|

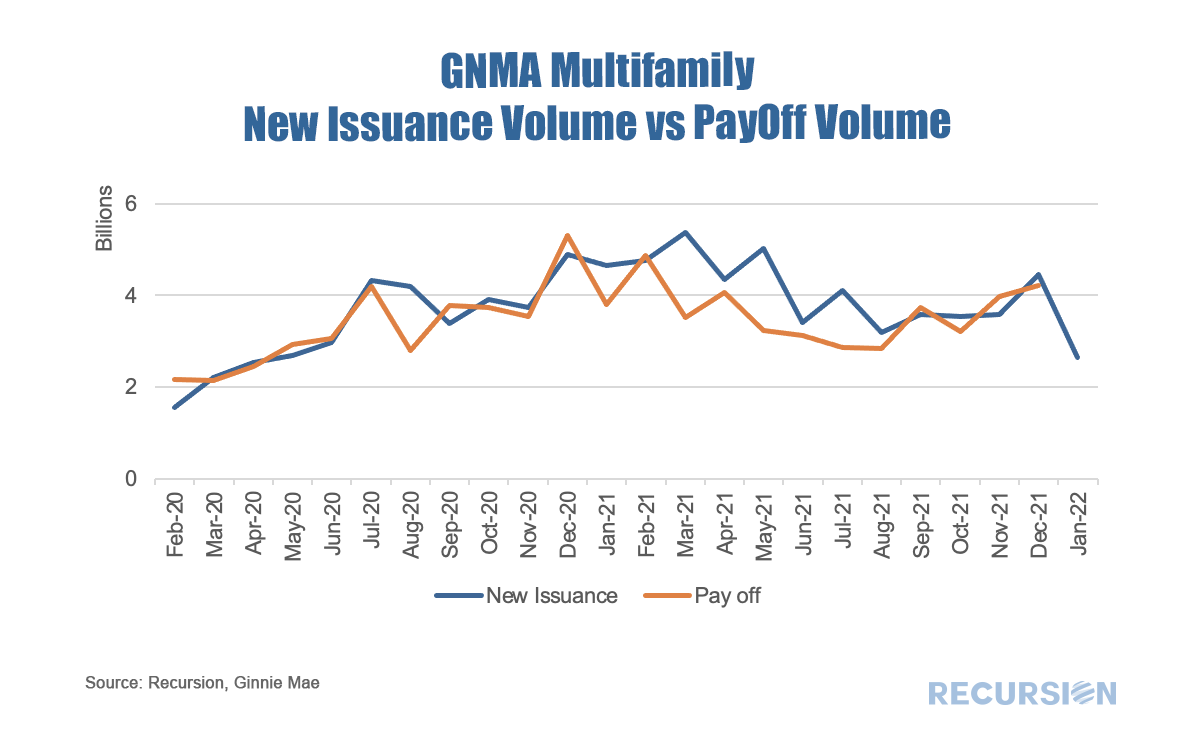

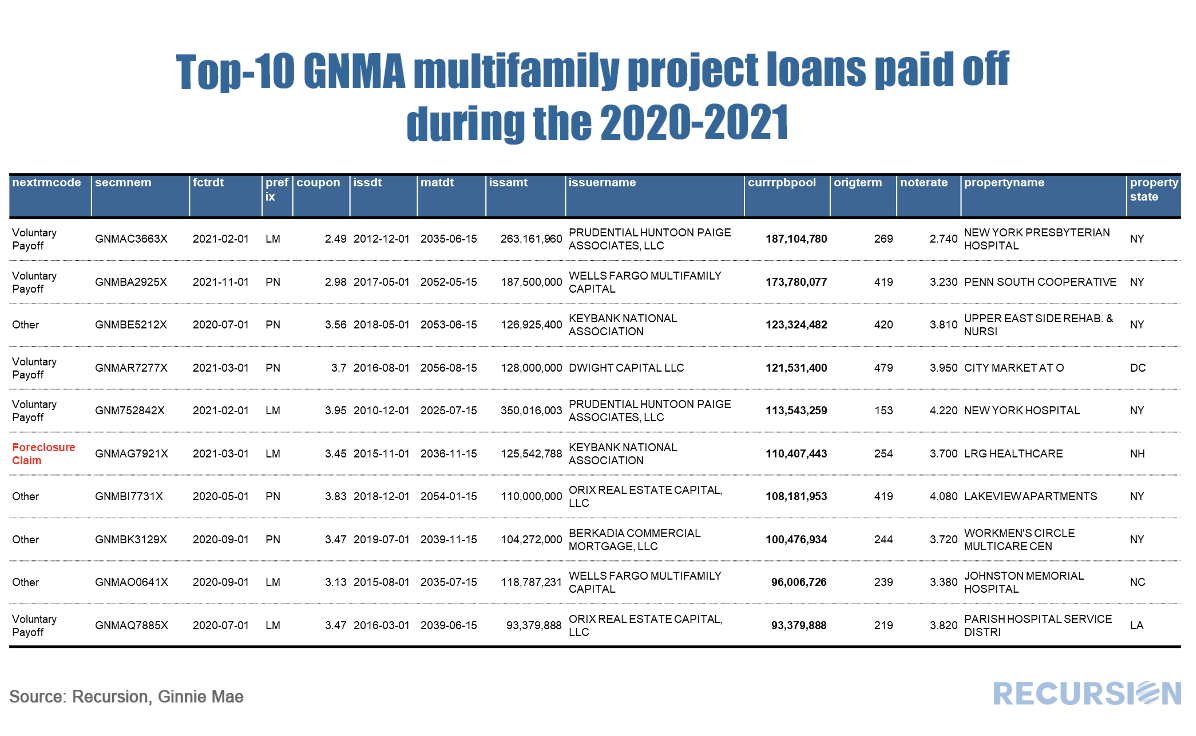

With home prices and interest rates on the rise, policy focus becomes more clearly fixed on the subject of affordability. This is particularly true for renter households, which tend to have lower incomes than is the case for homeowning households. As a result, Recursion is in the process of upgrading its capabilities in this area, through its Multifamily Analyzer. A recent upgrade is the addition of payoff volumes for GNM multifamily programs, in addition to the new issuance volumes already in place. This provides a sense of how much of the total volume is due to expiring loans, and how much to new activity. Besides total volumes, the Ginnie Mae multifamily files have interesting data points such as lender, and also the property level data contains addresses, a very different situation from the single-family data releases. Research topics such as loan genealogy, that tracks the refinancing activities between different programs, would be much easier in multi-family space than single family. Below find some details on the top-10 GNMA multifamily project loans paid off during the 2020-2021, the new loan they financed into, can be identified if they are securitized into agency or non-agency CMBS deals: A substantial amount of other characteristics are available, for further details please reach out. Much more to come.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed