|

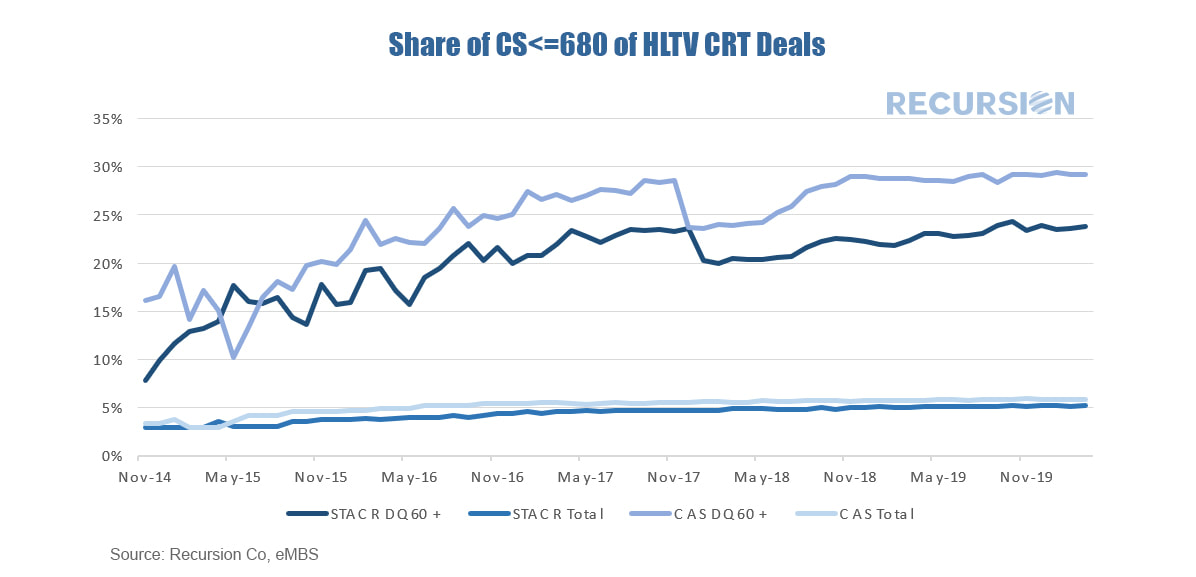

As noted in an earlier post[1] we discussed how the GSE’s have been sharing credit risk with private investors through the Credit Risk Transfer (CRT) [2]market. At that time, we discussed how losses tended to grow over time, and noted the significant geographical variation in default rates by state, reflecting local economic conditions. Another consideration noted along these lines is underwriting characteristics. This impact is particularly notable when comparing the performance of loans for lower-credit quality borrowers to others. The chart below looks at the relative performance in CRT high-LTV reference pools between those with FICO scores less and equal to 680 and those greater than that score: While loans with credit scores less and equal to 680 comprise only about 5% of the reference pools of the two programs, they are responsible for about 25% of STACR 60+day delinquencies and 30% of those in the CAS program. Given the uncertainties surrounding the extent and distribution of losses related to the Covid-19 virus, it is difficult to assess whether this relationship will continue to hold for the wave of delinquencies that is starting to sweep over the mortgage market. It is evident, however, that lenders are attempting to limit losses by tightening credit conditions[3] to avoid costs associated with selling loans in forbearance to the GSE’s[4], and other concerns. While the Federal Reserve has restarted its program to purchase MBS to encourage lower mortgage rates, the extent of declines is limited by the increased caution on the part of lenders to the crisis. [1]https://www.recursionco.com/blog/tracking-virus-related-mortgage-losses-through-the-crt-market

[2]The CRT market includes both STACR and CAS. STACR is Freddie Mac’s Structured Agency Credit Risk program while CAS is Fannie Mae’s Connecticut Avenue Securities program [3]https://www.reuters.com/article/us-jp-morgan-mortgages-credit-exclusive/exclusive-jpmorgan-chase-to-raise-mortgage-borrowing-standards-as-economic-outlook-darkens-idUSKCN21T0VU [4]https://www.cnbc.com/2020/04/22/coronavirus-relief-fannie-and-freddie-to-buy-loans-in-mortgage-bailout-program.html |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed