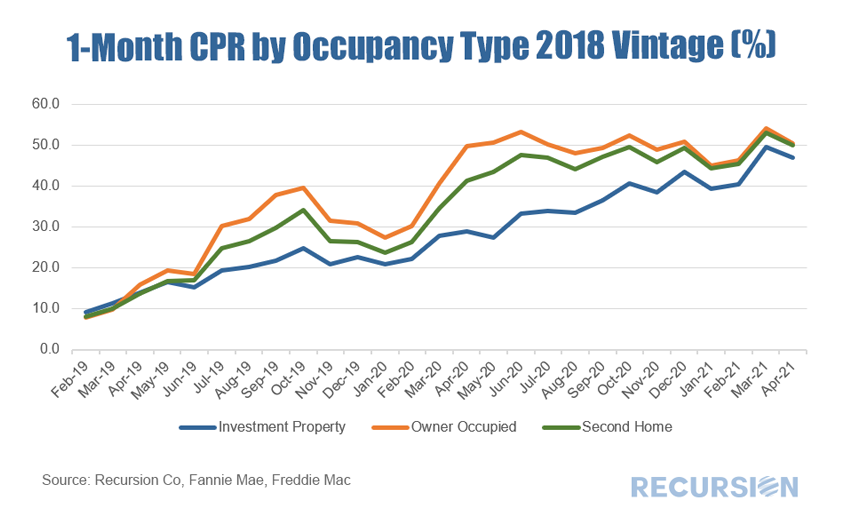

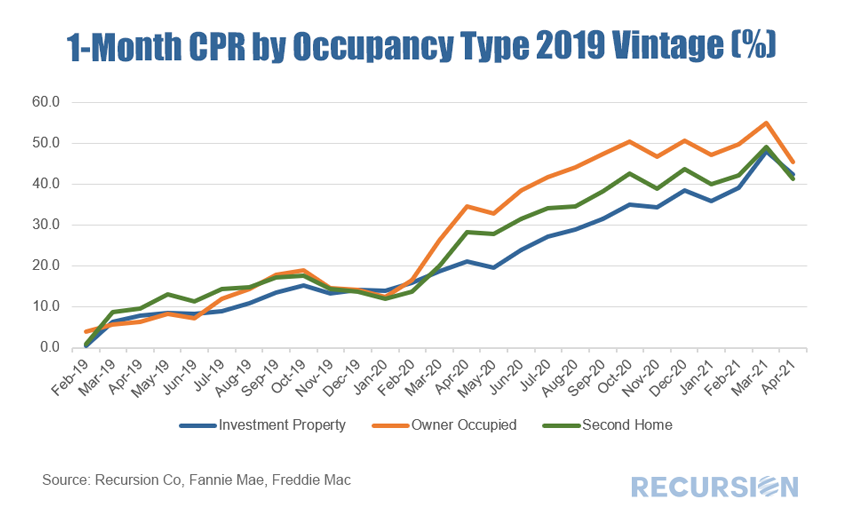

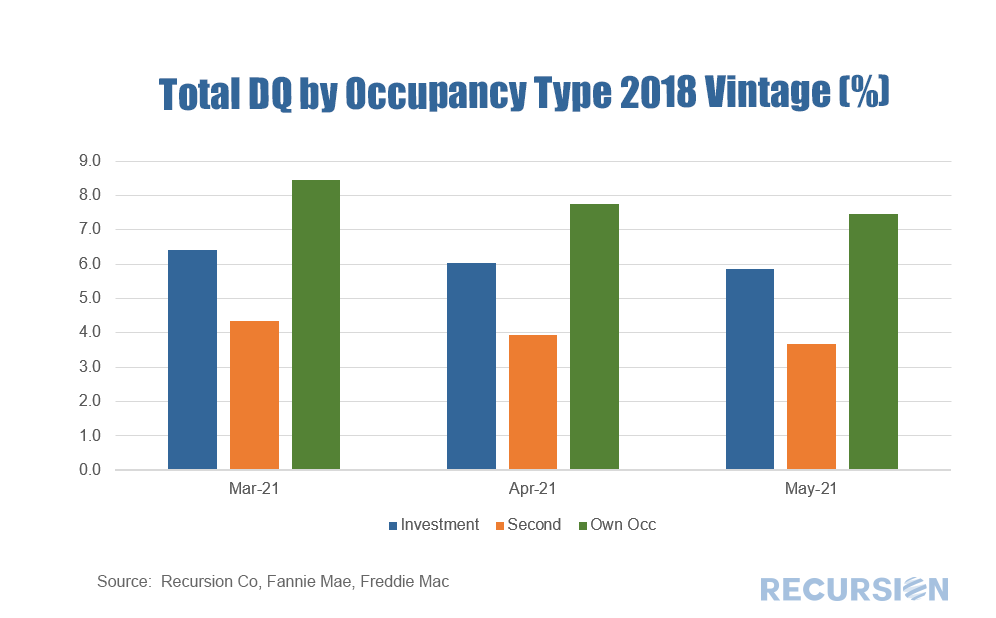

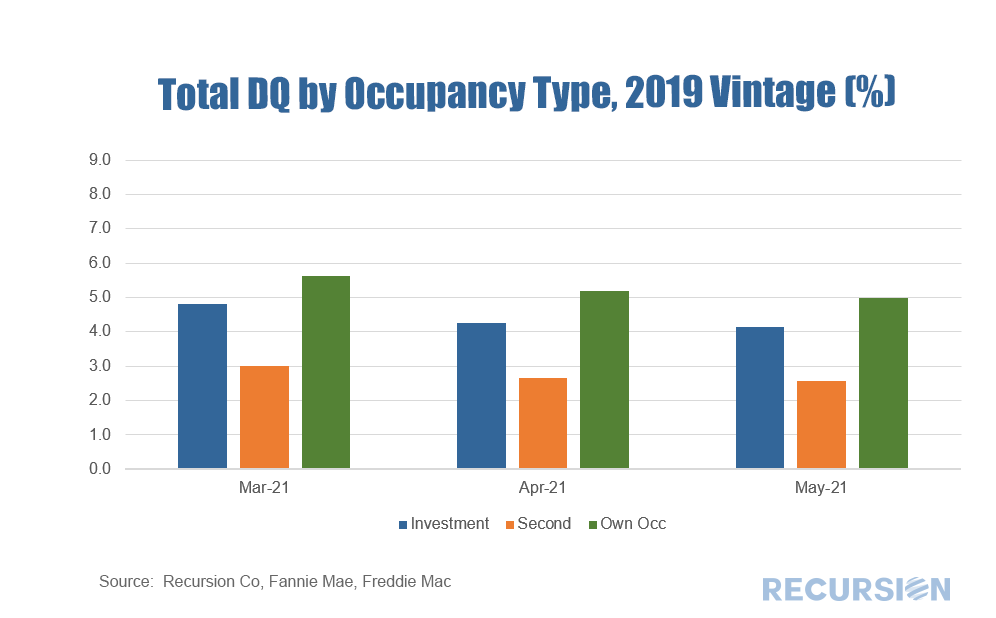

In a recent post we discussed trends in the conforming purchase market by occupancy type[1]. In this note we look at performance metrics. To begin, we look at prepayment speeds. It’s important to note that certain fees (which Fannie Mae calls LLPA’s[2] and Freddie Mac calls Credit Fees[3]) vary by occupancy type, particularly for those with high LTV’s. In general, fees for investment properties are higher than those for second homes which are higher than those for primary residences: Below find 1-month prepayment speeds for loans delivered to the GSEs by 2018 and 2019 vintages and occupancy types: For each vintage, since mortgage rates began to fall in early 2019, the lowest fee occupancy types have tended to prepay faster than higher-fee ones. It is interesting to note that second homes from the 2018 vintage prepaid close to primary residences, while for the 2019 vintage they prepaid more like investment properties. An interesting, related issue is the performance of loans by occupancy type as measured by delinquency rates. Below find tables of total delinquency for the March – May 2021 period for loans delivered to the GSE’s by occupancy type: In each category, owner-occupied houses had higher delinquency rates than investment properties while second homes posted the best performance. This pattern raises the question of whether the fees imposed for each occupancy type are set to limit the growth on non-owner occupied homes to support homeownership in general. The policy side of these questions is the subject of considerable attention, and will be addressed in upcoming posts. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed