|

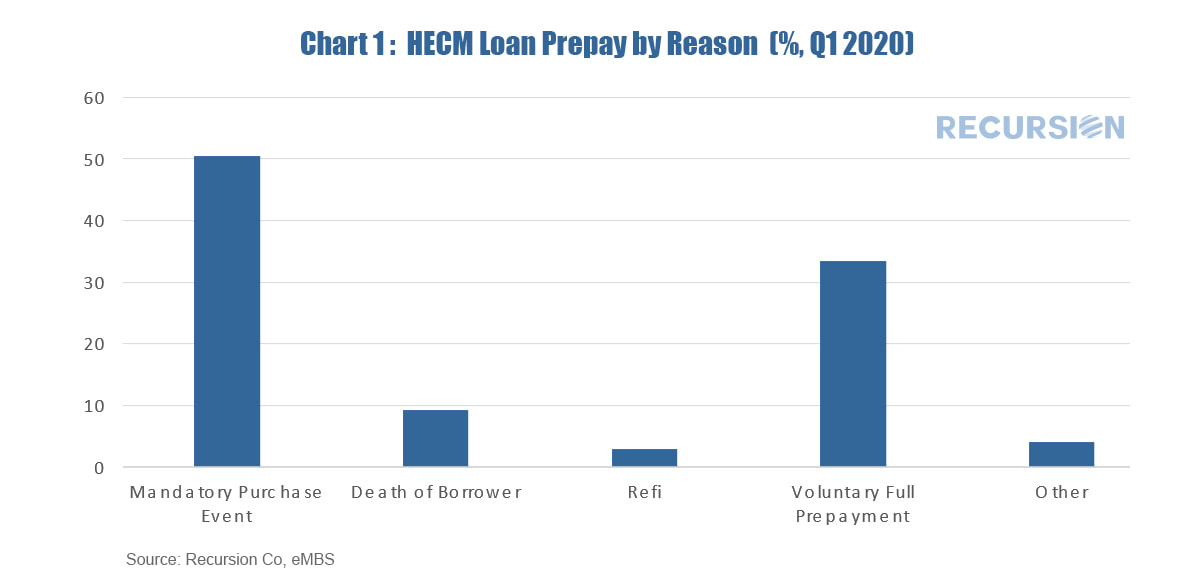

A reverse mortgage is a mortgage loan backed by a residential property, that allows the borrower to access the unencumbered equity in their home without making monthly payments. The loans are usually offered to senior homeowners. Currently, FHA has endorsed reverse mortgage loans an outstanding balance of 54 billion USD and these are securitized in Ginnie Mae’s HECM pools. This program is available for people age 62 and over. There are many differences between reverse mortgages and regular (forward) mortgages, particularly that the balance of reverse mortgages tends to grow over time as interest accrues and sometimes payments are made to the homeowner. But in both cases investors face prepayment risk. The HECM loan tape disclosed monthly by Ginnie Mae provides data by many characteristics, including reason for prepayment and the age of the borrower. Chart 1 shows the share of refinances for various reasons in Q1 2020. A relatively small piece is death of borrower, at just 9%. But this latter category is what is most subject to change due to the vulnerability of the older cohort to the COVID-19 virus, given the acute nature of the health impact.

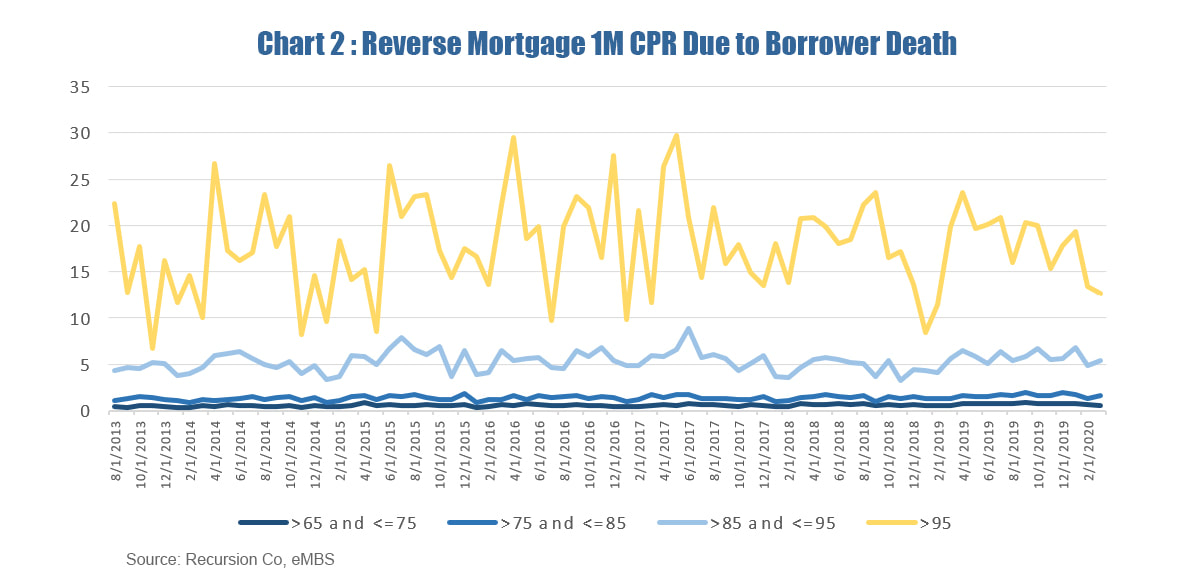

When we look at the prepayment rate due to “Borrower Death” only in Chart 2, we see that it increases with age, particularly for those age 95 and above. It is unclear how these relationships will develop as a result of the virus, but access to digital tools and very large data sets is essential in monitoring market developments to better formulate private and public strategies to deal with the crisis. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed