|

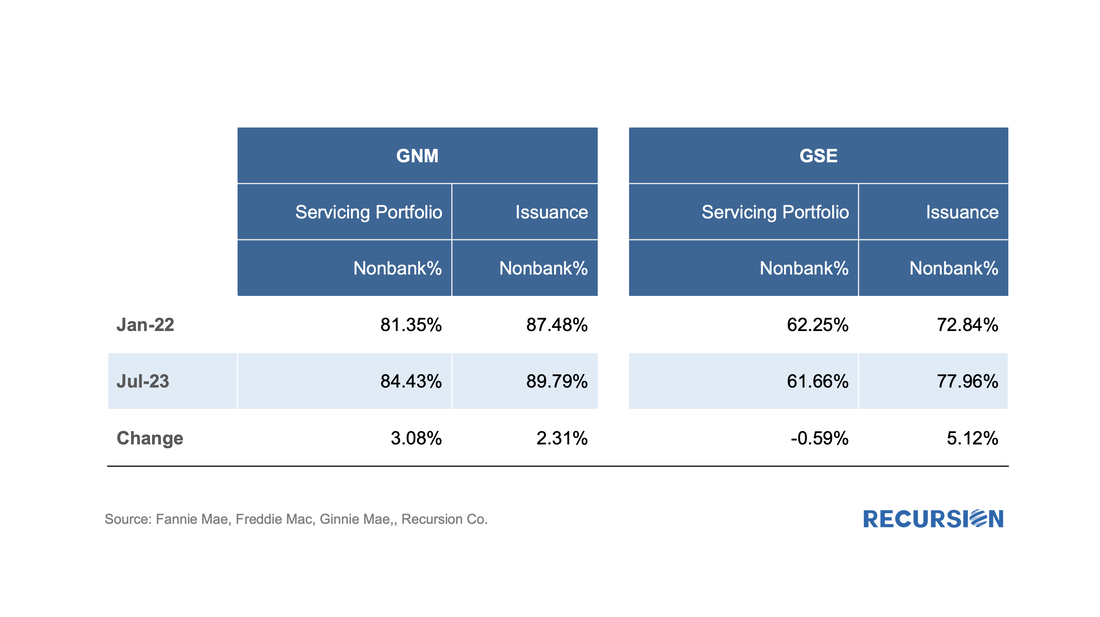

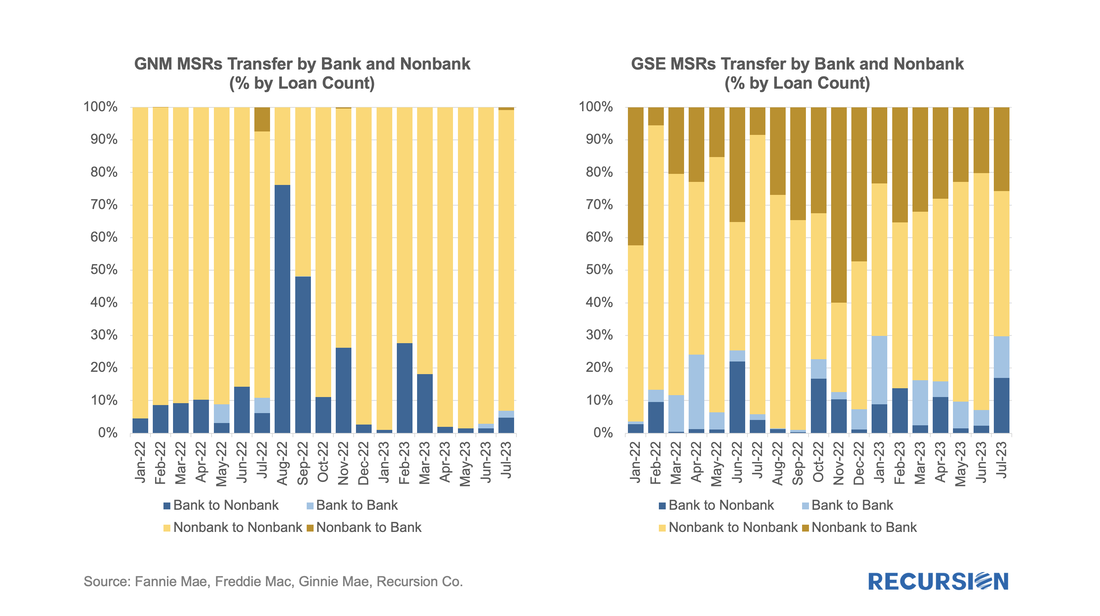

We’ve written many, many times about the inexorable rise in the role of nonbanks in the mortgage market[1]. A variety of factors have contributed to these gains, including superior technology, a relatively less oppressive regulatory environment, and Covid-19 chasing people out of bank branches online. This picture can be a little blurry, however, depending on the way you look at the market. There is, for example, the distinction between servicing book shares and origination shares. Our agency disclosure data doesn’t provide information on originators, but we can use “seller” as a proxy. The table below looks at the trends in outstanding portfolio and issuance for the conforming and Government markets over the period January 2022 – July 2023: The nonbank trend is clearly increasing by each measure, except for the GSE servicing book. It’s important to keep in mind that servicing is a stock of loans while issuance is a flow. The key observation is that a 2.31% jump in the issuance share of nonbanks is associated with a 3.08% increase in the nonbank GNM servicing book since the start of 2022. This compares to a 5.12% jump in the nonbank issuance share to the GSEs while a minor 0.59% decline occurred in their servicing shares. What accounts for the difference? One that jumps to mind is transfers in servicing rights. Our MSR Transfer League Table tool allows us to break these down in an intricate manner as follows: These are two very different pictures. In the case of Ginnie Mae, the general trend is for sales to be dominated by nonbank-to-nonbank transactions. (There is the notable exception of August – September 2022 when USAA FSB made a strategic decision to reduce its holdings of Ginnie MSRs.) The picture for the GSEs is much more dynamic, but it can be readily observed that nonbank sales of GSE MSRs regularly dominate those of bank sales to nonbanks. There are many possible reasons why this may be the case, but two that come to mind are, first, the nonbank advantage in origination and second, the desire of banks to avoid risks associated with origination such as rep and warrant risk. This can help explain the difference in the trend growth rates of securitization and holdings of nonbanks between the two categories of securities for the GSEs. An important takeaway here is that observing trends in MSRs can be very informative both for macro trends in the market and micro strategies on the part of individual firms. Having a tool like MSR Transfer League Table at your disposal is essential to obtain a clear picture of market developments. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed