|

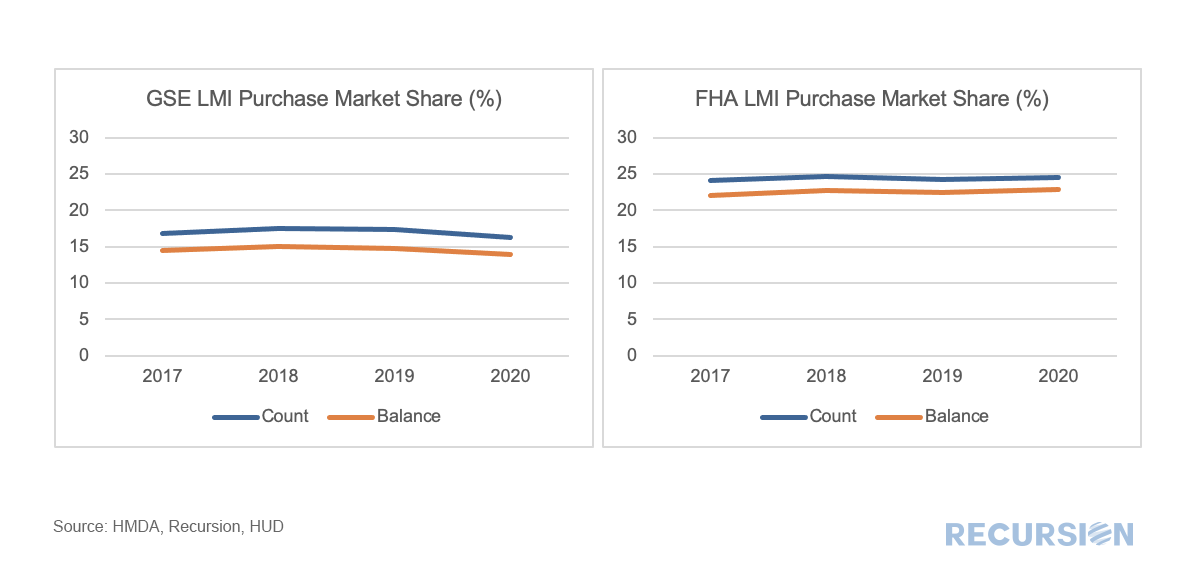

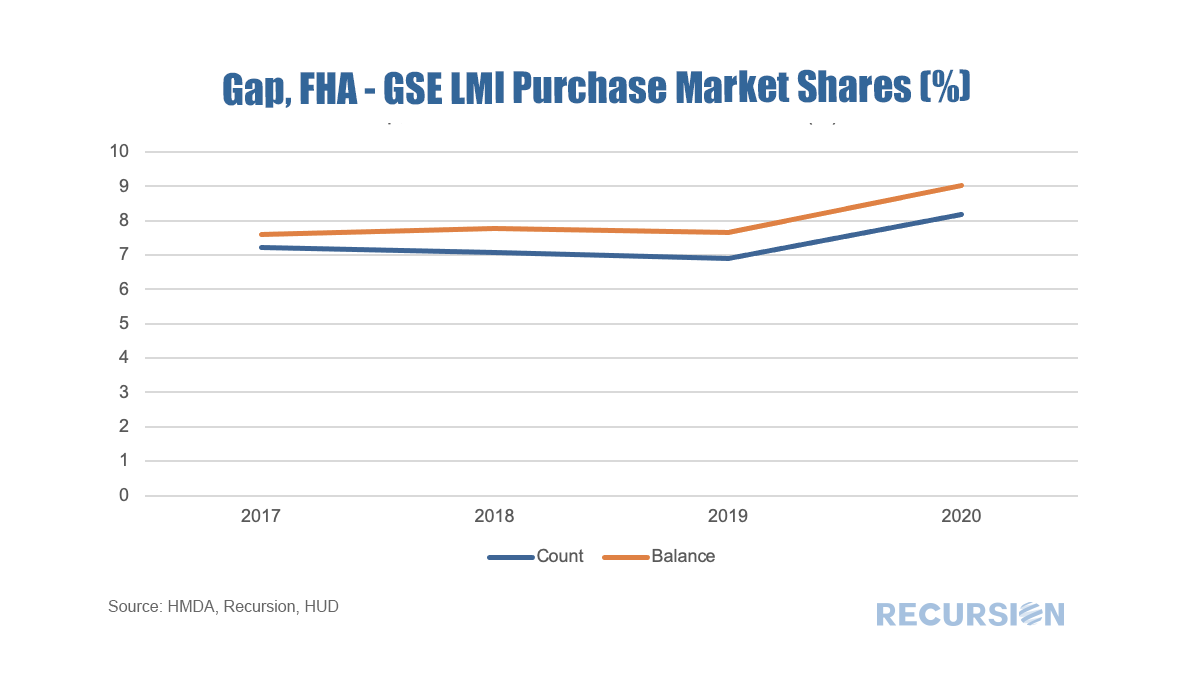

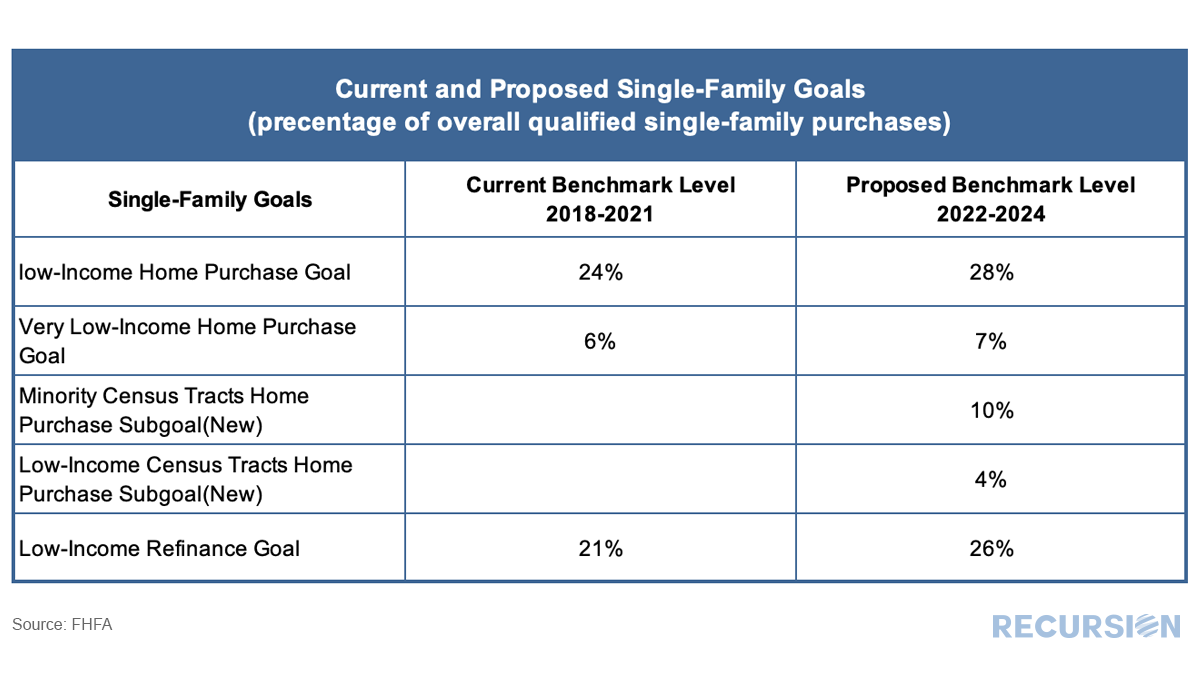

In a recent post[1], we looked at the declining FHA share of the purchase mortgage market relative to the GSE’s across a variety of price points. Another way to look at this question is by a geographic breakdown focusing on those census tracts with a Low-Moderate Income (no greater than 80% of area median income) population greater than 51% (we will call these LMI areas)[2]. To address this issue, we utilize the HMDA dataset, and then apply the LMI information to compute shares of originated purchase loans delivered to FHA vs GSE. This is done on both a loan count and loan balance basis. Unsurprisingly, FHA has a greater share of LMI loans delivered from 2017 to 2020. Below find the relative share between FHA and the GSE’s, also on both a loan count and loan balance basis: Interestingly, this gap was relatively steady from 2017 to 2019, but it has been on an increasing trend starting in 2019. Considering our earlier findings about FHA share losses[3], this indicates FHA lost more shares in higher income area than lower income area. In terms of the outlook for this trend, a recent interesting policy development was the release on August 18 of proposed housing goals for the GSE’s[4] over the 2022-2024 period. A key development in this release is the replacement of the Low Income Area Purchase Subgoal (with a target of 14%) with two new subgoals, the Low-Income Census Tract Purchase Subgoal (with a target of 4%) and a Minority Census Tract Purchase Subgoal (with a target of 10%). The Minority Census Tract Subgoal is based on the share of borrowers with an income at or below area median income; and the property is in a census tract where the median income is at or below AMI and minorities make up at least 30 percent of the population. In an interesting analysis[5], FHFA staff stated that that GSE targets for the Minority Census Tract Subgoal were set higher than their recent performance, implying that their priority is to increase liquidity for this cohort. Future analysis of the performance of this goal will need to address whether its attainment is the result of new borrowers being brought into homeownership or whether it represents an increase in GSE share at the expense of FHA. [1] https://www.recursionco.com/blog/affordability-and-the-agency-distribution-of-purchase-mortgages

[2] https://www.hudexchange.info/programs/acs-low-mod-summary-data/ [3] https://www.recursionco.com/blog/affordability-and-the-agency-distribution-of-purchase-mortgages [4] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Proposes-2022-2024-Housing-Goals-for-Fannie-Mae-and-Freddie-Mac.aspx [5] https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/2022-2024%20EHGs%20NPR%20to%20Fed%20Reg_website.pdf |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed