|

One of the many recurring themes of these posts is that the shock of the Covid-19 Pandemic and subsequent policy response has resulted in structural changes in behavior that cause loan performance metrics to shift compared to the pre-crisis world. An interesting example of this can be found in the performance of modified loans in Ginnie Mae programs. Modified loans in these programs are those that have been purchased out of pools by servicers that are past due that subsequently have features such as rate and term adjusted in order to bring households back to a current status. These are then often resecuritized into a new GNM pool.

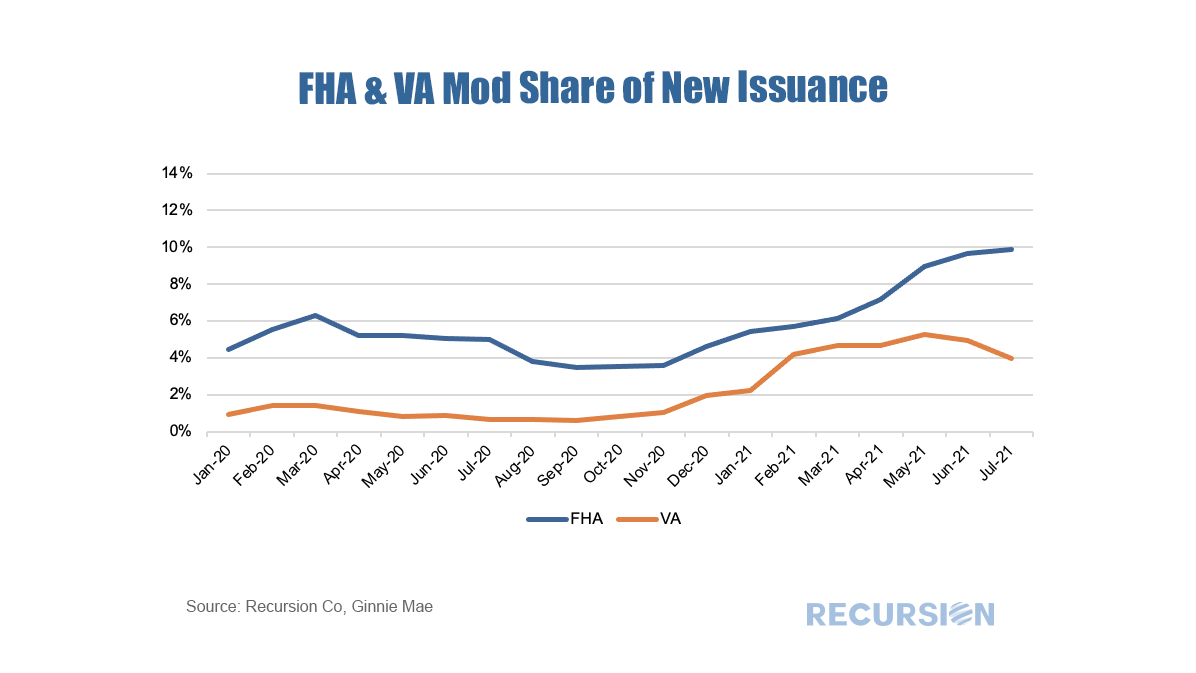

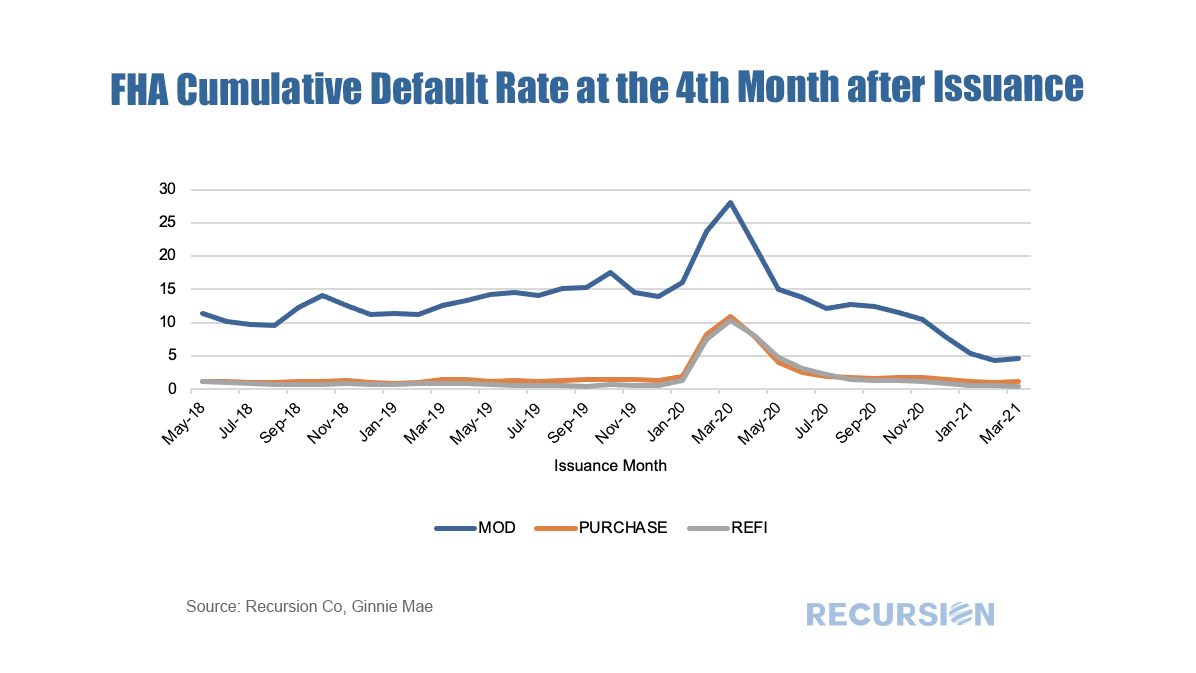

Historically, the FHA program has tended to have a higher modified share of total issuance than VA corresponding to the relatively higher delinquency rates for FHA vs VA associated with the relatively stronger credit stances of VA vs FHA borrowers. This gap narrowed significantly over the course of 2020, but in recent months the FHA share has continued to increase, albeit recently at a slower rate, while that for VA has turned down. The recent divergence in the two lines is not likely due to changes in the pace of delinquencies, but rather to the behavior of servicers active in the two programs. To get a sense of the impact of these developments, we look at the performance of these modified loans. Historically total default rates in this category of loans are much higher than regular purchase and refi loans, reflecting recent distress. Since the current distress is quite different from that experienced previously, we look at cumulative default rates[1] at the 4th month after pool issuance pre- and post-pandemic. As a consistency check we look at this metric for the two biggest government programs, FHA and VA.

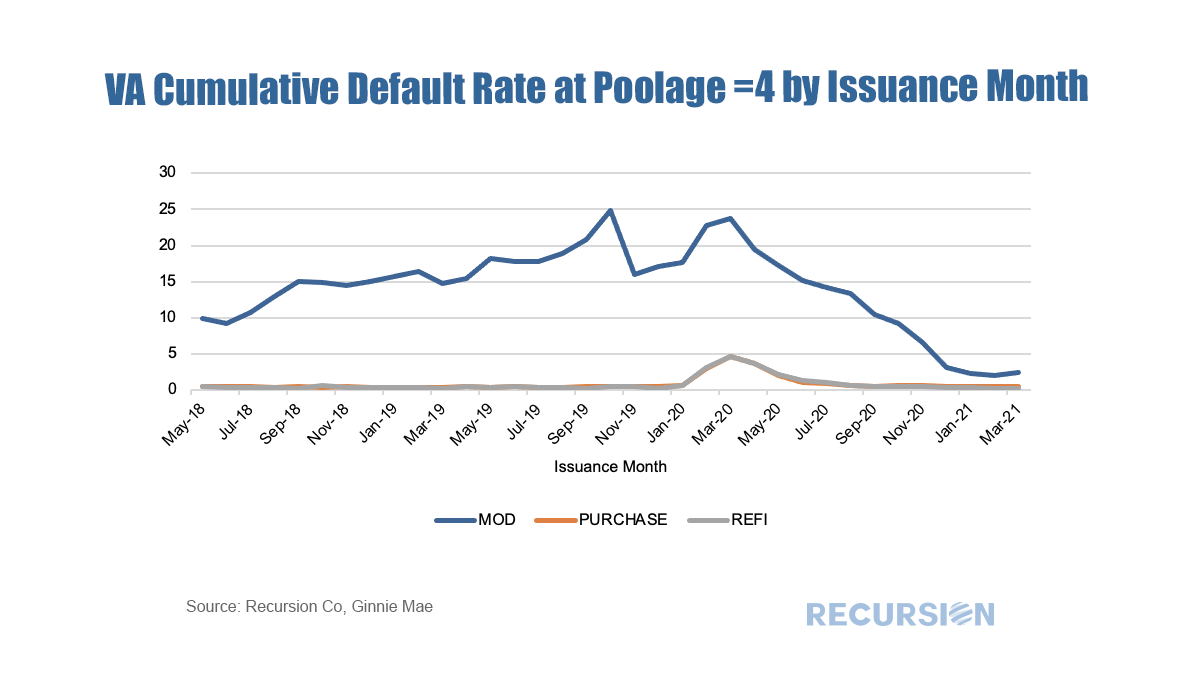

And the VA program: These results are striking. Somewhat unintuitively, by this measure the performance of modified VA loans compares unfavorably to that of FHA prior to the onset of the pandemic. The ratio of the cumulative default rate for mod loans relative to others at their peak in March 2020 as almost 5.2:1, while that for FHA is about 2.7:1. After the peak, relative performance sharply improved for both programs, but the pace has been much larger for VA relative to FHA. It seems that in both cases the characteristics of borrowers with modified loans has changed in the recent period compared to pre-pandemic times, but the changes are much more pronounced for VA[2]. There could be two possible reasons:

So, the supposition at the start that structural changes are underway that have a long-term impact on market performance appears to be verified. Whether this will persist or slowly adjust back to pre-pandemic norms remains to be seen, but the easy assumption of mean-reversion cannot be made with any real confidence. [1] Cumulative default rates measure % of loans ever reached 60 day delinquency

[2] The weighted average credit score for FHA newly issued loans increased from 609 in Jan 2020 to 645 in Mar 2021; the score for VA newly issued loans increased from 613 in Jan 2020 to 666 in Mar 2021. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed