|

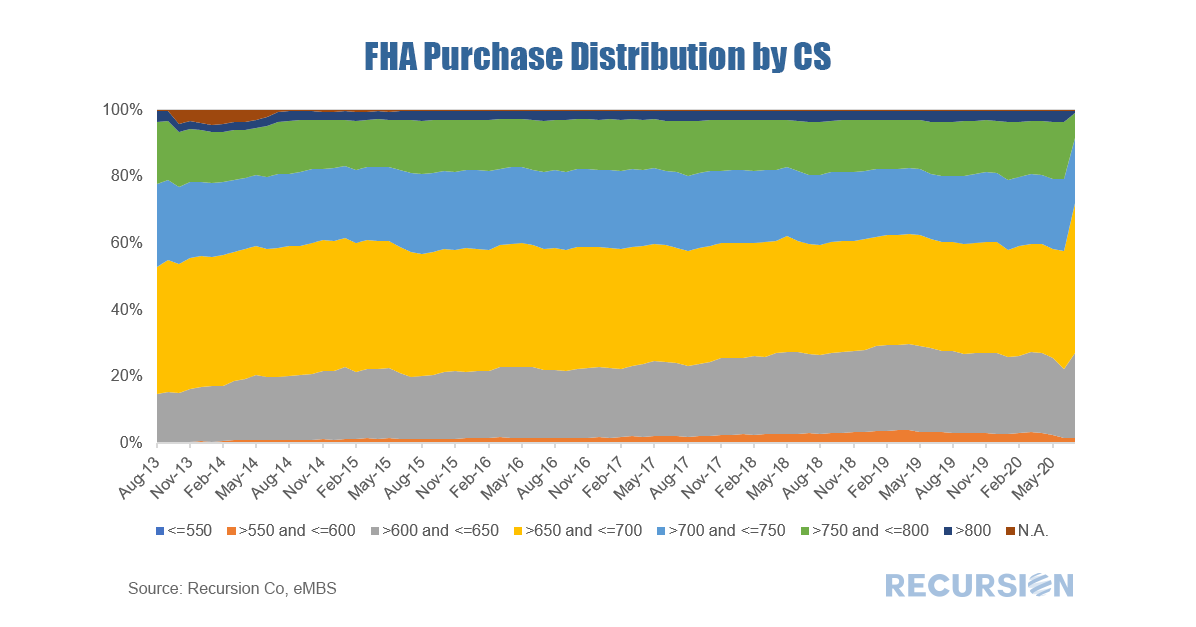

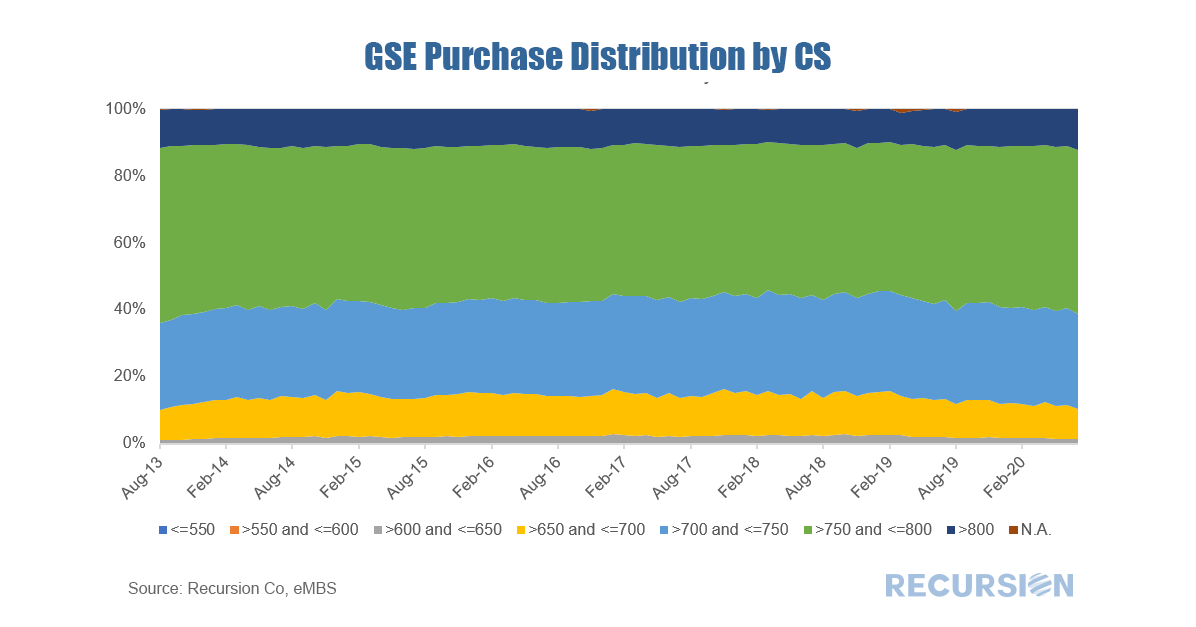

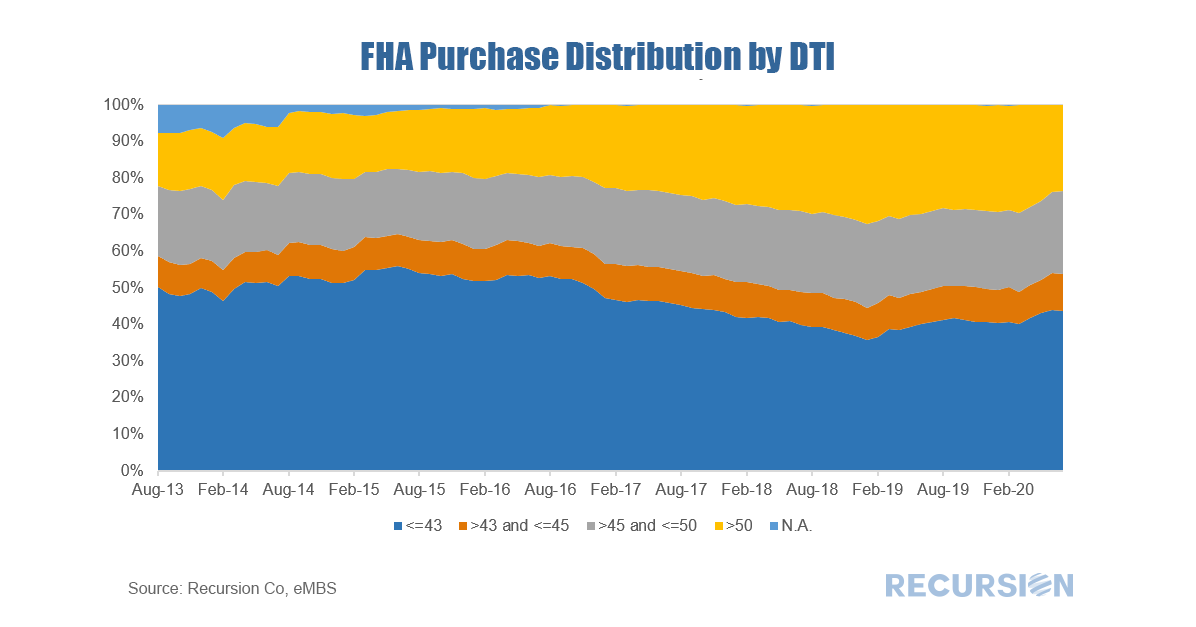

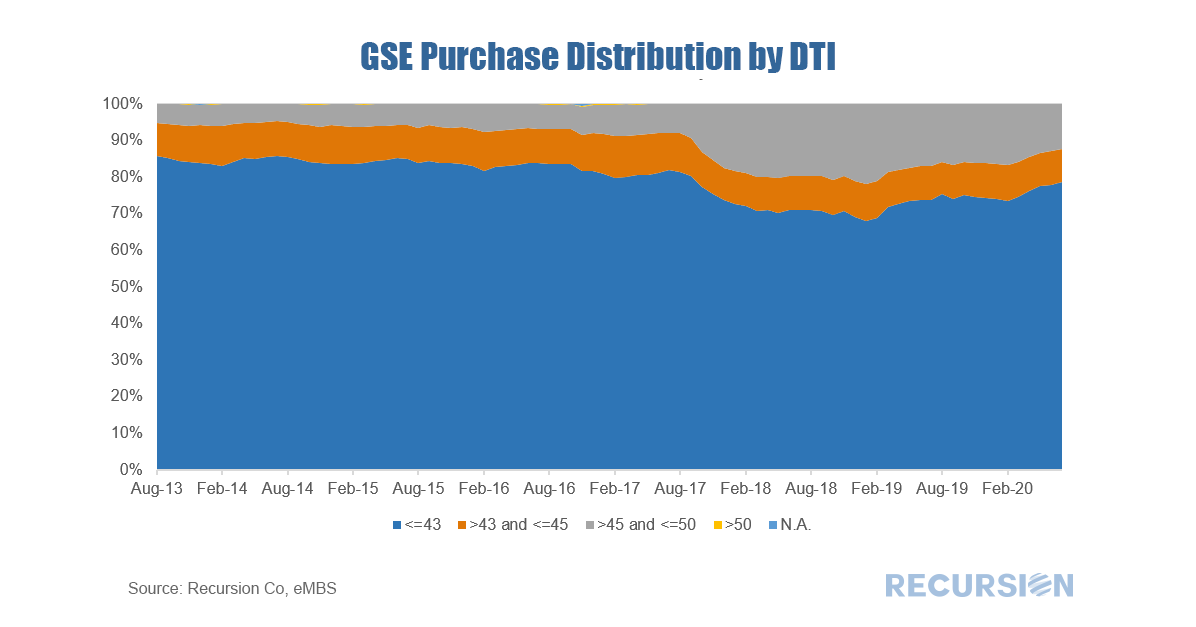

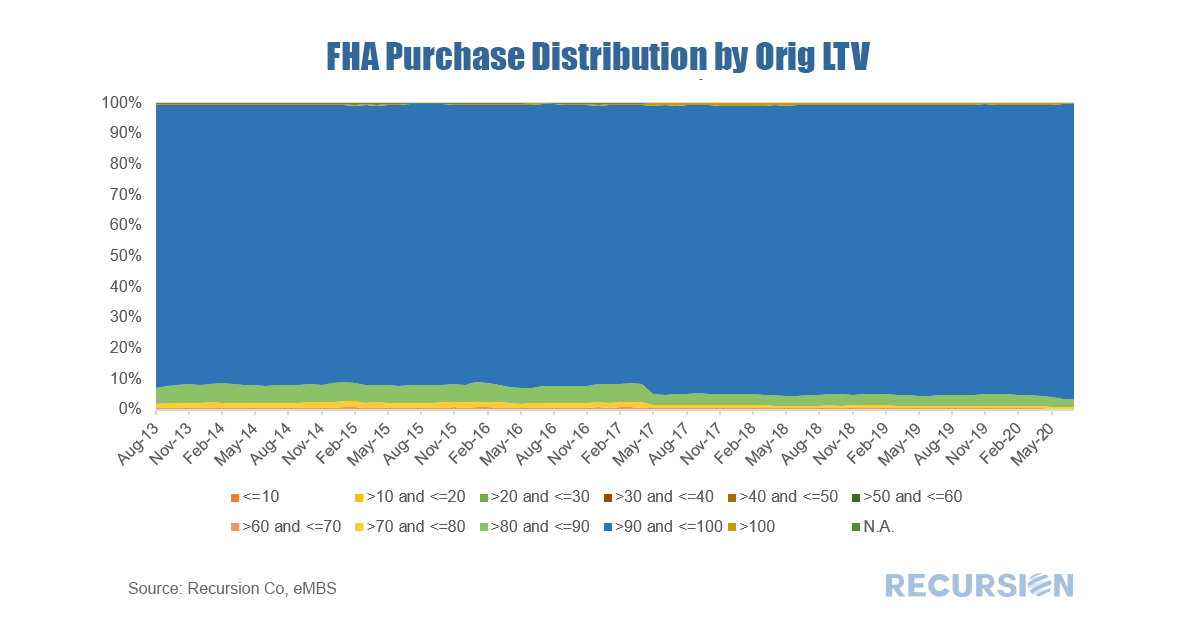

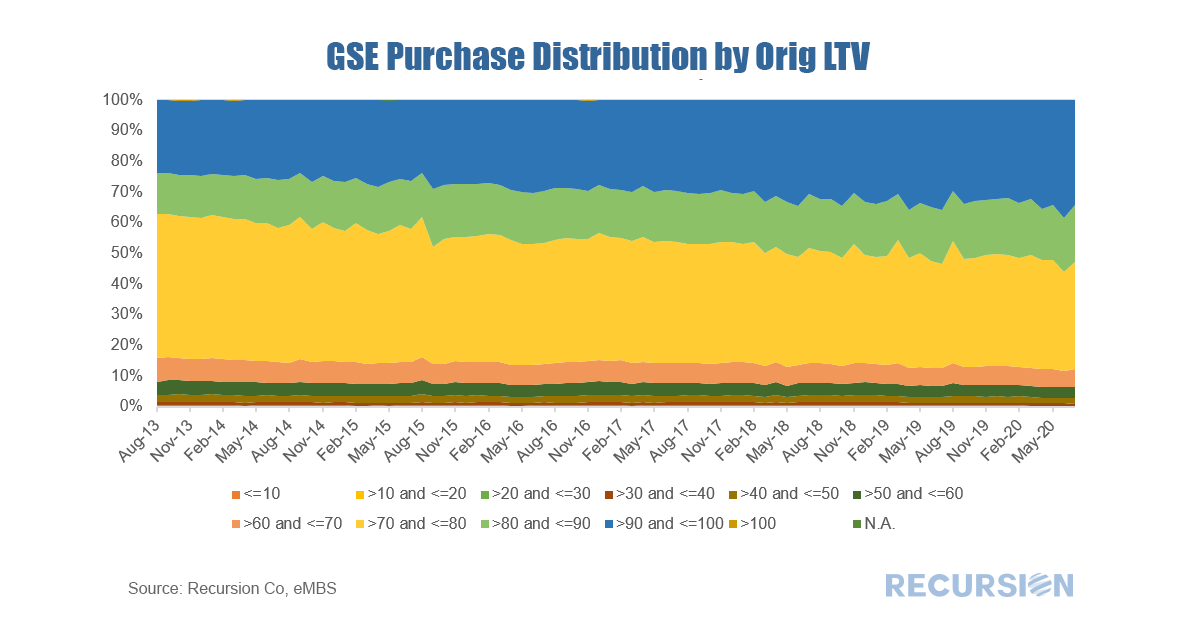

In a recent post we looked at the agency composition of the recent surge in MBS production[1]. We observed that Ginnie Mae’s market share in the three months to July 2020 is significantly below that experienced in the same period a year ago. The bulk of the decline is due to a drop in the refi share, while the purchase market share experienced less than a 1% decline. There are several drivers of share for purchase market share, including program design, the coupon spread between the government and conforming sectors, and differences in the credit boxes between the two. This note looks at competitiveness through the lens of the latter factor, credit boxes. As noted in the prior post, Ginnie Mae is the securitizer for four different programs, with the two biggest being FHA and VA. VA has a fairly unique set of program requirements, so the main competition in the purchase mortgage space is between FHA and the GSEs. In the three months to July 2020 FHA lost about 2.5% of its share in the purchase mortgage space compared to the GSEs. Let’s dive into credit factors, starting with credit score: There is a stark difference between FHA and the GSEs in credit score profiles, with FHA more heavily weighted towards lower-credit borrowers than the GSEs. The main overlap is in the 700-750 score borrower category, and the GSEs have been modestly more active in this category with such loans accounting for about 2% more of their purchases than a year ago. In July, FHA’s composition shifted to give more weight to the 650-700 category from 700-750. Similar differences can be seen in DTI: Again, FHA’s deliveries are more focused on borrowers with weak credit, this time evidenced by the greater weight of highly-indebted borrowers in their pools. It’s interesting to note that the share of loans with DTIs between 43 and 45 are very close between the programs. Finally, we look at LTVs: Almost all FHA borrowers put less than 10% down on their home purchases. But what stands out is the steadily growing share of loans on the GSEs’ books with high LTVs. In June this stood at a 7-year high of 38.4% of deliveries. By taking more house price risk the Enterprises are increasing their footprint in the purchase mortgage space. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed