|

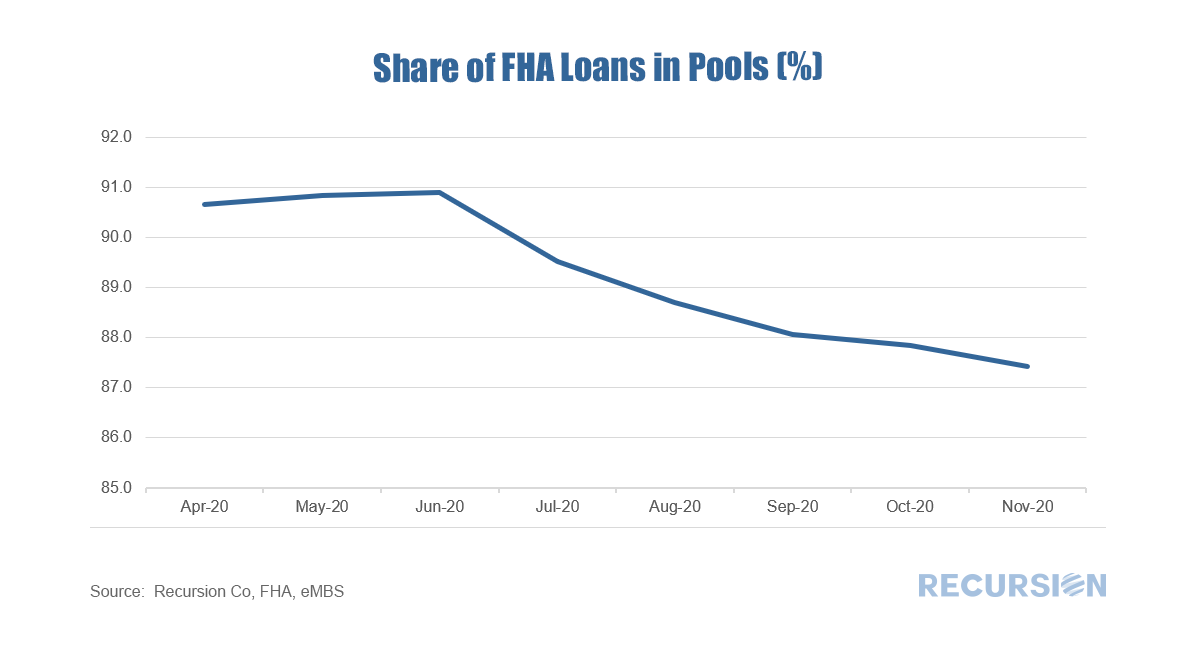

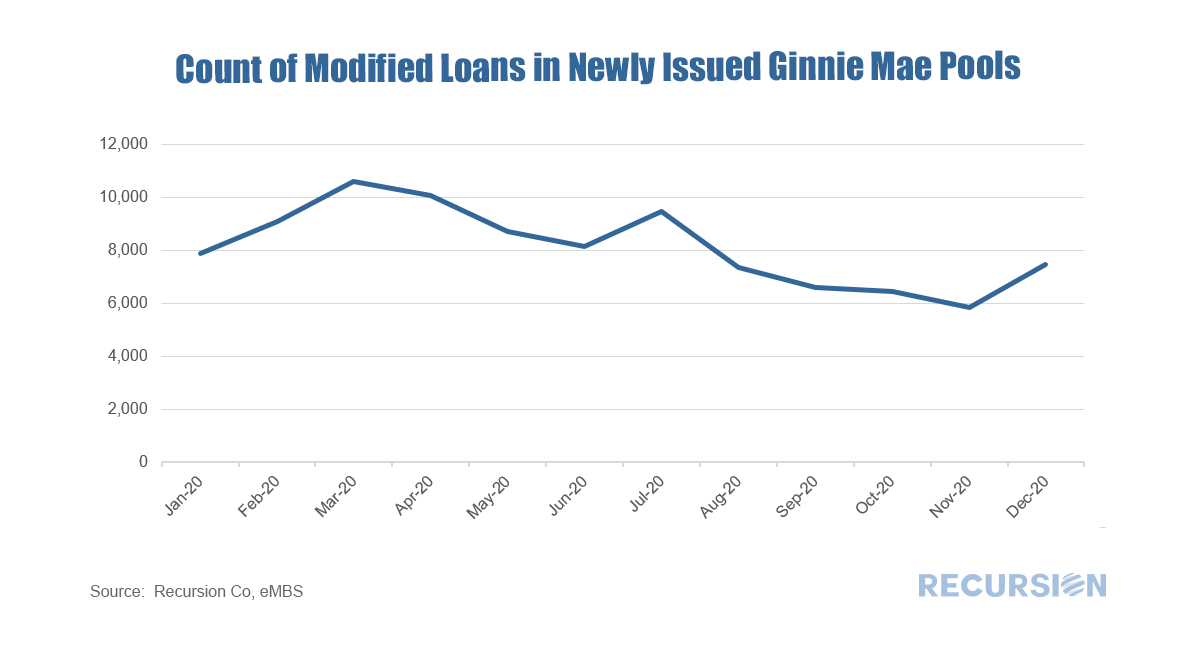

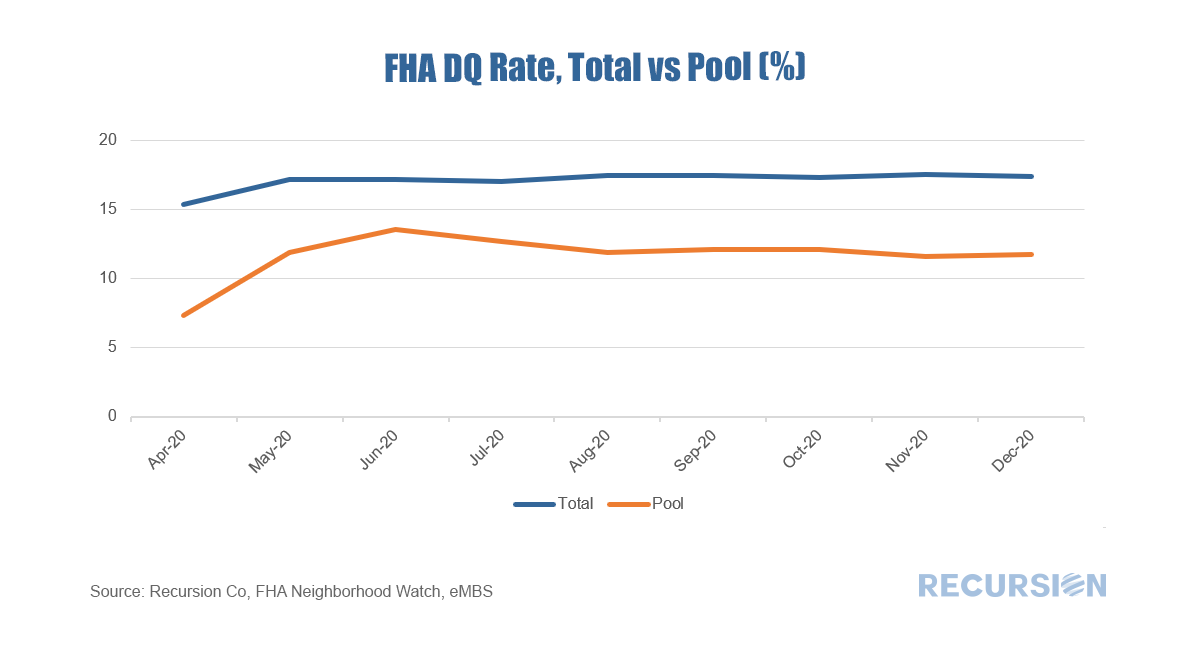

In a recent post, we discussed the application of the FHA Neighborhood Watch dataset to understanding the market landscape for this program[1]. Peering a bit deeper, more insights can be obtained. We just updated this dataset through December so it is an opportune time to take a look at FHA loan performance. First, the share of FHA loans in pools [2]continued to decline at the end of the year: The loans in pools fell by about 60,000 in December while the total fell by 40,000 implying that perhaps 20,000 loans were purchased out of pools, and presumably modified as foreclosures are currently forbidden. Interestingly, the number of loans in pools new issuance with mods rose for the first time since July: It shows even though most of the loans are expected to be cured by partial claims, modification remains a tool to work out delinquent loans. We will have separate pieces focusing on partial claims in future posts. Now what about delinquencies? What is the delinquency rate[3] of loans in the FHA program? As servicers may buy serious delinquent loans out of pools, and banks tend to hold conventional loans not FHA loans on their balance sheet, the overall FHA delinquency rate reported by FHA Neighborhood Watch data is generally higher than that for loans in pools. When COVID-19 first struck last spring, the 30-day delinquency rate spiked, narrowing the gap with the total figure, but many of these cured as labor markets recovered. More recently, lenders have picked up the pace of purchasing delinquent loans out of pools, as they have the financial incentive to modify the loans to allow the borrowers to become current and then resecuritize them. A key question for 2021 is when forbearance programs expire, how many borrowers will be able to work with lenders to keep their homes, and how many will lose them? Stay tuned. [1] https://www.recursionco.com/blog/fha-buyouts-and-loan-counts

[2] “In pools” means the loans were securitized by Ginnie Mae issuers [3] The delinquency rates are calculated using the delinquent loan counts divided by total loan counts |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed