|

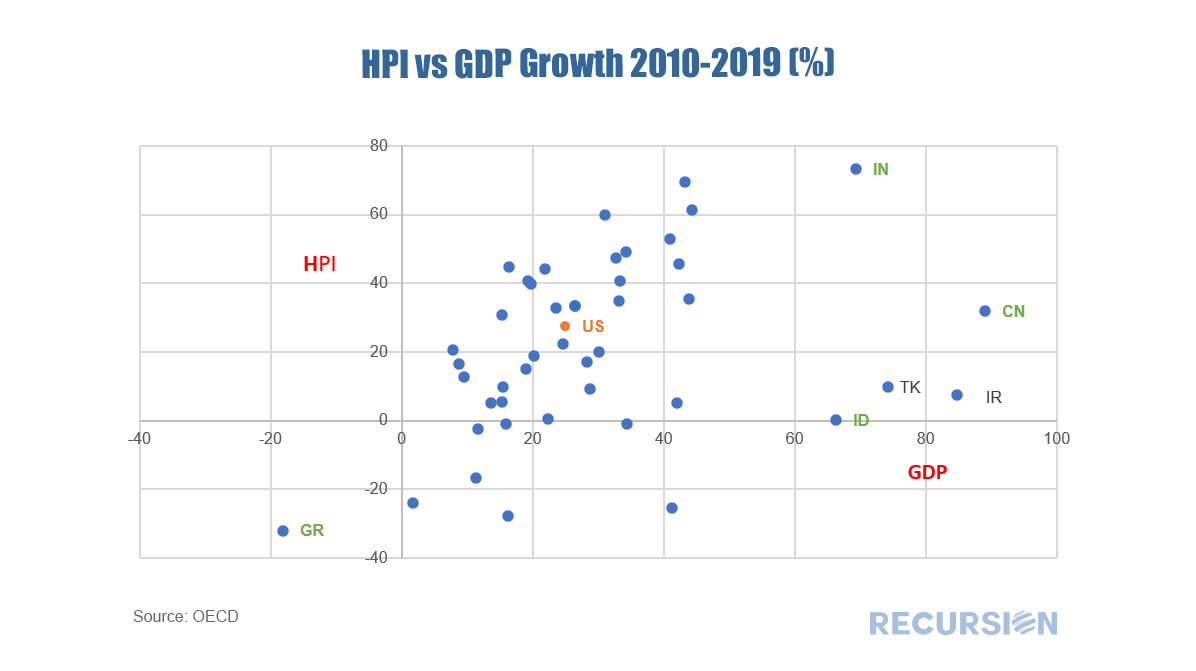

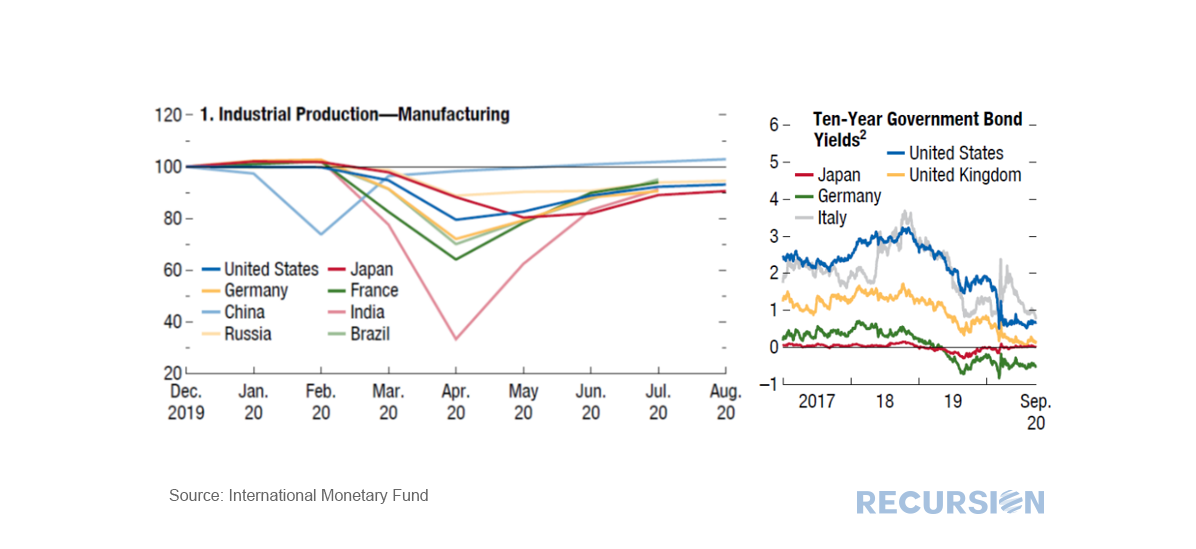

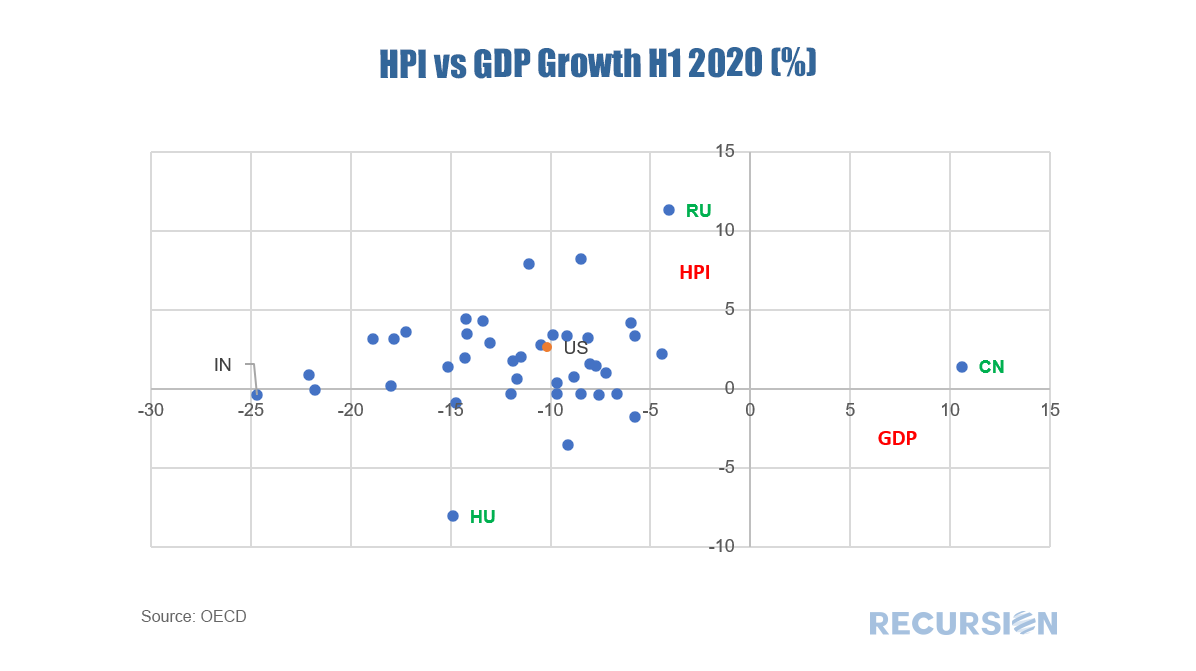

Our monitoring of the US housing and mortgage markets tends to focus on details obtained from a micro view of the market. This post takes a quite different perspective of treating the US as a single point across an international perspective. This is part of a long tradition in economics, including at the Federal Reserve[1], but is used infrequently as the market focus is generally directed more narrowly. But interesting patterns do emerge by stepping back and taking a big picture view. For example, here is a scatter diagram of cumulative real house prices vs GDP from 2010-2019 for 45 countries using data from the OECD. Most countries fall on an upward sloping trendline starting with Greece in the lower left quadrant, through the US in the center, and leading past India in the upper right. Some countries, notably China, experienced strong growth, but took measures to suppress home price appreciation in an attempt to forestall bubbles. The onset of Covid-19 certainly changes this picture. But the underlying factors are similar across nations. In its most recent World Economic Outlook[2], the IMF points out a similar path of economic activity across countries in 2020 for industrial countries in the wake of the Covid-19 crisis. That is, a very sharp decline in activity as the crisis unfolded, followed by a powerful monetary policy easing that served to drive down long-term interest rates, and induce a subsequent recovery, although the level of activity generally has flattened out below pre-crisis levels. As a result, in the first half of 2020 we saw a pattern of negative GDP growth, but most countries experienced positive growth, or only small declines, in real house prices: Once again, the main outlier is China, which experienced overall positive economic growth. An interesting observation is that the US is once again at the center of the global set of experiences. The country is not so different, at least this way. But perhaps the most important takeaway is that while housing did not cause the current crisis as was the case during the Global Financial Crisis, it most certainly is an important part of the solution to the current one. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed