|

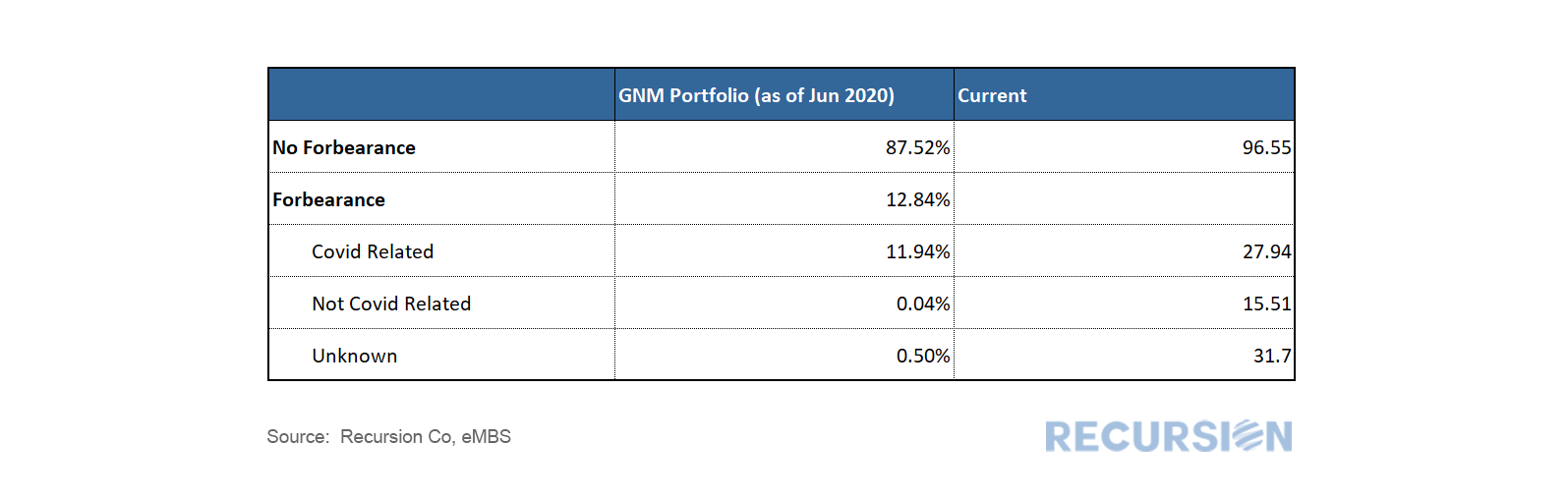

The release of the Ginnie Mae loan-level forbearance data[1] earlier this week enabled us to see the impact of the Covid-19 crisis on forbearance. An immediate question is how this data relates to delinquency. We have commented previously that forbearance and delinquency are distinct concepts as borrowers may choose to enroll in a forbearance program as an option to stop paying their mortgage on short notice in the future[2]. The pool level data released earlier this month by the GSE’s is not of high quality and showed forbearance rates less than those released from other sources. The Ginnie Mae loan level data appears to be very accurate, and in synch with other reports. Within the category of forbearance loans, 27.9% of Covid related are still paying. The portion for not Covid related is 15.5%[3]. This result provides confirmation that a significant portion of borrowers have availed themselves of the option to stop paying without exercising it yet. With the confidence gained from this analysis we can go on to investigate other interesting issues, such as relating the decision to go into forbearance by credit scores, DTI, and LTV. In addition we can look at these tendencies across bank and nonbank servicers. [1] https://www.recursionco.com/blog/new-loan-level-forbearance-data-from-ginnie-mae

[2] https://www.recursionco.com/blog/forbearance-and-delinquency-are-not-the-same [3] The number of non-Covid related loans in forbearance is very small at just 4,522 loans out of 11,590,707 in the sample. These have been in forbearance prior to the Covid-19 crisis, likely due to some previous natural disaster. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed