|

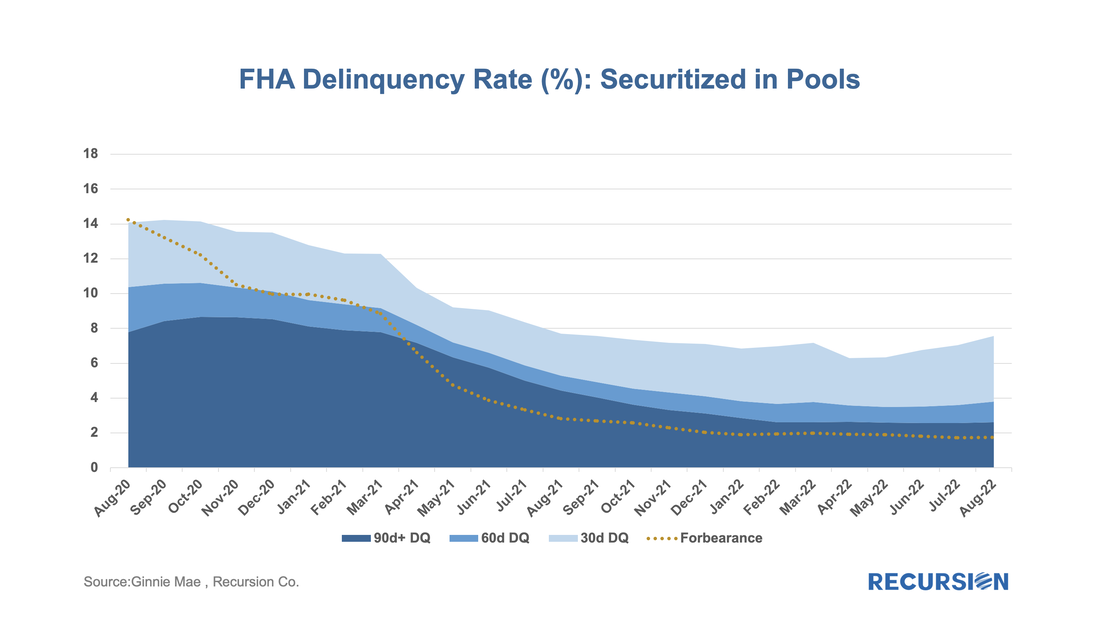

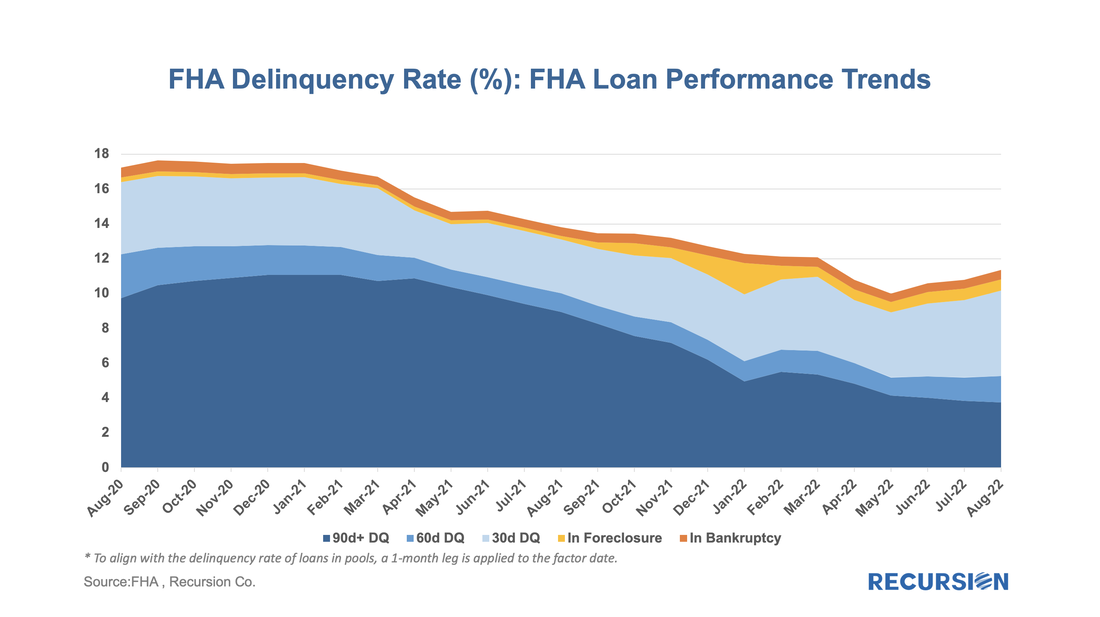

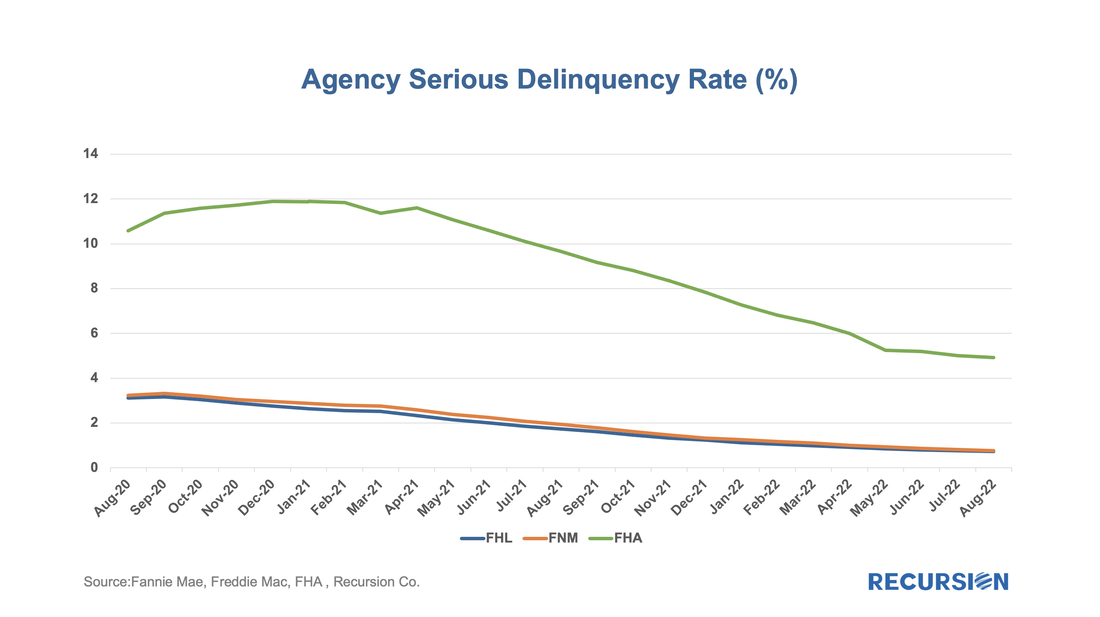

We recently wrote about the increase in short-dated delinquencies in FHA pools relative to loans in conforming pools[1]. We took this as a sign of the disproportionate impact that inflation has on lower-income households. This is a useful observation, but it is limited by the lack of visibility on delinquencies of three-month duration or longer as these loans are often bought out of pools. To address this gap, we recently imported the FHA performance data. This data is not available at the loan level, but the aggregate characteristics are informative. There are two main takeaways from these charts. First, while the 30- and 60-day DQs are very similar, the 90+ days delinquencies are significantly higher in the FHA performance data reflecting the loan buyouts mentioned above. Second, the FHA performance data contains information on foreclosures and bankruptcies that is not available in Ginnie Mae’s disclosure. These trends could prove a valuable indicator of financial impairment during a downturn. We do not have a similar dataset for the GSEs, but there have so far been relatively much lower volumes of buyouts in the conforming space relative to the Government programs[2]. This could, of course, change. The only complete source of information on the status of GSE loans comes from the Monthly Reports from each Enterprise[3]. Through the first half of 2022, conforming borrowers have shown no signs of increasing stress, while the month-over-month change rate of serious DQ rate for FHA borrowers slowed down to -0.01% in June 2022 from -0.13% in the previous month. With the Federal Reserve raising its benchmark interest rate range to 3.0% - 3.25%, it will be very interesting to see if FHA is a leading indicator for more well-off borrowers. [1] A Quick Note on the GNM – GSE Early Delinquency Gap - RECURSION CO [2] Agency RPL Market Structure and Performance - RECURSION CO [3] Freddie Mac Monthly Volume Summaries, Fannie Mae Monthly Summary Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed