|

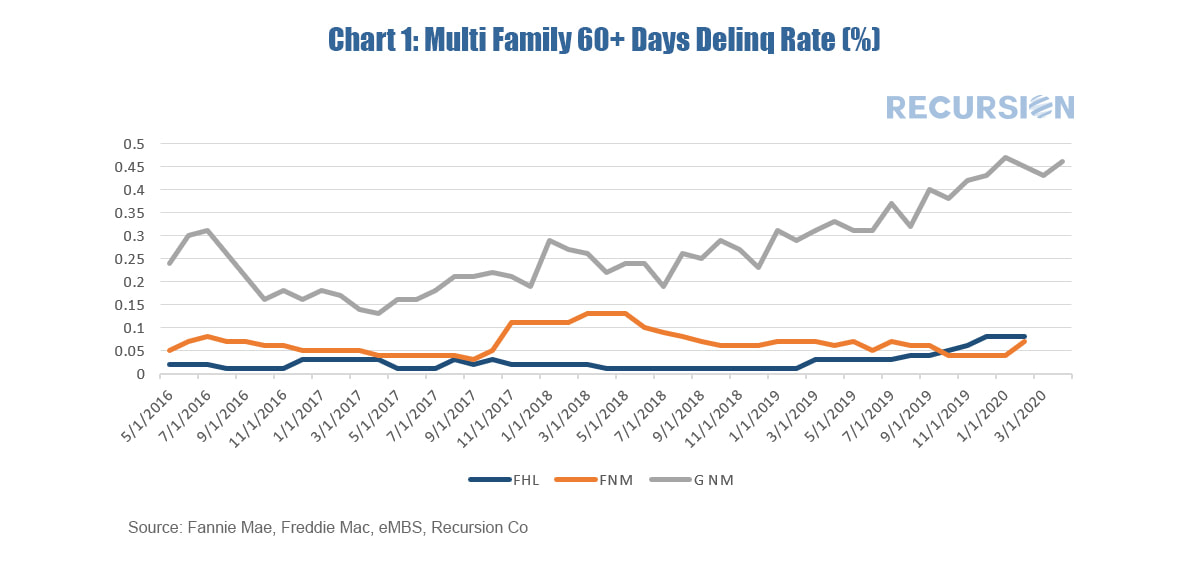

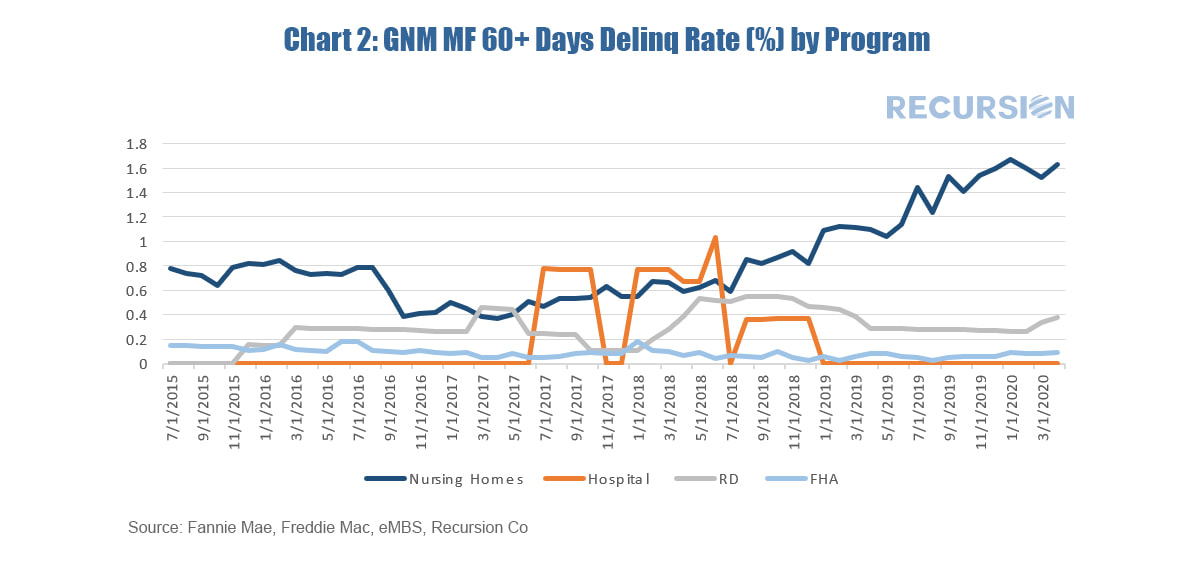

During the 2008 global financial crisis, the agency multifamily CMBS (commercial mortgage backed securities) and the RMBS (residential mortgage backed securities) markets performed differently as measured by delinquency rates. For example, at the peak of the financial crisis in Feb. 2010, single family Fannie Mae loans had a 90+ day delinquency rate of 5.6% in Feb. 2010, compared with their multifamily 60+ day delinquency rate of just 0.8% in Jun. 2010. However, the historical performance cannot guarantee the same relationship will hold during the current Coronavirus pandemic. The huge surge in unemployment currently being experienced will fall equally on renters and homeowners alike. The CARES act provides forbearance to households with mortgages, but there is no such broad program for renters[1]. As of March 2020, the market share of agency multifamily outstanding balances by Fannie Mae, Freddie Mac and Ginnie Mae are 48.1%, 33.5%, and 18.4% respectively. Although GNM has the smallest share among the three agencies, it still has a substantial market portfolio amounting to $128 billion. Chart 1 shows that the multifamily serious (60+ day) delinquency rates by agency. Although the overall delinquency rates for all three agencies are quite low, GNM’s rate is significantly higher than the others and in an upward trend. We further broke down GNM’s multifamily portfolio by its four main programs – FHA, nursing homes (including assisted-living facilities), hospitals, and rural development (RD). Currently the biggest programs in GNM are FHA, which is 72% of the total portfolio, following by nursing homes, which is 24%. Chart 2 shows that the delinquency rate of nursing homes is the highest and continues to increase. This shows that the observed increasing overall GNM delinquency rate is mostly driven by the performance of nursing homes. Given the potential virus impact on the nursing home industry, we will need to continue watching the performance of this segment. [1] The three agencies Fannie Mae, Freddie Mac and Ginnie Mae account for less than half of holdings of multifamily loans. Both Fannie Mae and Freddie Mac have programs that provide forbearance to lenders for three months.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed