Introducing the Recursion Agency Multifamily Dataset Part 2: Outstanding Balance Benchmarking3/20/2023

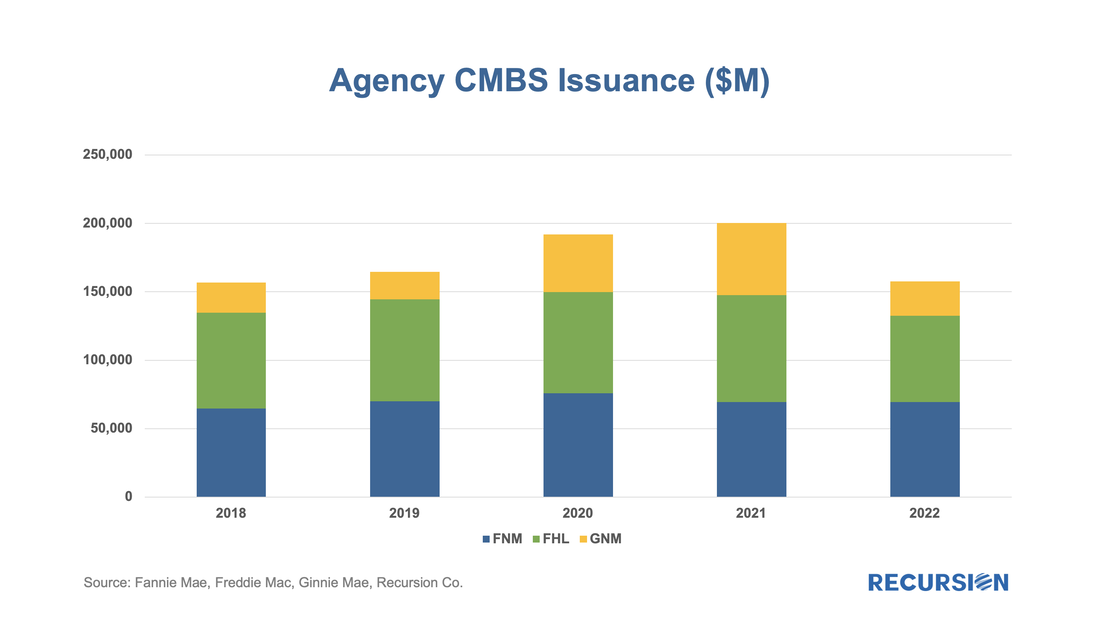

In a recent post, we introduced the Recursion Agency Multifamily Dataset, a complete accounting of multifamily loans securitized in Agency pools, going back to 2009. We provided a breakdown of issuance for the total market and by agency in that post. A natural question that arises is how can we benchmark our new dataset? In this case, we look at outstanding balance rather than issuance volume. The Agencies provide quarterly data on total outstanding balances on their web sites. When we compare this to our own data, we get this:  To read the full article, please send an email to [email protected] Over the past 18 months, Recursion has undertaken an extensive effort to aggregate multifamily loans and properties across all three Agencies by Deal Type. The data is complete back to 2009 for all three Agencies and somewhat longer for individual deal types. This allows us to aggregate the loans to the pool and then CMO levels for in-depth analysis. An innovation is that we have tied the loans to the property level, giving us the ability to perform analyses on a wide variety of topics, including ESG considerations and much more[1]. For this note, we will provide a basic overview of the dataset. Here is the topmost view from the Agency level: To read the full article, please send an email to [email protected] On February 9, Ginnie Mae announced a new Low-Moderate Income Borrower (LMBI) disclosure[1] “in response to investor interest in having greater transparency into Ginnie Mae mortgages in pools, in particular as part of meeting Environmental, Social, and Governance (ESG) investment mandates”.

“The new disclosures capture the number of underlying loans made to LMI borrowers, the percentage of LMI loan count of total loan count, the unpaid principal balance (UPB) of LMI loans in the mortgage-backed security (MBS), and the percentage of LMI UPB of total MBS UPB.” “LMI households are classified according to the Federal Financial Institutions Examination Council (FFIEC) Median Family Income Report Tables[2] corresponding with the time of loan origination. These disclosures are being provided at the aggregate pool level for Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA) loans originated beginning in 2012.” In other words, grist for the Recursion mill. First, we look at the share of Ginnie vintage 2012 and later pools that consist of loans for which more than 50% are LMBI borrowers: In recent posts, we introduced the phrase “Mortgage Winter” to describe the current environment where high-interest rates and elevated home prices lead to a severe drop in transaction volumes[1]. Subsequently, we looked at the impact of this situation on individual market participants[2]. The bulk of market participants across the mortgage ecosystem is experiencing year/year revenue declines of two-thirds or more. These entities are having to adjust their business models to this situation and develop strategies to navigate the uncertain environment ahead.

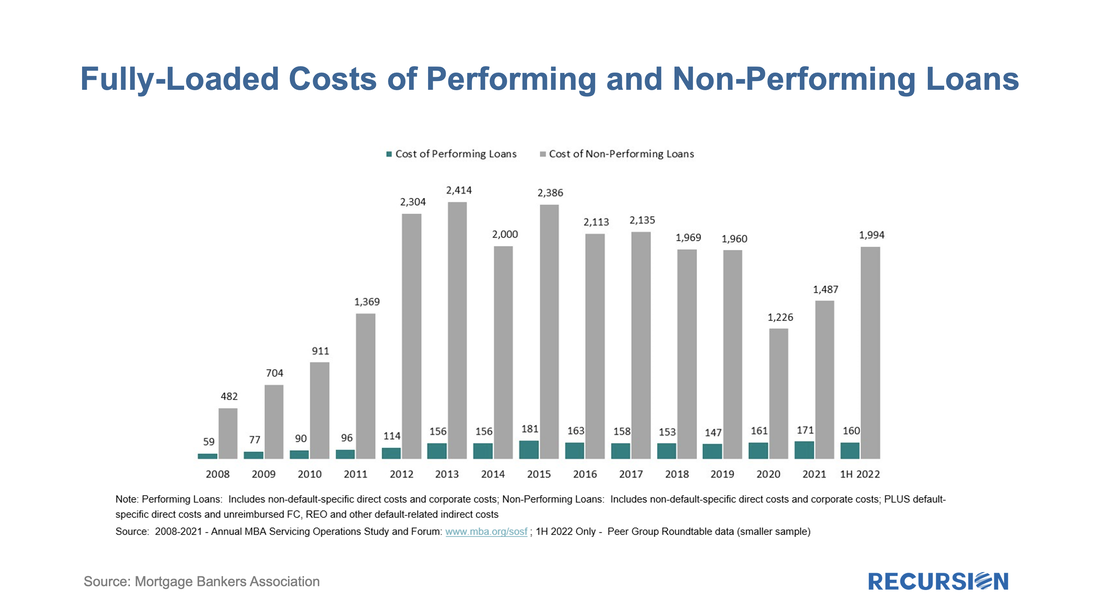

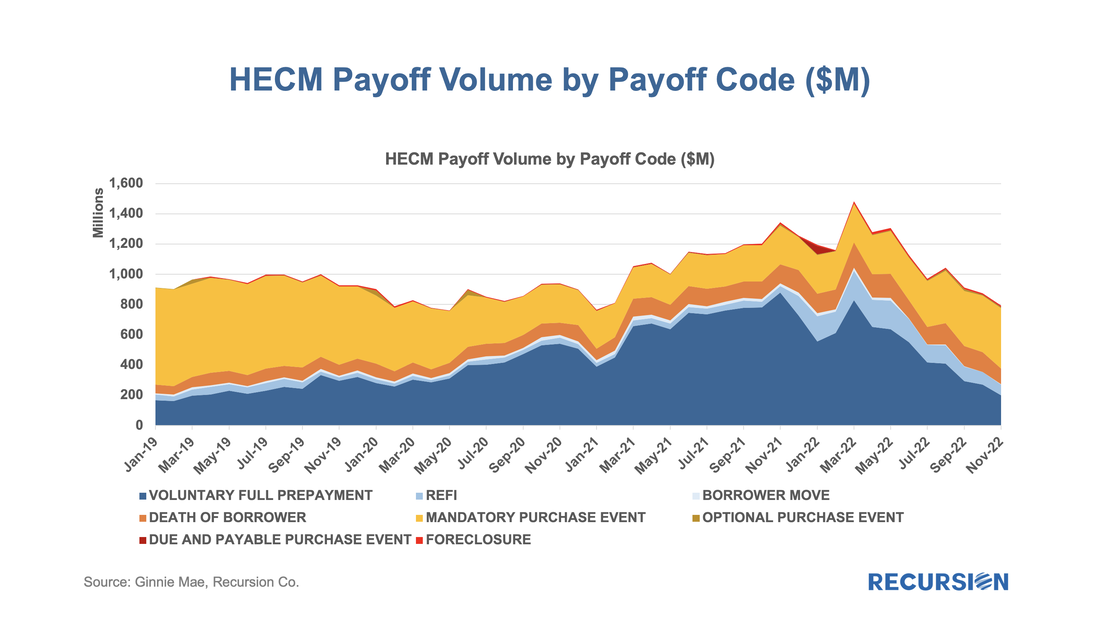

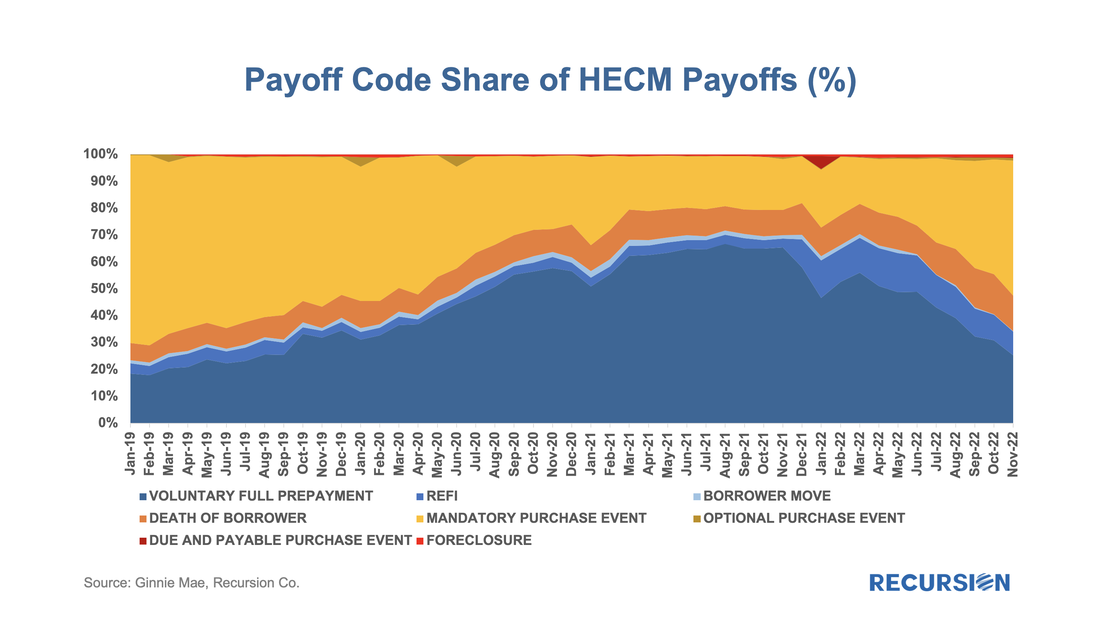

Spring will come, but whether the ensuing rebound will be sufficient to return the sector to a state of financial health is a question that remains far from assured. There is also another factor to consider besides revenue, and that is the potential for increased servicing costs associated with delinquent borrowers. As the economy slows and the impact of inflation weighs on many households, we have noted signs of distress in mortgage performance in parts of the market despite the resilience observed in the labor market[1]. Another corner of the market that is drawing attention is reverse mortgages. The metric used to assess performance in this space is the number of mandatory purchase events. Unlike the situation in the forward mortgage market, these occur not when the borrower faces financial distress[2], but when the servicer is compelled to purchase a loan out of a pool once the balance reaches 98% of a pre-set amount -- the “Maximum Claim Amount (MCA)”[3]. This amount is capped so as to reduce the risk of the loan amount surpassing the valuation of the collateral. The fundamental factor driving this event is interest rates as HECMs are floating-rate loans, and a higher rate brings the loan balance up faster.

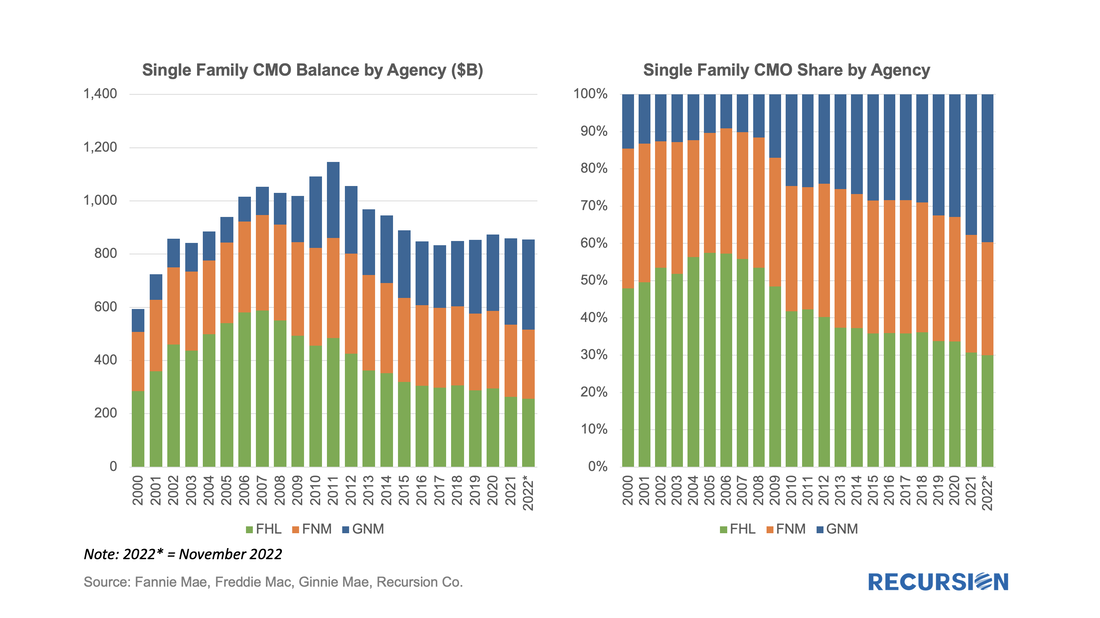

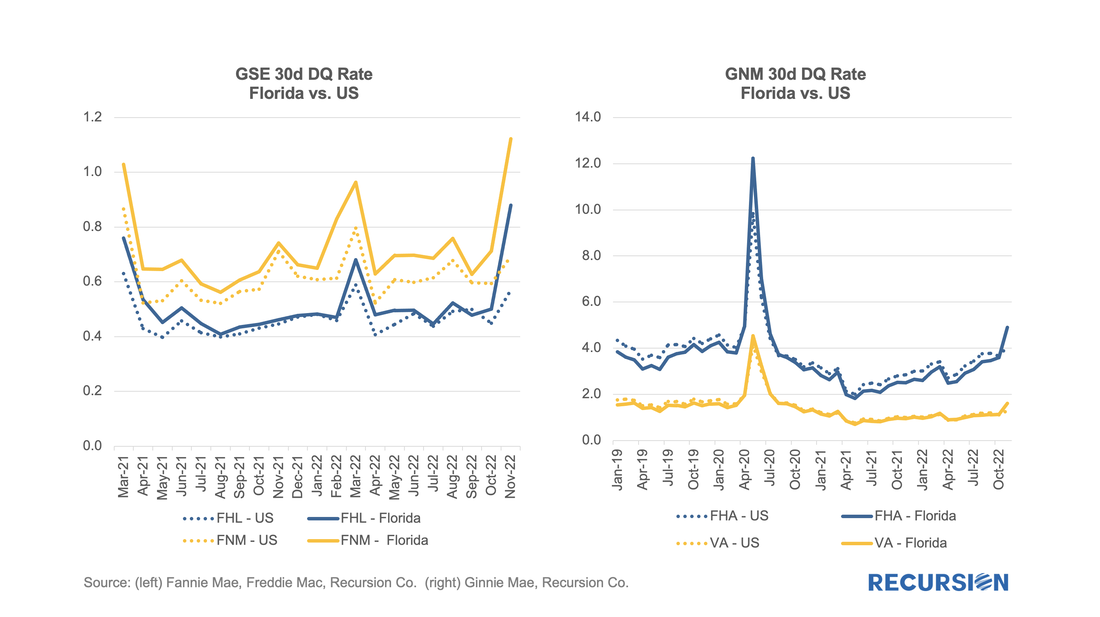

Recursion’s HECM Analyzer tool allows us to quantify the number of prepayments that are due to this factor, both in absolute dollar amount and as a share of total prepayments. Recursion has undertaken an intensive effort to compute the size of the Agency CMO market back to 2000. The size of the Agency CMO market is calculated by building up from the loan level. This data is provided by agency disclosure of the portfolio of each collateral group and collected from text files, pdfs, and other formats across single-family and multifamily CMOs. The formats of the disclosure files differed across agencies and changed over time, presenting a challenge to unify. To read the full article, please send an email to [email protected] As policy interest rates continue to rise and economic activity begins to slow, attention in the mortgage market shifts towards concerns about the potential for borrower distress. We are early in this process as the labor market continues to add jobs, and there continue to be more job openings than people looking for work. Nonetheless, signs of strain begin to be seen, and it's worthwhile to point out early trends and consider implications.

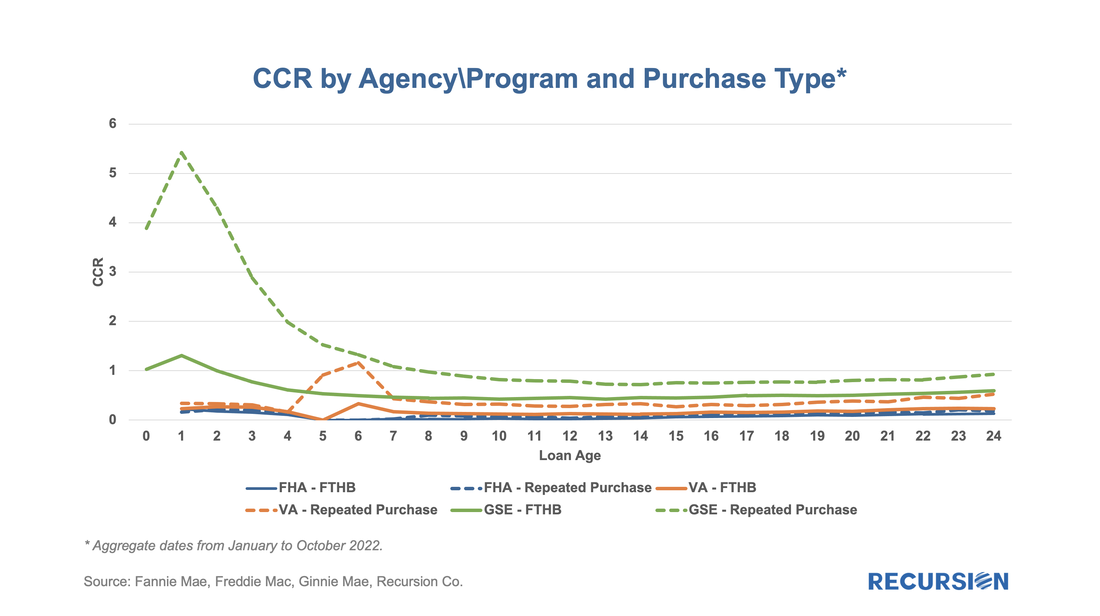

Notably, the impact of Hurricane Ian could be seen in the short-term delinquency data: We’ve written before about curtailments, which are particularly interesting during times of rising interest rates when refinancings are at low levels[1]. We believe that investors and modelers would benefit from examining this aspect of borrower behavior. A good way to demonstrate this is to look at the home payment patterns of repeat homebuyers. In the recent environment of skyrocketing home prices, buyers of new homes have been confident about their ability to sell their current residence and have been more likely to purchase their new home before they pay off their old mortgage. If this story is true, we would expect to see significant curtailment activity within a few months of the purchase of a residence on the part of repeat buyers. In our previous note, we introduced the concept of a “Constant Curtailment Rate”, and implemented the calculation in Cohort Analyzer to quantify this effect:

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed