|

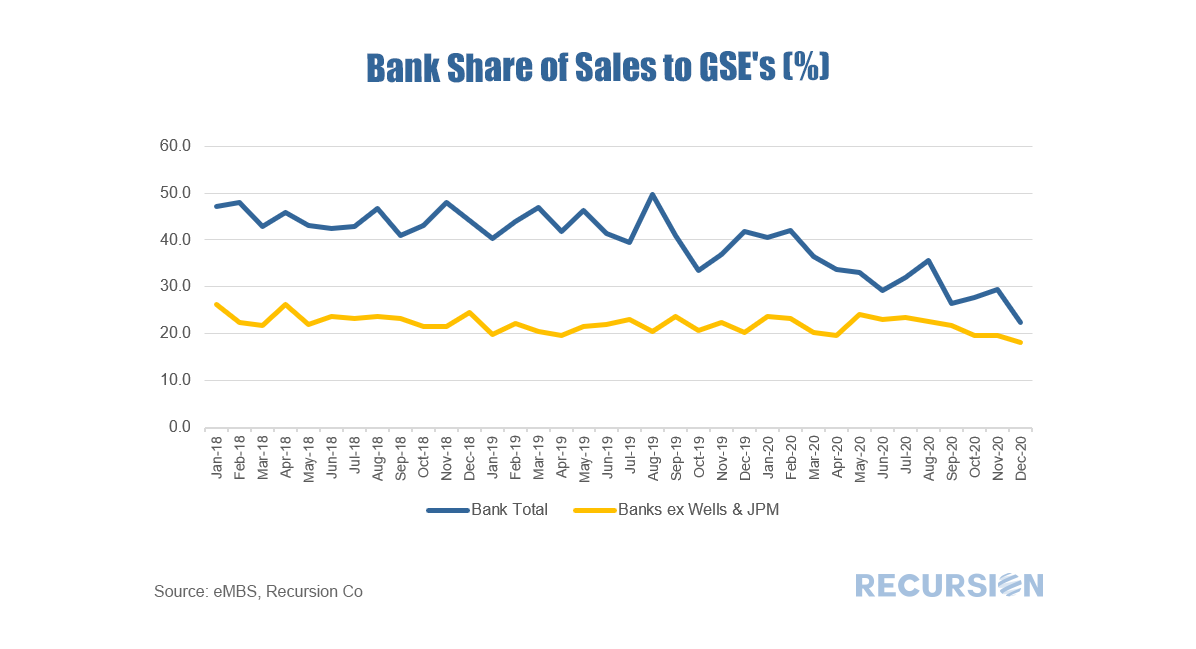

Our regular readers will be aware that an ongoing theme is the collapsing bank share of mortgage deliveries to the Agencies[1]. Our recent monthly download shows that the bank share of deliveries to the GSEs fell sharply again in December, collapsing by over 7.0%(!) from November to a record low 22.3%. A year earlier this figure stood at 41.7%. The plunge witnessed over the past year marked an acceleration in a long-term trend, as banks face a heavier regulatory burden relative to nonbanks, and as nonbanks have made inroads into the market through their development of superior technology interfaces with their clients. Covid-19 has served to accelerate this trend by pulling customers out of bank branches and putting them in front of their laptops and smart phones. The latest drop incentivized us to dig a little deeper; we didn’t have to peer too deep to find an interesting result. Below finds a bank of the bank share of GSE deliveries, and the same chart excluding Wells Fargo and JP Morgan Chase. This is quite remarkable. The share excluding the two banking behemoths is also down, reaching a record-low 18.1%, but it fell by only about 1.5% last month, and by 2.0% from a year earlier. The share of deliveries for each of these banks was a little over 2% each in December, down from double digits a couple of years ago. We will leave it to others to decide whether this stepping back on the part of these firms represents a deliberate strategy change regarding the allocation of capital, or difficulties in competing related to the fallout from Covid-19. In either case, it will be harder to regain share in the future than it was to lose it. [1] See for example, https://www.recursionco.com/blog/the-covid-19-nonbank-juggernaut-rolls-on

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed