|

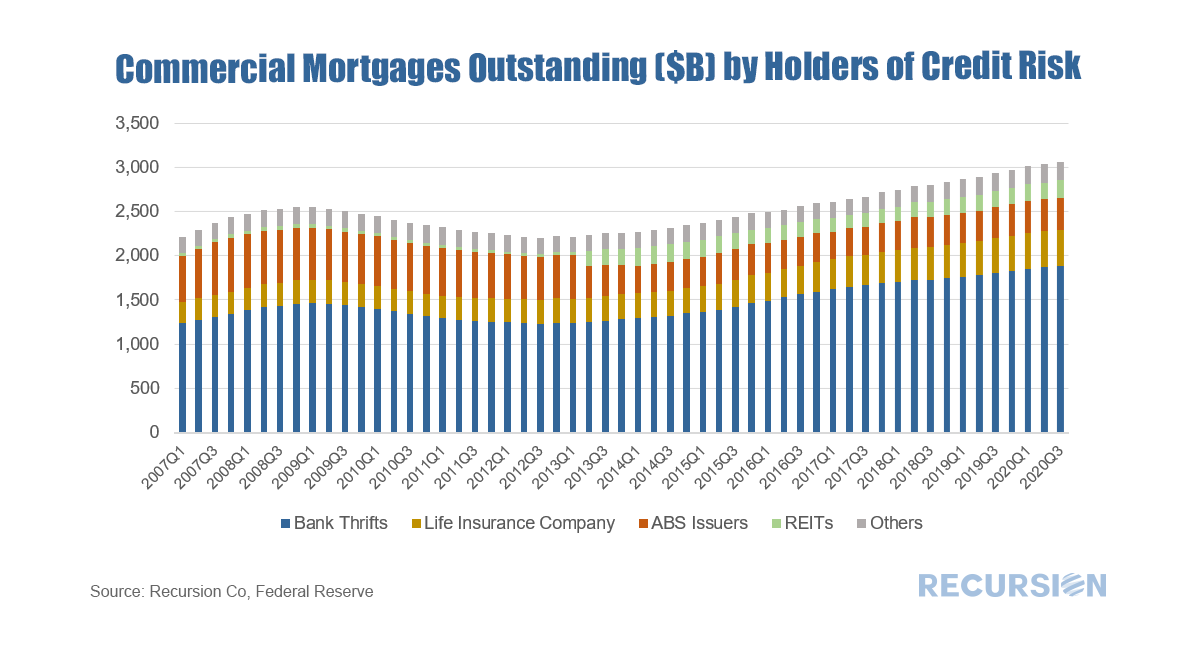

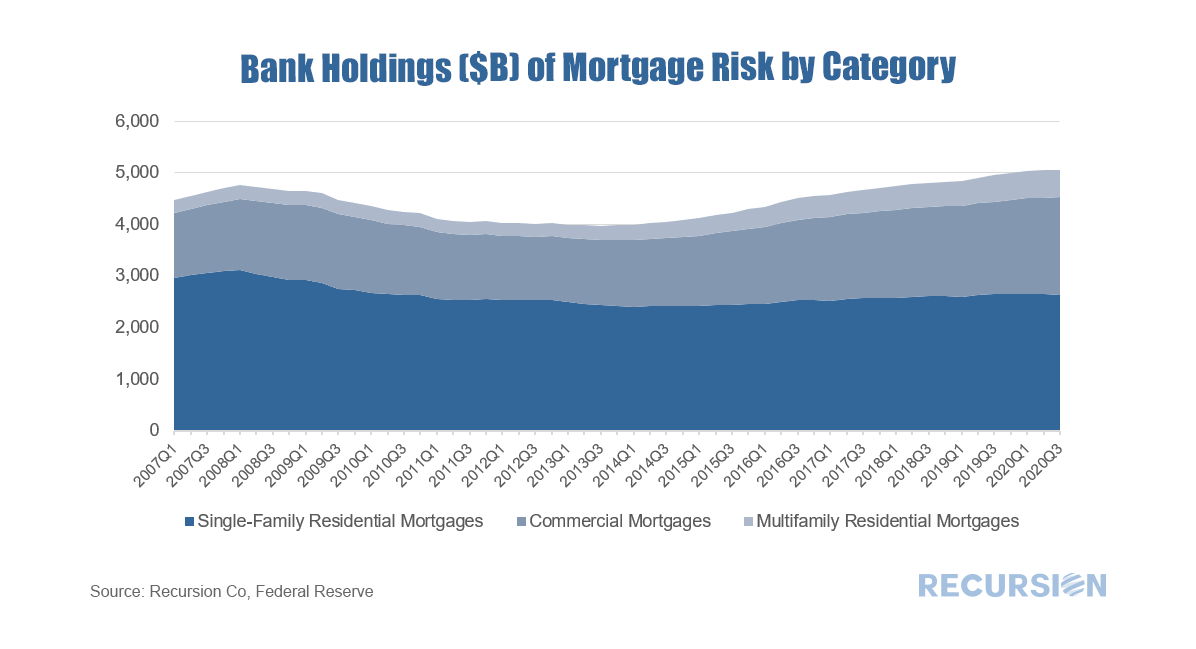

In prior posts, we commented on trends in the distribution of risk in the mortgage markets of single-family residential[1] and multifamily markets[2] from the Federal Reserve Z.1 data. This note takes a look at the commercial mortgage market[3] in a similar fashion. Other than the multi-family category, commercial mortgage for properties such as office, retail, hospitality etc is not normally in our wheelhouse at Recursion, but insofar as it is a substitute as an investment vehicle for the residential markets it is useful to take a look at trends here. Commercial mortgages (excluding multifamily) are exposed to unique risk due to COVID-19, as it is very likely offices, hotels and shopping malls will never to able to achieve the same occupancy rate as before the pandemic. The commercial mortgages(excluding multifamily) outstanding crossed the $3 trillion threshold in Q1 2020. Of interest is that the dominant holder of this risk is banks and thrifts. Their share has been in a narrow 1% range between 61.4% and 62.5% over the past four years[4]. This observation leads naturally to the question of bank holdings across the residential and commercial categories: What is interesting is the steady drop in the share of single-family mortgages held on bank balance sheets over the past dozen years by about 1% per year (currently 52.1%). [5]The impact of Covid-19 on this trend appears to be quite small. Both multifamily and commercial mortgages have gained shares. It’s worth noting that banks hold sizable amounts of single-family MBS in addition to loans, on the order of $2.9 trillion [6] in Q3 2020. In this case, the agencies hold the credit risk, not the banks. There is ample room for banks to boost their holdings of residential loans, one more item to watch in the transition year 2021. [1] https://www.recursionco.com/blog/that-was-then

[2] https://www.recursionco.com/blog/big-data-and-the-multifamily-market [3] Also called “nonfarm, nonresidential” in the Federal Reserve Z.1 data [4] From Q4 2016 – Q3 2020 [5] The denominator of calculation only banks’ holdings of single-family mortgages, multifamily mortgages, and commercial (non-farm, non-residential) mortgages; It does not include the “farm” sector on the Federal Reserve Z.1 data [6] According to L.211 Agency-and GSE-Backed securities outstandings from the Federal Reserve Z.1 data |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed