|

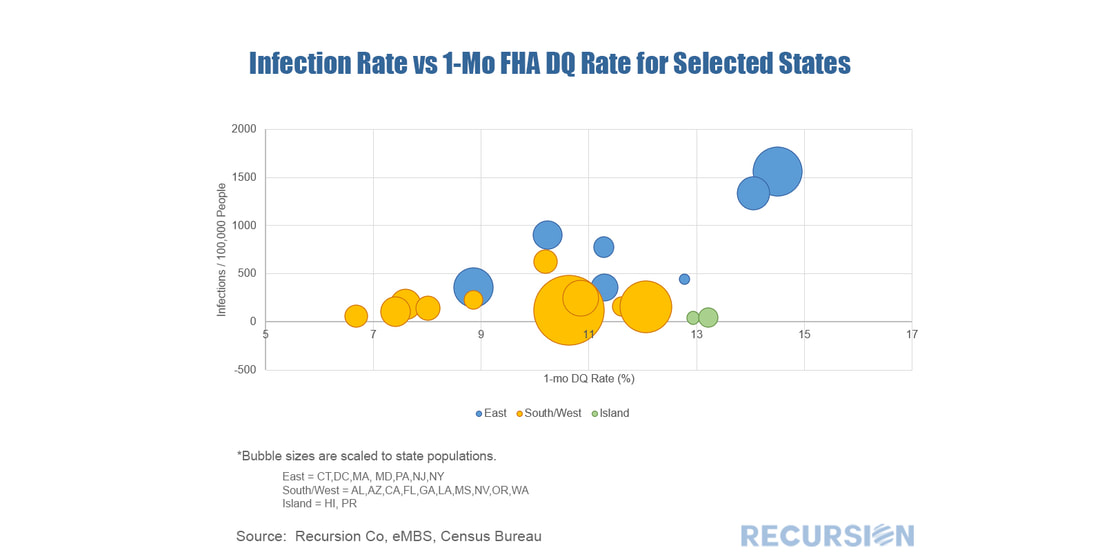

Previously we have noted the connection between aggregate unemployment and delinquencies in the mortgage market[1]. With the release of state-wide delinquencies for FHA loans earlier this month, we can dig deeper into the connection between mortgage distress and the Covid-19 crisis. Based on data released by the Covid Tracking Project[2], and the Census Bureau on population, we can correlate infection rates with mortgage delinquency rates. There are many factors that influence the relationship between infection rates and strains in the mortgage market. These include differing local health policy responses, economic sector compositions, climate, and population densities. Nonetheless the correlation between these two variables across all 50 states, the District of Columbia and Puerto Rico is a robust 0.55. This data can form the basis for a wide range of analyses, but one point worth noting is broad geographic trends. States in the Northeast ranging from Maryland to Massachusetts tend to have higher delinquency and infection rates, led by New York and New Jersey. Southern and Eastern states tend (thus far) to have lower infection rates but wildly different delinquency rates depending, likely, on differences in the sector compositions of the economies across this region. Only Louisiana in this category has an infection rate comparable with many of its counterparts in the Northeast. Finally, we note that the two islands in the sample, Hawaii and Puerto Rico, both have low infection rates and high delinquency rates. Puerto Rico has been maintaining quite high delinquency rate due to its long term economy distress. Hawaii has high delinquency due clearly to the dependence of its economy on the tourism sector. The future course of the health and economic crisis facing us is inherently highly uncertain. Over time, we will gather experience with both facets. Incorporating our learnings into public and private decisions can be greatly enhanced through the use of digital big data tools. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed