|

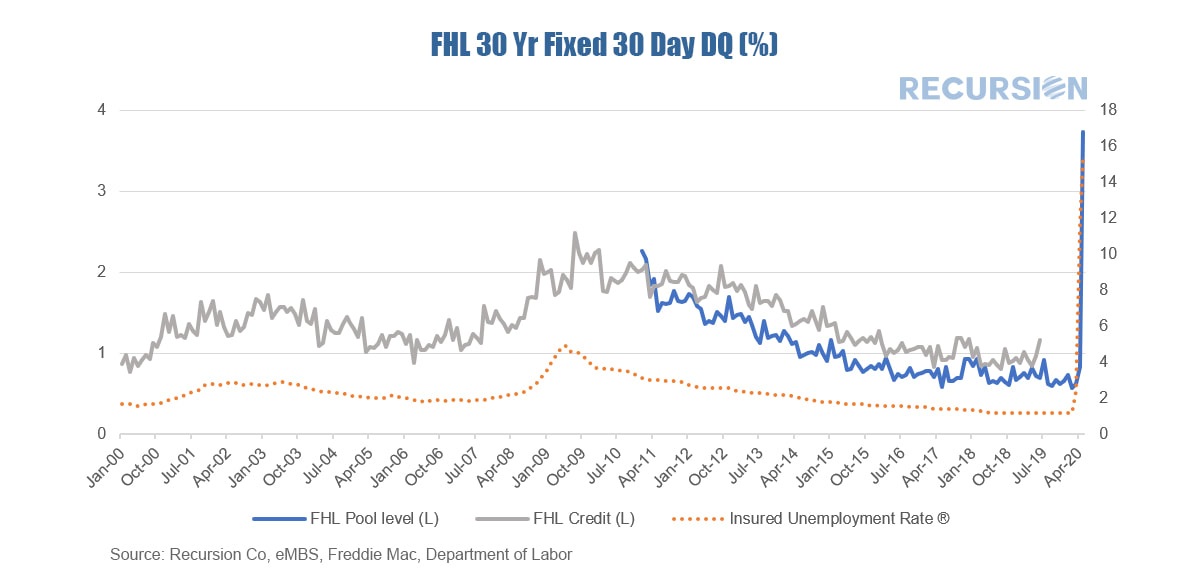

Just-released data from Freddie Mac is the first clear signal of distress in the conforming mortgage market. Data at the pool level for April 2020 showed a record high share of 30-day delinquencies (dq’s) of 3.735% for pools backed by 30 year mortgages. This data set goes back only to January 2011, so to get a reference to the Global Financial Crisis (GFC) we calculated the 1-month dq for 30 year mortgages from the Freddie Mac Loan Performance data set which goes back to 1999, although the most recent observation is June 2019. This dataset consists of a large sample of Freddie Mac loans but is not the whole universe. During the period of overlap there is a clear correlation between the two series. Finally, we overlay the insured unemployment rate to obtain a clear connection between the shock to the labor market from the Covid-19 virus and borrowers who have missed their mortgage payment. These borrowers are virtually all in forbearance programs, implying that their delinquent status will not impact their credit scores. Nonetheless, the servicers are responsible for four months of principal and interest payments to mortgage owners for the first four months of forbearance, so high levels of dq’s have an impact on the stability of the overall financial markets. Moreover, servicers are passing these costs along to new borrowers, keeping mortgage rates high relative to Treasury yields[1] despite the step up in mortgage purchases on the part of the Federal Reserve. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed