|

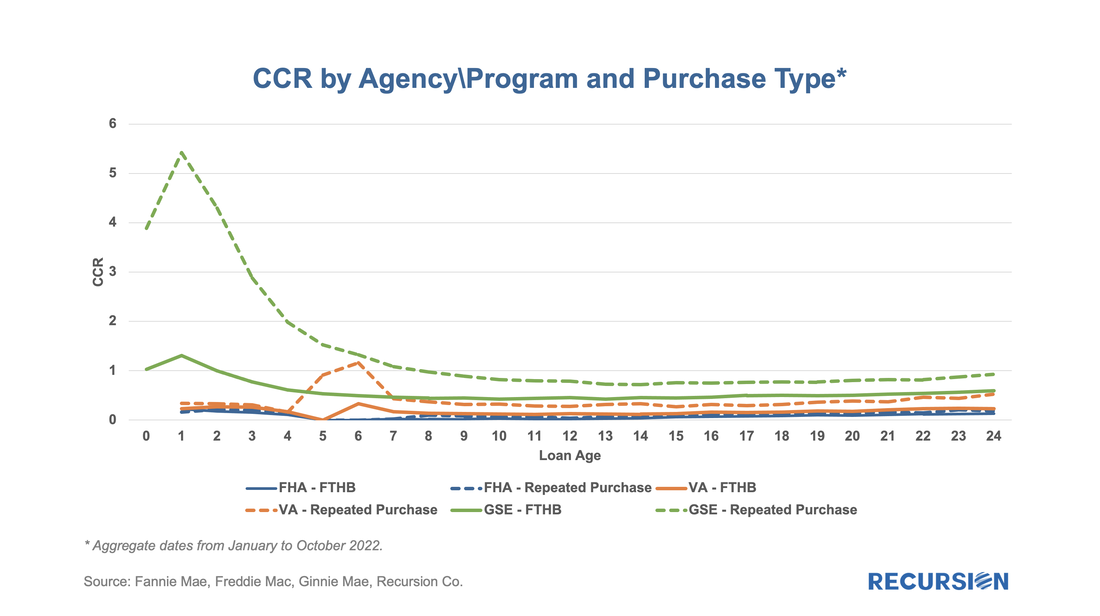

We’ve written before about curtailments, which are particularly interesting during times of rising interest rates when refinancings are at low levels[1]. We believe that investors and modelers would benefit from examining this aspect of borrower behavior. A good way to demonstrate this is to look at the home payment patterns of repeat homebuyers. In the recent environment of skyrocketing home prices, buyers of new homes have been confident about their ability to sell their current residence and have been more likely to purchase their new home before they pay off their old mortgage. If this story is true, we would expect to see significant curtailment activity within a few months of the purchase of a residence on the part of repeat buyers. In our previous note, we introduced the concept of a “Constant Curtailment Rate”, and implemented the calculation in Cohort Analyzer to quantify this effect: There are many takeaways from this chart. First, there is a sharp spike in the CCR for repeat home purchasers within a few months of their attaining a new conforming mortgage. Second, there is a small bump in the CCR curve for first-time homebuyers using conforming mortgages, but the overall impact is very muted. Third, there is no such impact on either first-time or repeat homebuyers in the FHA program, likely reflecting the reluctance of lenders to fund two mortgages for lower credit score and income cohorts. Finally, there is a modest but distinct bump in curtailments on the part of VA borrowers centered around a loan age of six months. This is interesting and likely the product of specific features of that program. As always, this sort of analysis points to useful avenues for future research. Once again, we point out the unique analytical power available to our customers through the suite of Recursion Analyzers. [1] https://www.recursionco.com/blog/introducing-the-constant-curtailment-rate-ccr-in-the-low-prepay-era Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed