|

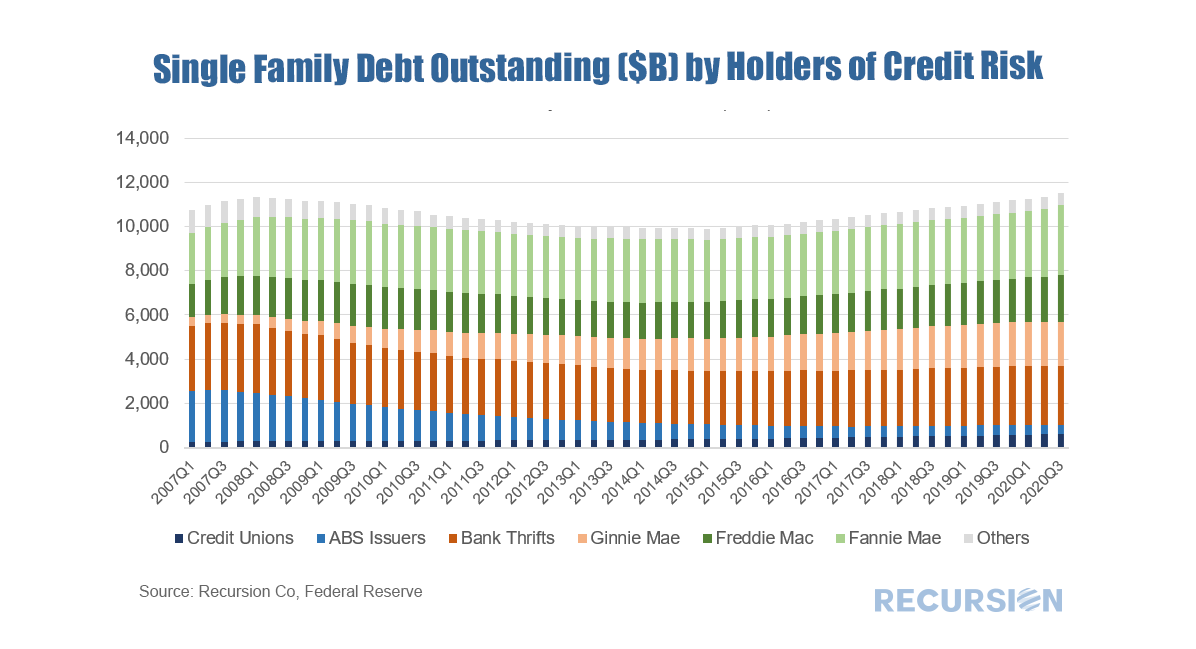

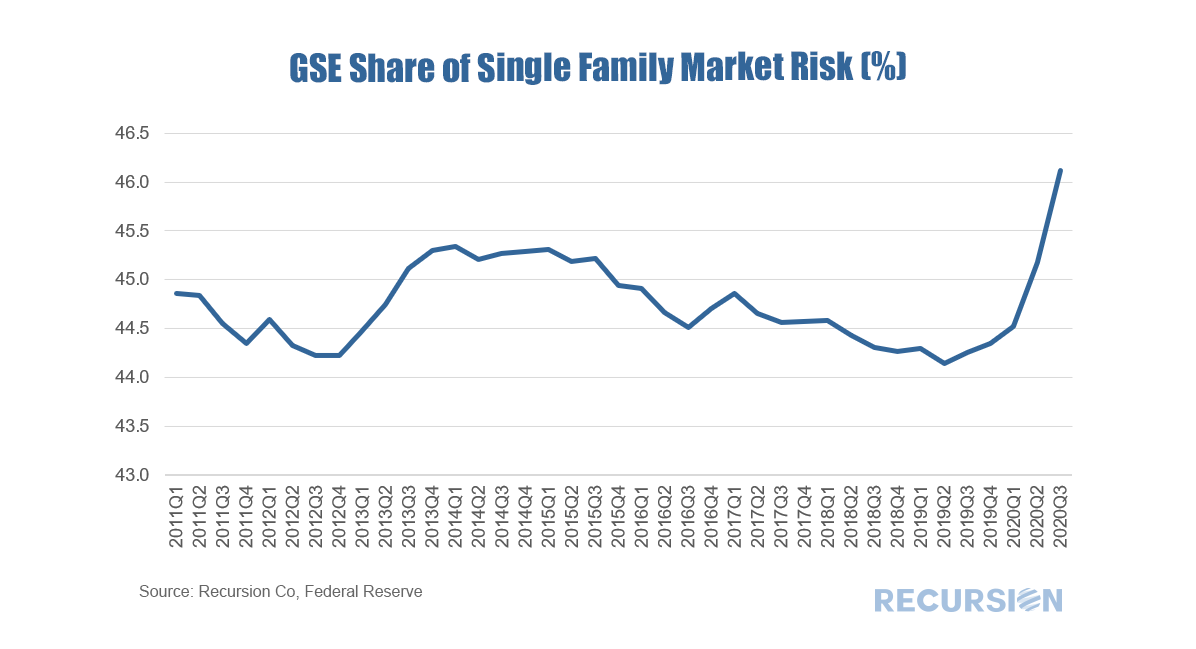

As we have commented several times, the Federal Reserve Z.1 data is a fine source of information on long-term financial market trends. This post looks at trends in ownership of single-family mortgage risk. The chart below shows this distribution from Q1 2007 to Q3 2020: Several points jump right out. First, the dollar value of outstanding single family mortgage debt edged above the prior peak of $11,323 bln attained in Q1 2008 in Q2 2020 when it hit $11,342 bln. Second, the “private label” share of the market tracked here in the “ABS Issuers” segment has never recovered since the Global Financial Crisis, despite all the publicity around the non-QM market. The quarterly contribution from this segment has declined every quarter since Q1 2007, with the share dropping from 21.3% that quarter to 3.8% in Q3 of last year. Finally, Covid-19 has resulted in a substantial jump in single-family mortgage outstanding volumes with Q2 and Q3 volumes combined increasing by just under $254 billion, a 13-year high for a six-month period. This increase was more than accounted for from the growth in the GSE sector ($298 bn), with declines reported for ABS Issuers (-$26 bln), Ginnie Mae (-$23 bln) and Banks and Thrifts (-$15 bln). The decline in the Ginnie sector is likely due to refinances out of Government program loans into conventional loans[1], while that in the bank sector reflects a growing preference on the part of lenders to keep mortgage holdings on balance sheets in the form of MBS during the pandemic instead of whole loans. The GSE share of the risk contained in the $11.5 trillion mortgage market remained in a remarkably narrow range from 44.2% to 45.3% from Q1 2011 to Q1 2020. As of Q3 2020, it stood at 46.1% This increase comes at the expense of both the public sector (Ginnie programs) and the private sector (primarily banks). The implications of this jump for housing policy are potentially profound. We conclude with our ongoing observation that mean-reversion is not part of the new normal. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed