|

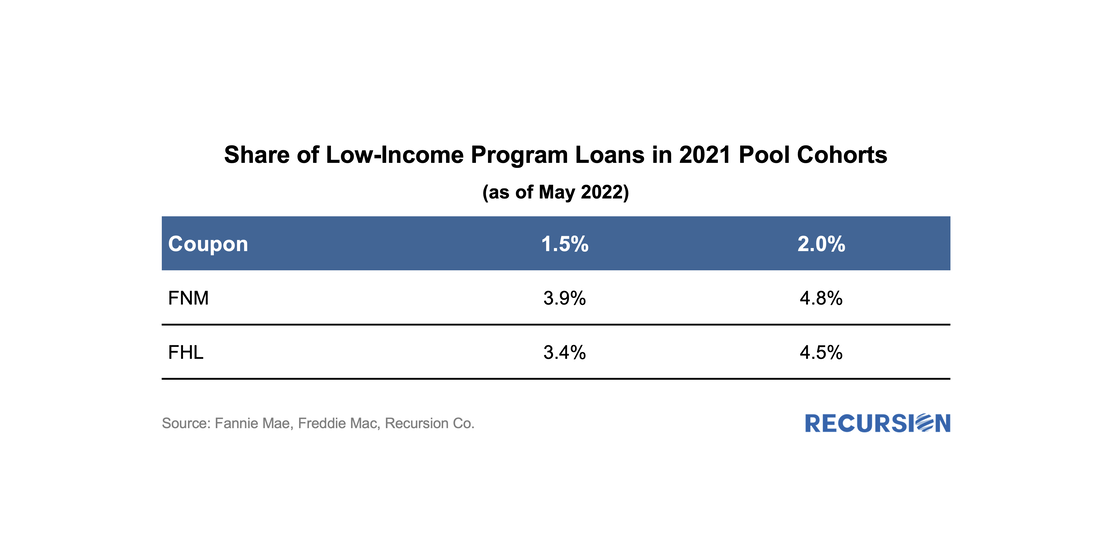

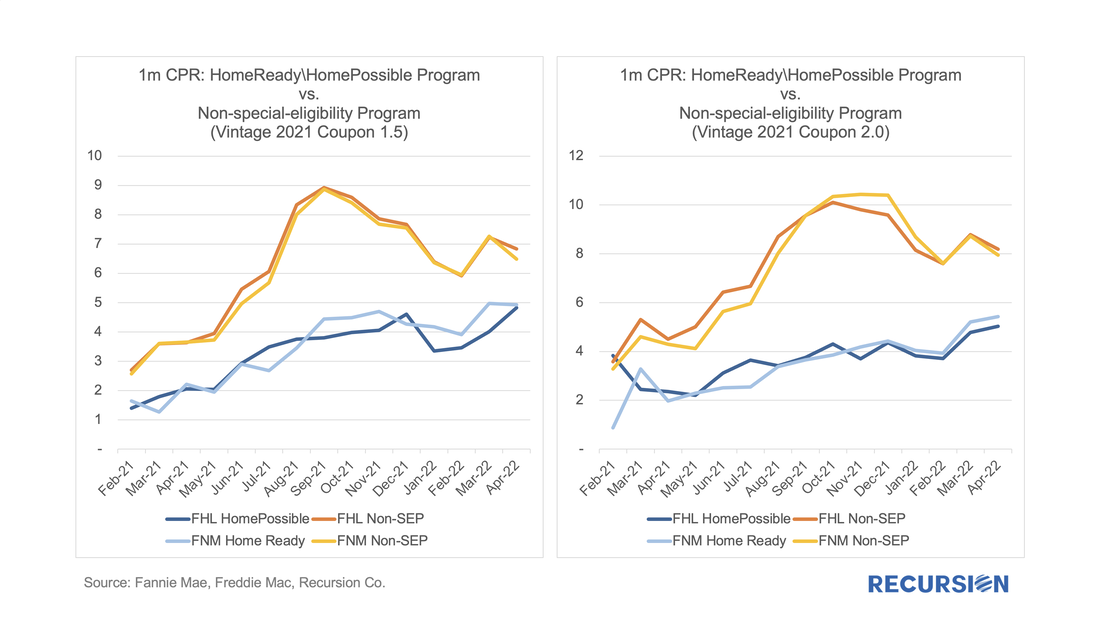

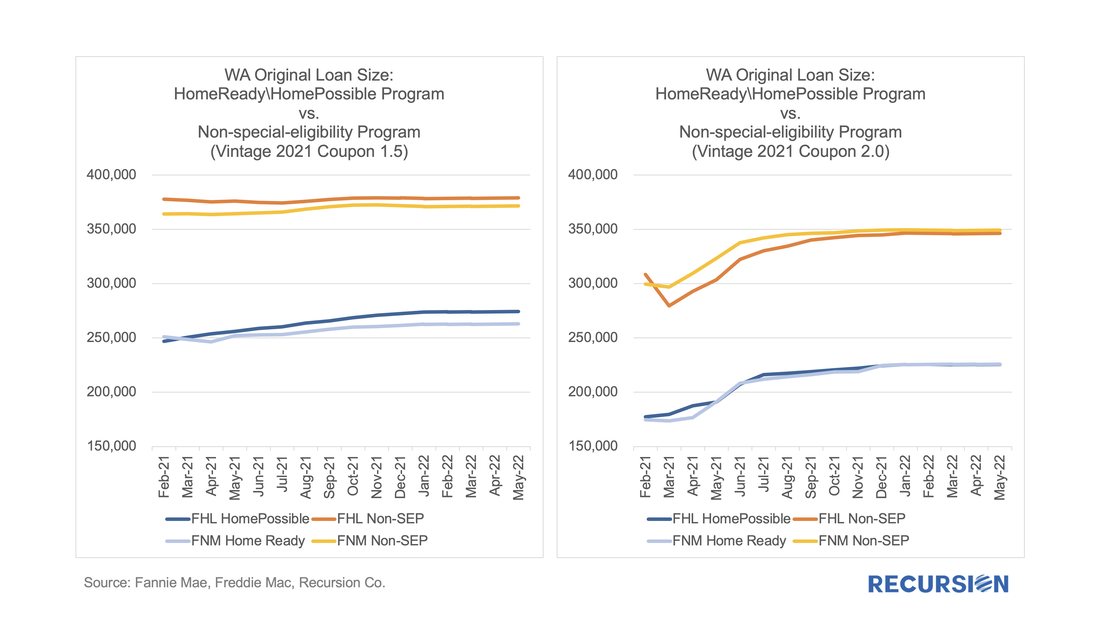

Back in 2021, we wrote a comment on the properties of the GSE Special Eligibility Programs designed to provide lower income households with access to mortgages (HomeReady for Fannie Mae and Home Possible for Freddie Mac)[1]. Given the increasing policy focus on the provision of credit to these households[2], it is appropriate for investors to look at the investment opportunities in this area. In this note, we look at the performance of HomeReady/Home Possible Program loans (referred as Low-Income Program in the following) vs. non-special-eligibility program loans, as measured by one month CPR, controlling coupon and vintage. We focus on just two such cohorts, 1.5% and 2.0% coupon pools of 2021 vintage. By loan count, the share of Low-Income Program loans in these pools by agency for May 2022 is: With corresponding prepayment speeds: In each case, the Low-Income Program loans in these pools are considerably slower than the others. A note of particular interest is that rising rates have not yet slowed the speeds of the Low-Income Program loans, while CPRs for the others are well below their peaks. There are two key distinctions between the Low-Income Program loans and the others that drive the performance differences. First, loan sizes in the Low-Income Program loans are distinctly below the others: The other distinction is underwriting characteristics, notably the 97 LTV that is typical in the special affordable programs. We have noted many times that an understanding of housing policies is increasingly important in determining investment performance. To enhance investor interest in these programs, both GSEs, late in 2021, began a program to issue pools with 100% special affordable collateral[3]. Given the distinct features of the collateral, these policy-driven pools offer a unique blend of characteristics that provide diversification opportunities that, when properly applied, can add distinction to mortgage portfolios. [1] A First Look at the Special Eligibility Programs - RECURSION CO [2] Low-Income Borrower Refinance Option | Federal Housing Finance Agency (fhfa.gov) [3] https://capitalmarkets.fanniemae.com/media/21961/display, https://freddiemac.gcs-web.com/news-releases/news-release-details/freddie-mac-announces-multi-billion-dollar-bond-program-focused Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed