|

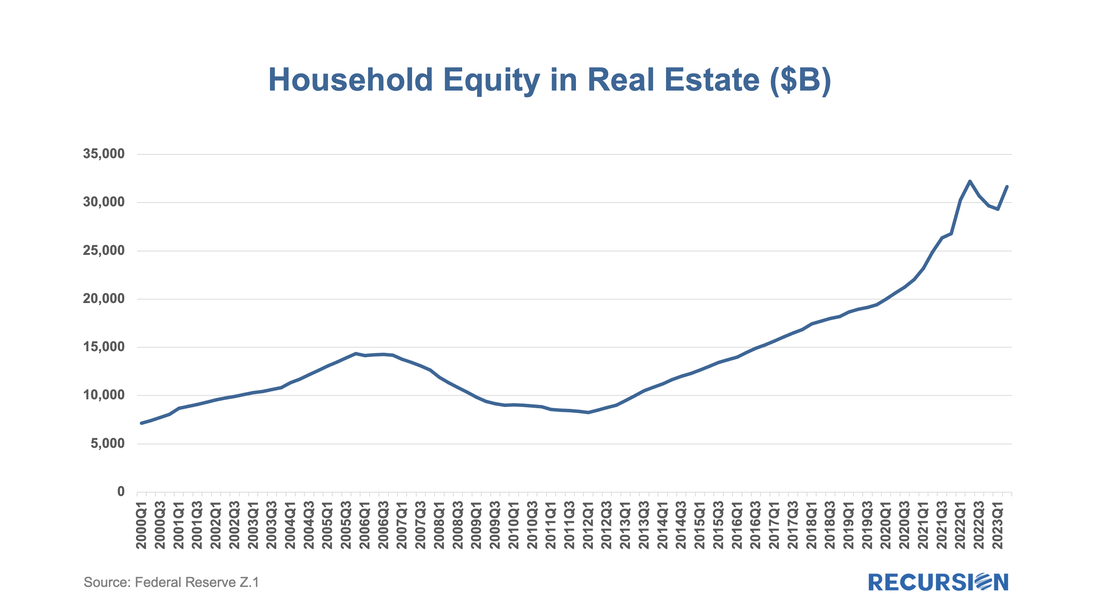

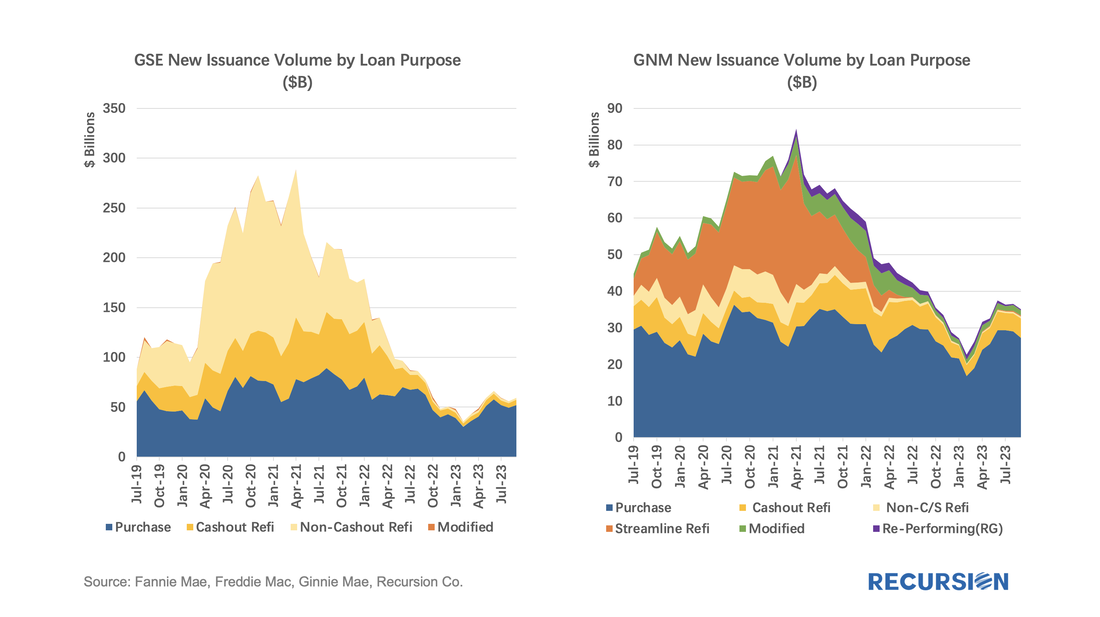

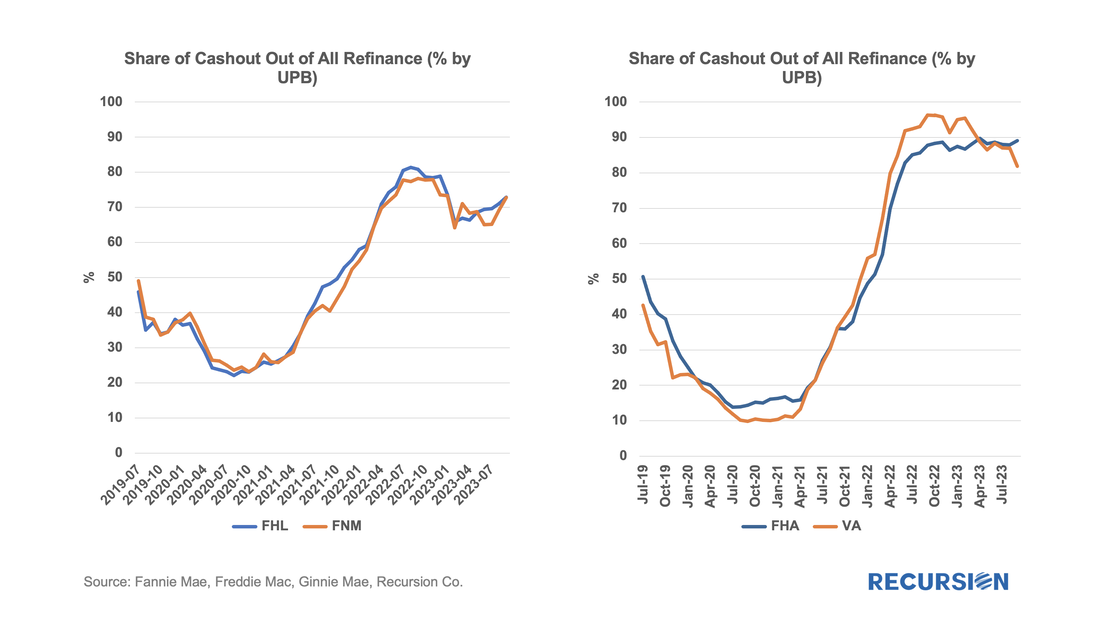

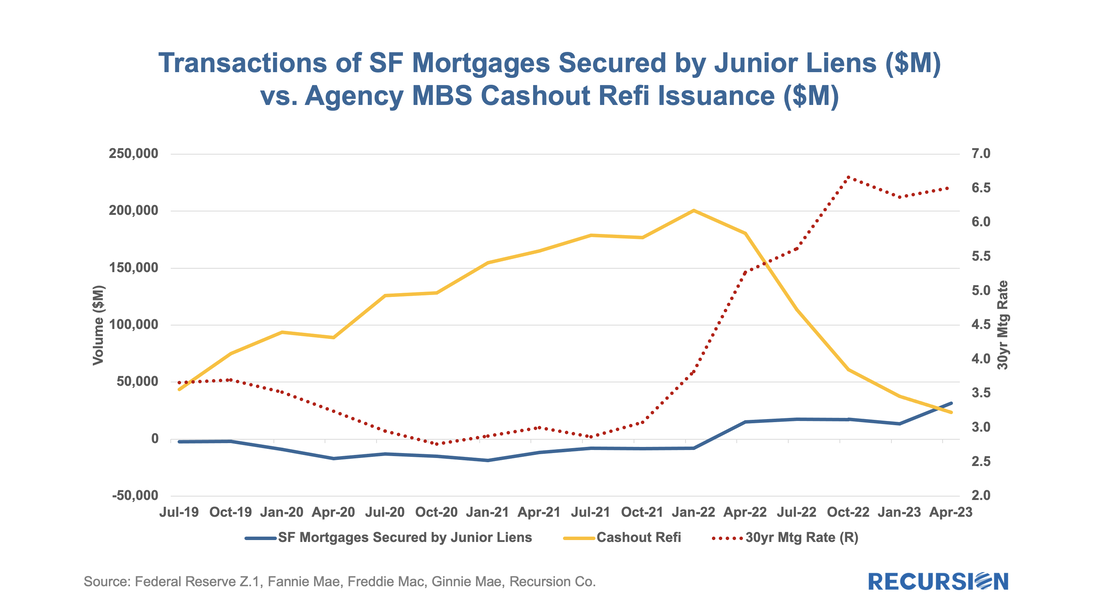

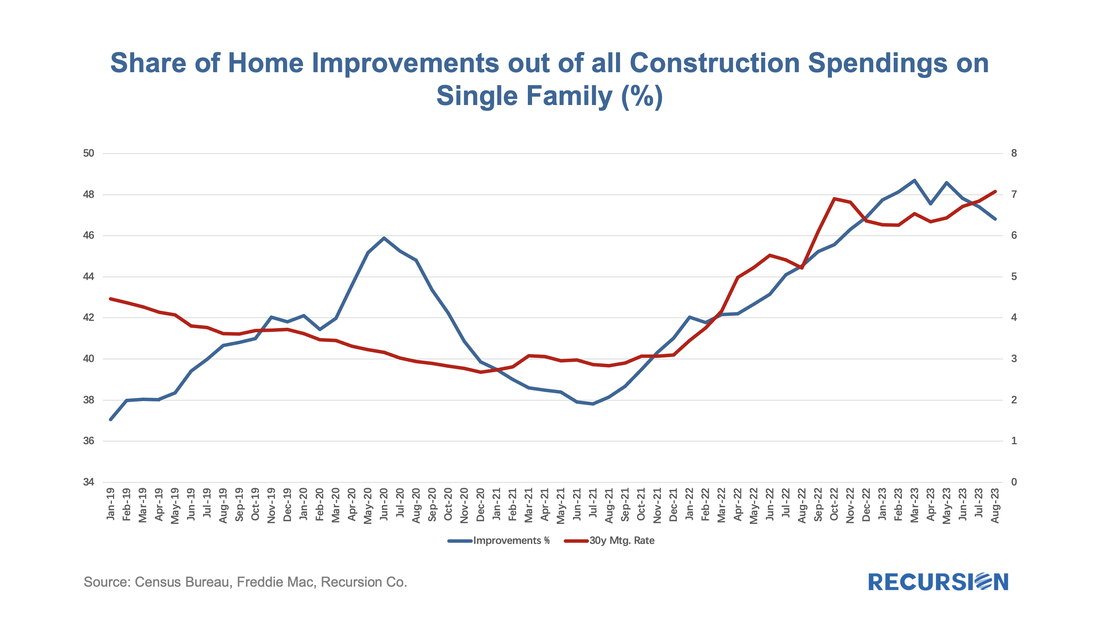

With home prices at record high levels and mortgage rates at their record highs since the turn of this century, it’s natural to ask if the housing market will be the source of new systemic risk. Over the past year, we have written extensively about “mortgage winter”, a condition where housing demand is held back because of affordability, while at the same time, supply is constrained by current homeowners who are locked into properties by mortgages with rates far below those available in the prevailing market. This is what economists would call a “bad equilibrium”, a state of great strains in the market that tends to persist. While the housing finance industry is under great duress, the spillover to the broader economy remains limited, as for example, the labor market has held up well despite soaring borrowing costs. Within housing, the notable good economic news is that the extraordinary surge in house prices in the wake of the Covid-19 pandemic has resulted in an astounding 50% surge in the value of homeowner’s equity in real estate since Q1 2020 to over $30 trillion. This surge served to directly support the economy over the 2020-2021 period as households extracted some of this equity for their personal spending and investment. In an article published earlier this year, researchers at the New York Federal Reserve found that households extracted about $430 billion from the second quarter of 2020 through the fourth quarter of 2021 via the refinance market[1]. Interestingly, the amount taken out was less than half of what was observed as a share of income during the housing bubble period of the early 2000s. This relatively subdued behavior may in part be the consequence of tighter lending standards in place at present compared to the earlier period. The lid on the cookie jar slammed shut, however, beginning in the second half of 2022 when mortgage rates started their steep upward climb. Volumes of issuance by loan type, newly updated for the third quarter for conforming and Government loans, show this clearly: Total volumes have collapsed since 2021, but the share of cashout refinances out of all refinances remains elevated, although at production levels far below those seen in 2021: The constraint on cashout volumes is that borrowers refinance the entire remaining balance after the cash extraction at prevailing interest rates, which will be prohibitively expensive for most households. An alternative source of funds out of housing equity is second liens. In this case, borrowers only need to borrow the amount they wish to “extract” at the prevailing rate which is generally much less than the remaining loan balance. As these “seconds” are not eligible to be included in agency securities, we do not have the detailed loan-level information we have for refinance loans, but we can get an aggregate figure from the Federal Reserve Z.1 report. Below find a chart of second liens and cashout refinances on a quarterly basis, with the 30-year mortgage rate as an overlay. A key point to underscore in this chart is that the blue line is the new production of “seconds”, while the yellow line is the total volume of deliveries of securitized cashout refinance loans. Seconds remained subdued during the high refinance period 2020-early 2022 and have only recently started to pick up now that the refinance channel has dried up. Many banks have not offered second liens so progress on this front is slow, but impediments to new production may decline over time. An interesting feature of second liens is that interest payments on these loans are generally not tax deductible, although prior to 2019 an exception was made for spending on home improvements[2]. While the tax incentive is gone at present, the idea that funds obtained from tapping home equity end up being spent on improvements remains alive. As the rate lock set in starting last year, many homeowners who wished to move up to larger properties instead found themselves improving and expanding their current homes. It seems reasonable to think that a significant portion of this increase was funded by equity extraction. In fact, the share of spending on home improvements rose from 38% in the mid of 2021 to above 48% earlier this year, aligning with the steep climb of mortgage rate. Where does that leave us?

[1]https://libertystreeteconomics.newyorkfed.org/2023/05/the-great-pandemic-mortgage-refinance-boom/

[2]https://www.irs.gov/faqs/itemized-deductions-standard-deduction/real-estate-taxes-mortgage-interest-points-other-property-expenses/real-estate-taxes-mortgage-interest-points-other-property-expenses-2 [3] https://www.recursionco.com/blog/a-first-look-at-buydowns [4]https://www.recursionco.com/blog/refinance-risk-in-the-agency-multifamily-market |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed