|

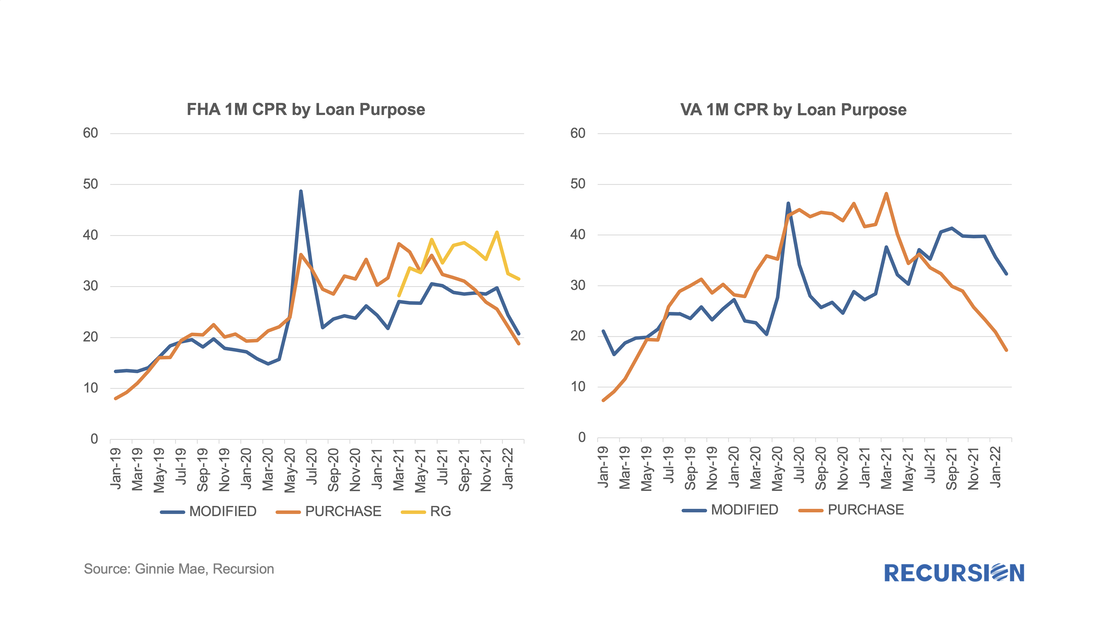

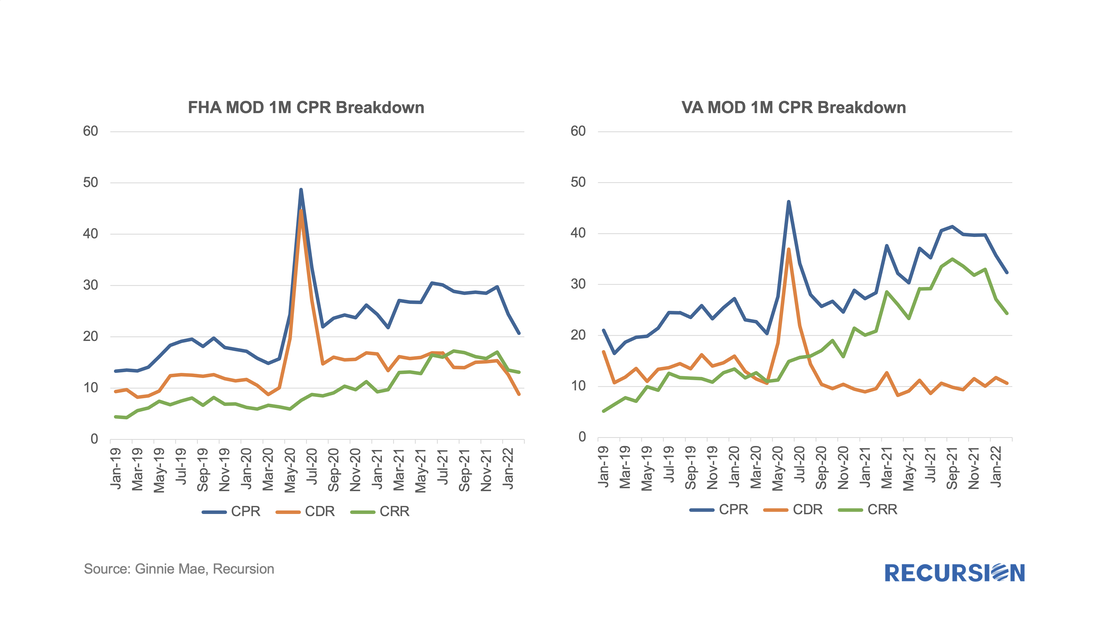

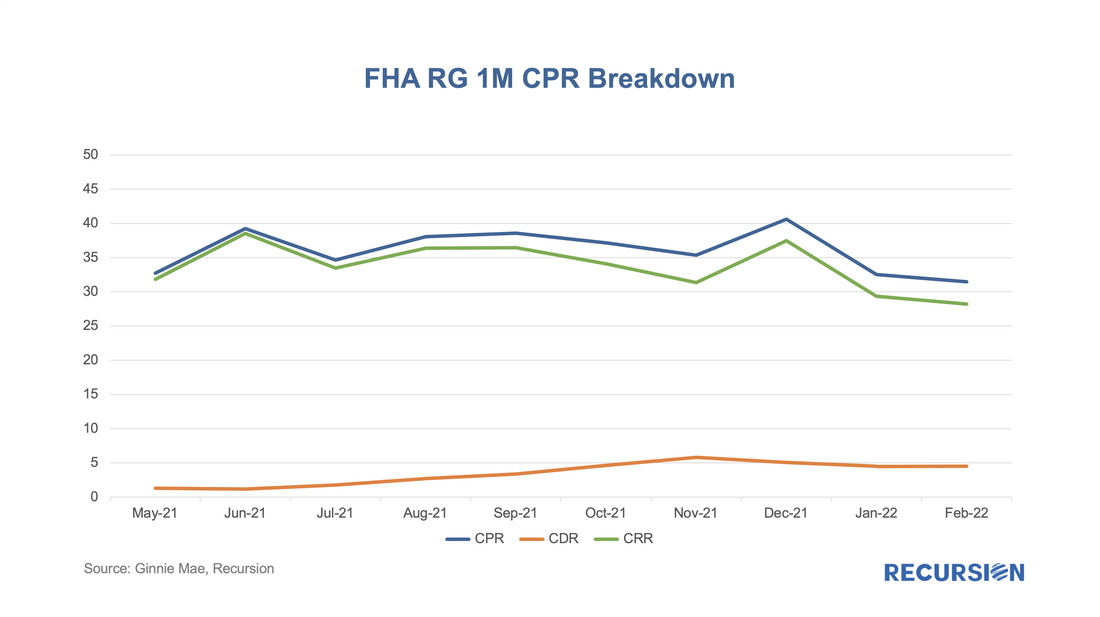

With the expiration of forbearance programs underway, there is an interesting question about how loans exiting these programs will perform once they are resecuritized. For Ginnie Mae programs, these are either loans that exit forbearance with a partial claim or receive a permanent mod under the various waterfall options in the FHA or VA programs. In our previous blogs[1], we have noted MOD and RG loans are becoming a significant portion of loans delivered to newly issued Ginnie Mae pools. In the charts above, we compare the prepayment speed (as measured by 1M CPR) of these MOD and RG loans to that of purchase mortgages for the FHA and VA programs. The overall prepayment of purchase mortgages for FHA and VA display a similar downward trend over the past year, so these can serve as a benchmark. In fact, the pattern for MOD and RG loans is distinct. In the case of FHA, MOD loans have recently performed like that of purchase mortgages, while for VA, MOD loans have been prepaying faster than the benchmark. RG loans have been prepaying faster than MOD loans for FHA loans, while there are very few VA loans securitized in RG pools. A great thing about big data is to look at an issue from different points of view. The charts below break down the CPR into voluntary (CRR) and involuntary (CDR) speeds, first for MOD loans and then RG loans. For FHA MOD loans, the voluntary and involuntary speeds have been similar before and after the pandemic, while for VA MOD loans, voluntary prepays are the dominant factor after the pandemic. For loans in RG pools, voluntary prepays are the major contributor to speeds. Interestingly, VA MOD loans performed very similarly to FHA RG loans, with voluntary behavior driving prepayment speed. While FHA MOD loan prepay is mainly driven by buyouts. Each perspective on the performance of loans coming off forbearance offers an understanding of new behaviors associated with this innovative policy, contributing both to the possibility of improved investment outcomes and policy designs. For investors, it is time to polish their GNM prepayment models for reperforming loans such as MOD and RG, as they are becoming a much bigger part of the GNM pools. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed