|

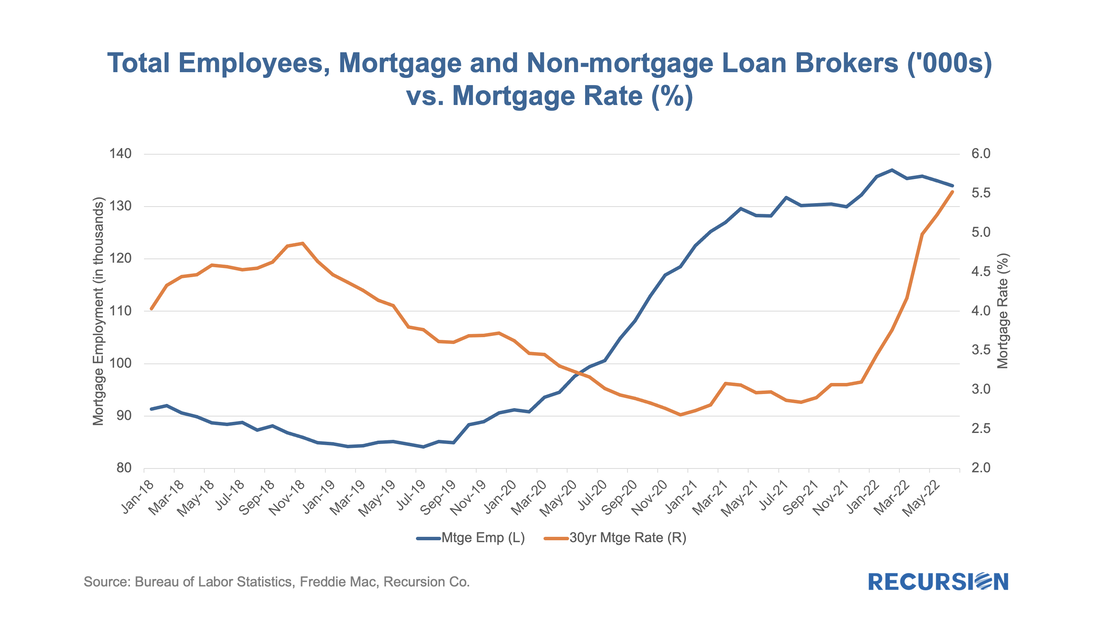

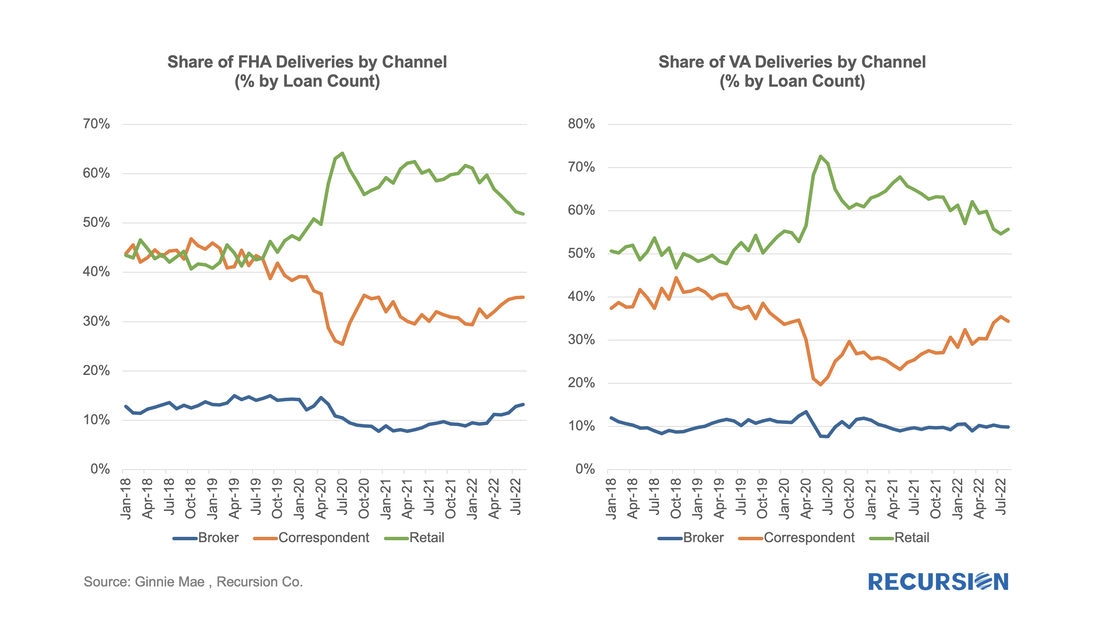

The rise in mortgage rates is having a profound impact on lender strategies in the mortgage market. These can be seen by looking at trends in the use of Third-Party Originators (TPOs). Some lenders, such as Quicken, traditionally work almost exclusively with loans originated in-house, while others, such as PennyMac, primarily accumulate and package loans produced by other lenders. Most larger institutions do some of both. The advantage of acquiring loans from a mortgage broker or correspondent in addition to origination is that the lender has flexibility regarding what method they use to turn volumes up and down to fit its strategy and market views. In both cases, there are costs to increasing and cutting capacity. As the market grows, bringing on new employees carries expenses such as training, while building trusted new external relationships can also be time-consuming. As markets contract, there are direct costs to layoffs, while unwinding networks can impact relationships that can be difficult to rebuild when the cycle turns. Of course, in a sufficiently bad market, the company may have no choice but to cut back. Recently there have been some high-profile announcements of layoffs across the mortgage lending space, but through the first half of 2022, the reported decline in employment has been modest. But employment tends to lag interest rates, so further declines cannot be ruled out. This is a good indicator of current housing activity to watch in the current market. But it’s not the whole story. There is also information to be gained from observing shifts in acquisition channels. Here is the recent trend of the GSEs: As can be seen, when the housing market boomed following the onset of the pandemic, the surge in hiring led to a corresponding jump in the share of loans delivered to the GSEs, at least in part based on the idea that the surge in activity would persist to some degree. As interest rates have taken off and volumes decline, firms have been cutting back their retail activity to a greater degree than that of their TPOs, bringing the correspondent/retail share close to its pre-pandemic levels. What is interesting is that employment appears to be more sensitive to market conditions than the structure of network relationships, at least during the pandemic. To see if this result is robust across various mortgage types, here are the same charts for FHA and VA: While the degree of mean reversion in channel shares for the GNM programs is so far less than that observed for the GSEs, the overall picture is quite similar. Of course, much more research can be conducted, looking at banks vs. non-banks, big lenders vs. small lenders, the role of underwriting standards in this analysis and more. From a corporate strategy perspective, firms can use this information to compare their strategies to market aggregates and individual competitors, broken down by several factors, including geography. Of interest along these lines are recent announcements by significant lenders that they are completely exiting from the correspondent channel[1]. [1] How Wells Fargo's correspondent exit may impact the mortgage industry - National Mortgage News, After $223M loss in Q2, LoanDepot closes wholesale channel - HousingWire Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed