|

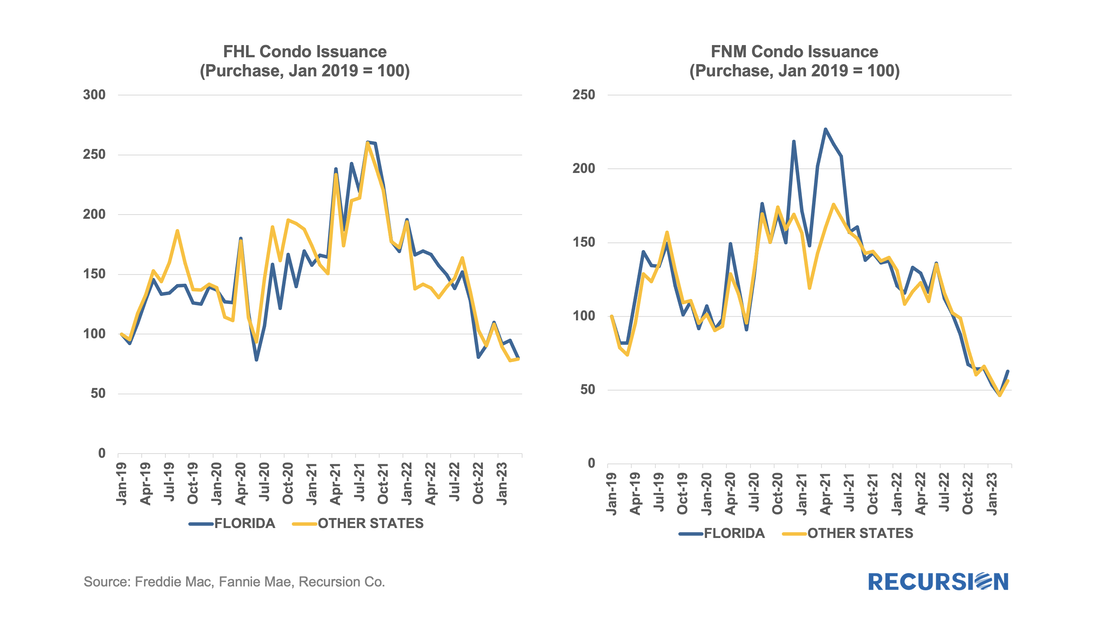

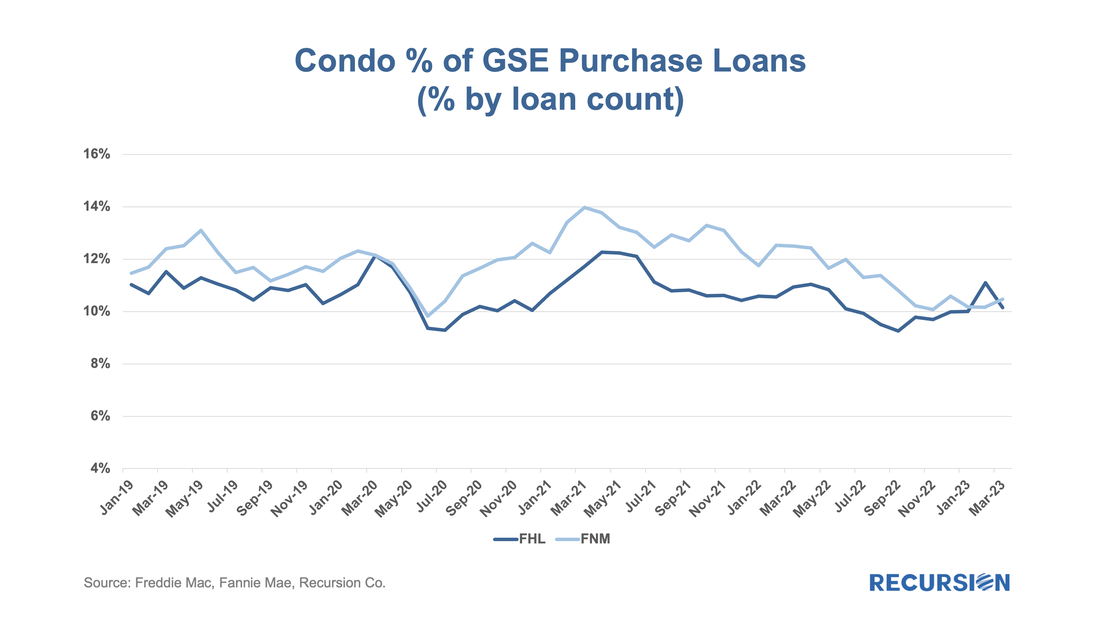

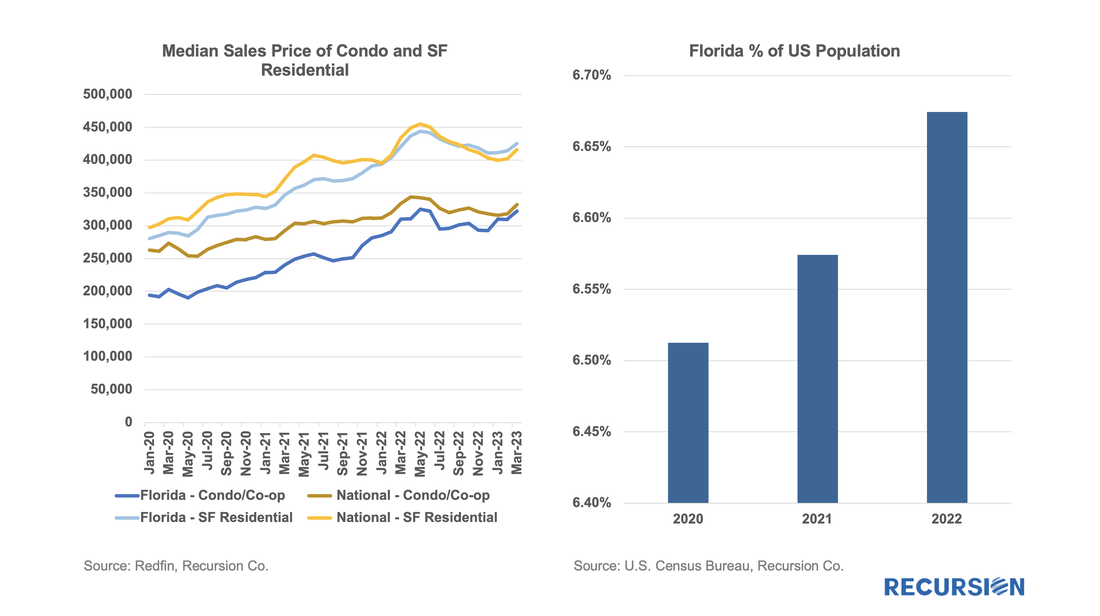

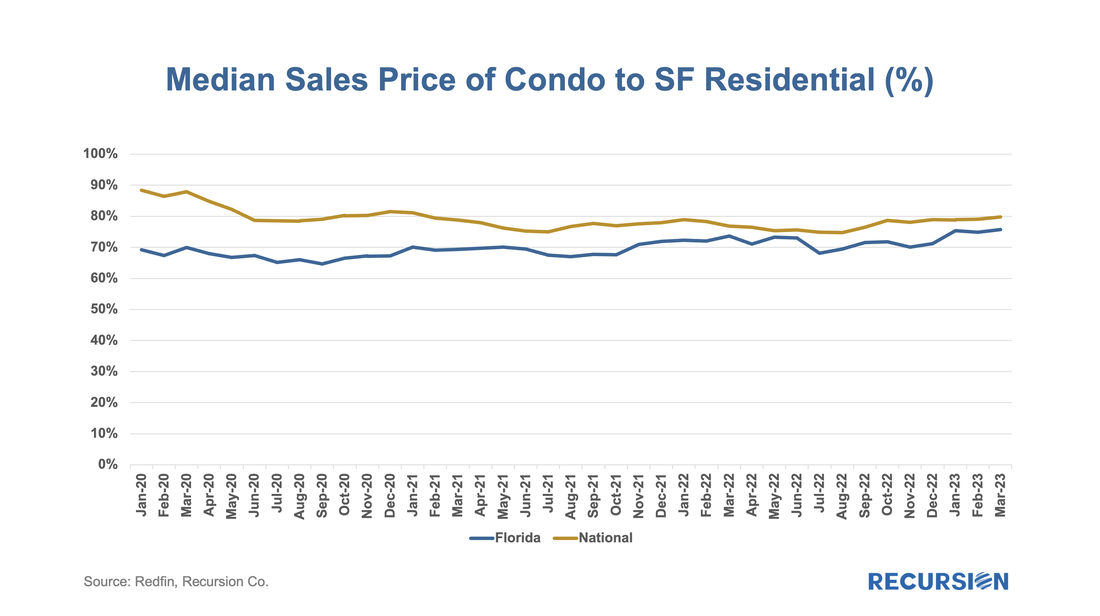

The recent release of “Social Scores” on the part of the GSE’s serves to point out the broad range of ESG issues facing the mortgage market.[1] Of course, this covers a lot of policy territory, and over time investors, lenders and policymakers will have to come to grips with the details associated with these concerns. In today’s post, we look at environmental issues related to the condo market. These issues came to a head with the disaster in Surfside Florida in June 2021, when the partial collapse of Champlain Towers South, a 12-story condo, resulted in 98 deaths and over $1 billion being awarded to victims in a class action lawsuit. Implications for regulation and insurance costs continue to be felt as the event brought home the immediacy of issues surrounding climate change to the general public. In October 2021, Fannie Mae issued a Lender Letter presenting tightened requirements that impact the eligibility of loans made in buildings with five or more attached units[2]. These new policies were “designed to support the ongoing viability of condo and co-op projects…(as) aging infrastructure and significant deferred maintenance are a growing concern across the nation.” These new standards came into effect on January 1, 2022. Among other things, they may land a building on an “unavailable” status if there is significant deferred maintenance, failure to pass local regulatory inspections, or not meeting the 10% budget reserve requirement. To see if there is any impact, we start with a look at Freddie Mac and Fannie Mae condo loan deliveries from January 2019 to March 2023. During this period, the two Enterprises delivered 1.16 million purchase loans securitized by a condo, of which Fannie Mae generally had a share of about 57%: Considering the noisy nature of the data, we set the delivery loan count of January 2019 as 100 and observe the monthly changes compared to the first month. There is much to take away here. First, it’s clear that reluctance to accept condo collateral grew shortly after the disaster, before the implementation of the rules in 2022, particularly for Fannie Mae. Second, since Q3 2021, the pattern for Florida and the other states has been very similar for both agencies, indicating that this impact is not limited to the Panhandle State. Finally, we know that in general, deliveries for all products surged in 2021 and subsequently fell in 2022 as interest rates soared. Consequently, to see the condo-specific impact, we need to benchmark deliveries to those of all products: While the data is unsurprisingly noisy, a downward trend in the condo share can be clearly seen for both agencies. Over the period from June 2021 to March 2023, the share of condo deliveries out of all Fannie Mae products fell by 2.6% to 10.5%, while for Freddie Mac, it dropped by 1.9% to 10.2%. A natural next question to address is, what is the impact on condo prices? In this case, we obtain prices for all metros from Redfin for condos and single-family homes: As can be seen in the above chart on the left, prices for all products rose from Jan 2020 to mid-2022. Single-family homes were modestly cheaper in Florida than nationally over this period but converged over the past year. In the case of condos, Florida was much cheaper than the national average in early 2020, but this gap has largely disappeared recently. This is likely due to the surge in the US population moving to Florida over this time as shown in the right-hand chart above. Finally, we look at the important question of the ratio of condo prices to single-family homes. Over the past nine months, the ratio of condo prices to single-family home prices rose from 75% to 80% across all metros and from 68% to 76% in Florida. As policymakers often view the condo market as an affordability product that is suitable for first-time homebuyers, it will become increasingly important to observe future developments in this trend. As fees increasingly reflect the costs of preservation and investments to maintain sustainability, this role may come under increasing pressure. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed