|

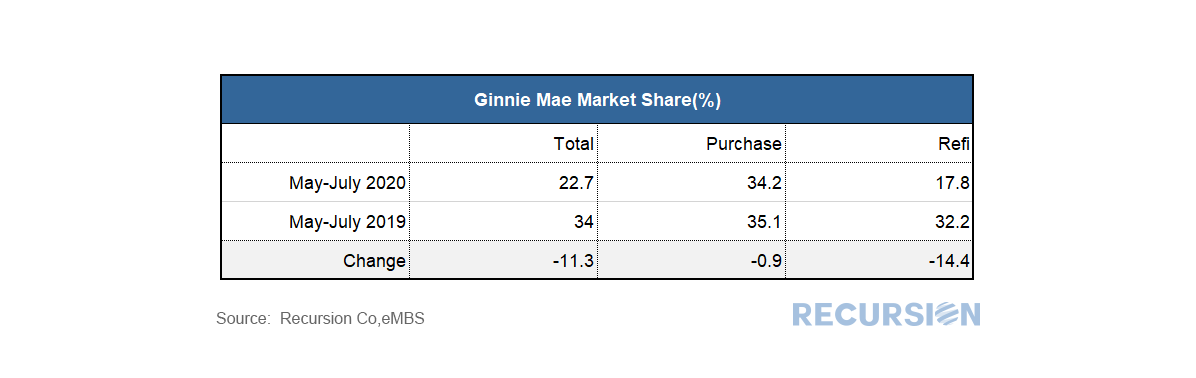

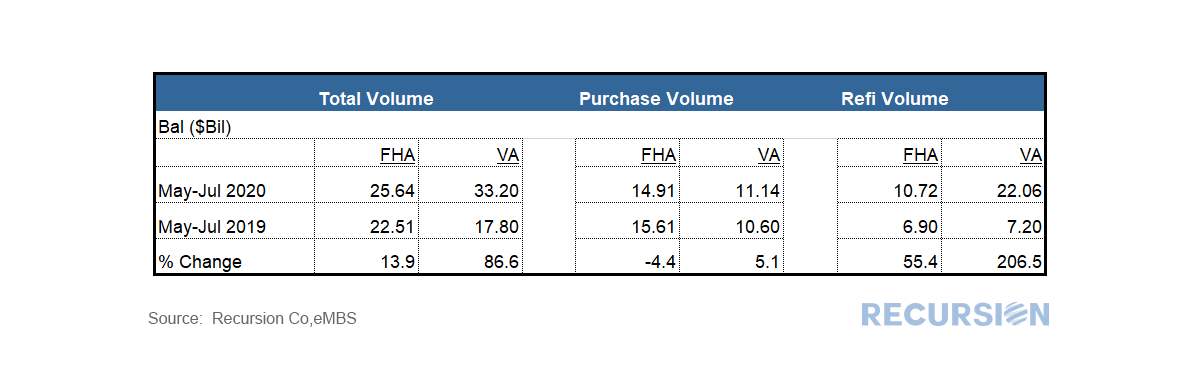

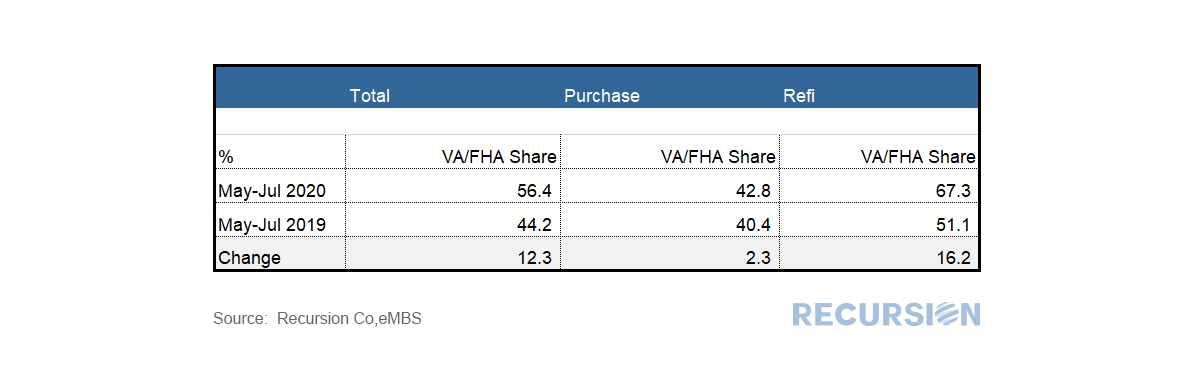

In a recent post, we noted the surge in new mortgage deliveries to a record level[1] in July. Besides this sharp increase, there is an interesting shift in the composition of these deliveries in the form of a striking decline in the government share. As can be seen from the above table, Ginnie Mae lost over 11 full points in market share over the May – July period from a year earlier. The bulk of this loss is concentrated in refi loans. To dig a bit deeper, it is natural to look at a breakdown of volumes into the various Ginnie programs[2]. Notably, VA’s refi volume in the three-month period ending in July was triple what it had been in the same period last year, while FHA’s grew by only a bit more than 50%. And in terms of the VA/FHA Share: VA gained over 12 points in the VA/FHA share over this period, led by a 16% jump in the refi share. Ginnie Mae securities are collateralized with loans from programs with widely varied guidelines. Understanding the abrupt changes in shares requires a deeper look into the program guidelines, and the behavior of the individual lenders in each. [1] Refer to our previous post: Mortgage Deliveries Surge to New Record in July

[2] Unlike the GSEs which both guarantee and securitize loans, Ginnie Mae’s role is primarily as securitizer and the guarantor role is taken by four other agencies: FHA, VA, Rural Development, and Indian Housing. The first two comprise the bulk of the volumes and we refer to the rest as “others”. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed