|

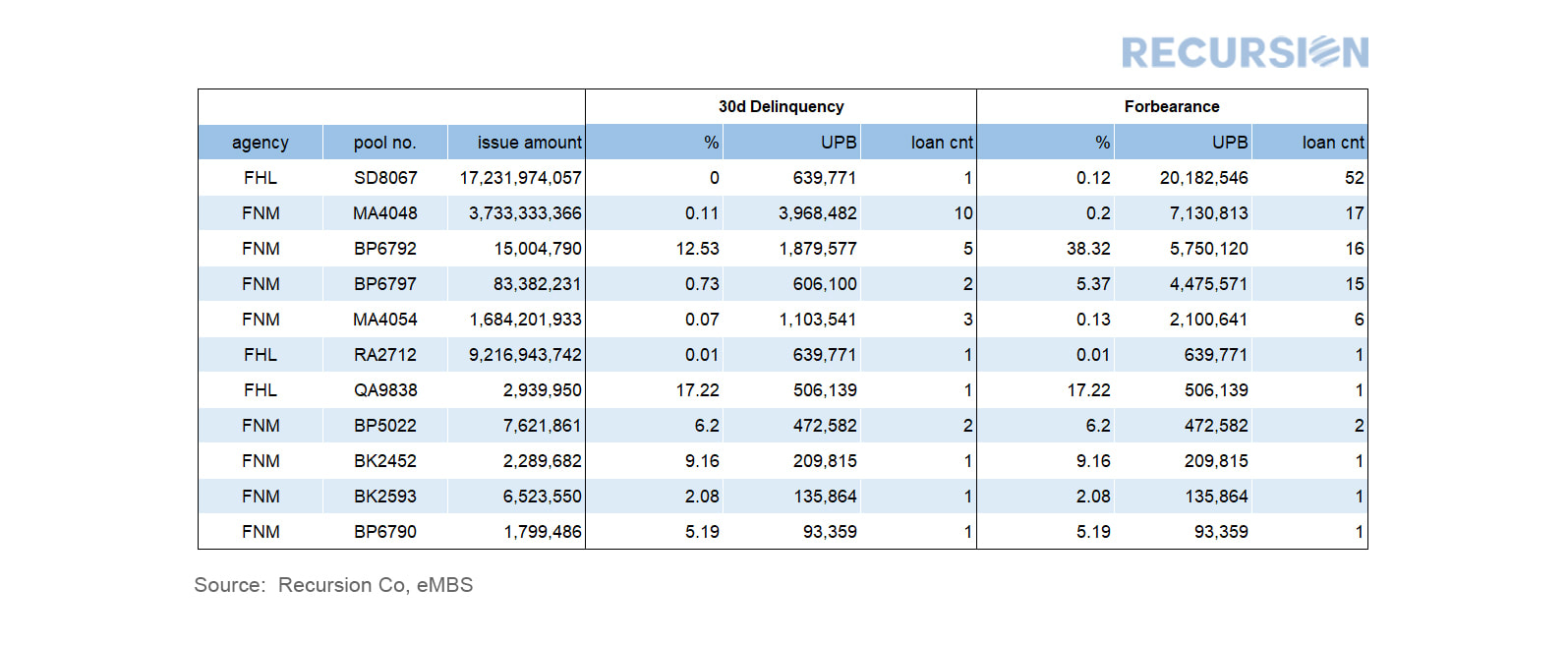

There is a lot of confusion in the market regarding the interpretation of new data released by the two GSE’s, the delinquency distribution and forbearance distribution for some new pools. The data available so far are very limited, but we can draw some tentative conclusions from what we have. As of this morning we found 11 pools with both a delinquency distribution and a forbearance distribution from the eMBS data feed. For 6 of them, forbearance numbers are the same as 30d delinquency numbers. For 5 of them, forbearance numbers are bigger than the delinquency numbers, and often by a significant margin. So what does this mean? The small number of pools with high forbearance and low 30d delinquency figures lead us to guess that some borrowers are asking for forbearance not because of an immediate need but rather to have the option to not pay their mortgage available should their finances deteriorate in coming months. As forbearance does not require any documentation for distress, some servicers make it easy to obtain this status via online registration, automatically granting forbearance to all who request it. Hence the forbearance numbers can be significantly larger than the delinquency data, at least for a while.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed