|

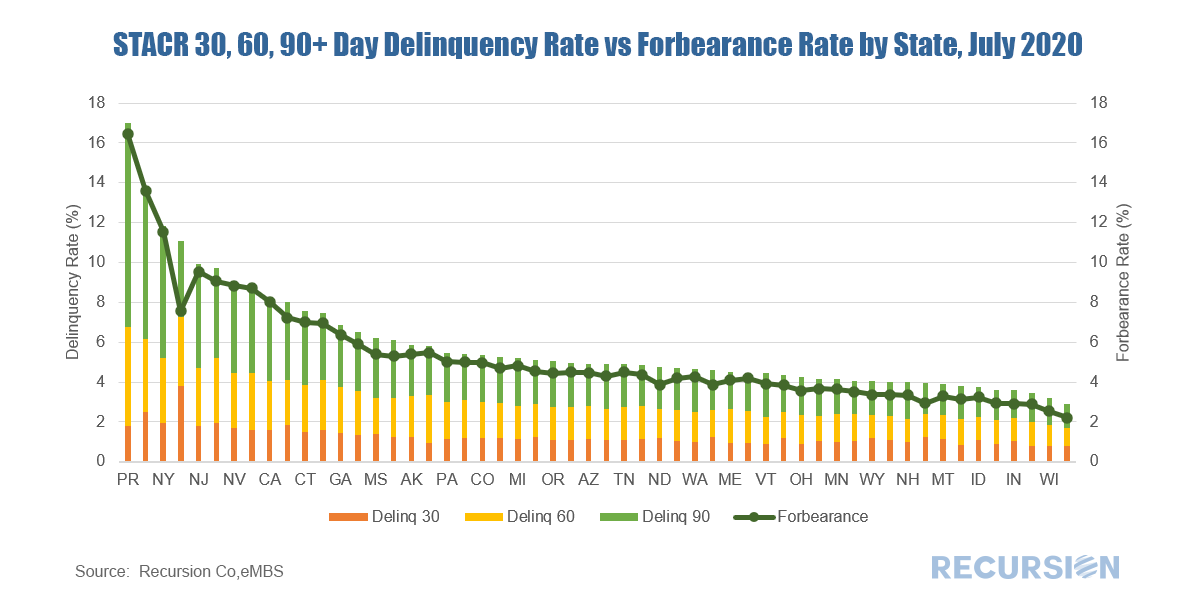

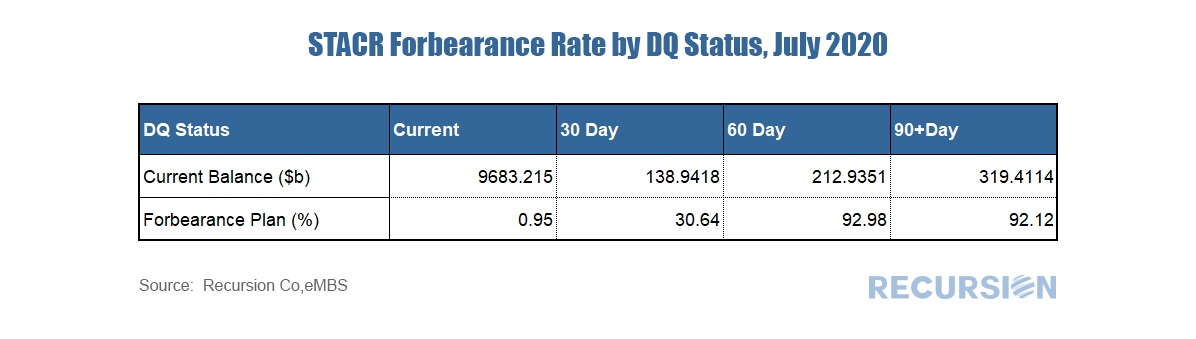

Freddie Mac started to release forbearance data on its STACR CRT program in the July reporting cycle. Previously, the GSEs disclosed only pool-level delinquency and forbearance information [1]. As the loans in the STACR program have a UPB representing over 50% of total deliveries to FHL balances with no obvious state level bias, they would serve as a representative sample in calculating GSE state level delinquency [2]. Similarly, the new STACR data is helpful in assessing the impact of the COVID-19 crisis on forbearance at loan level. From the July STACR data release, we can see a clear correlation between total delinquency rates and forbearance rates at state level. States with higher delinquency rates, such as New York, New Jersey, Hawaii, and Nevada, also have higher forbearance rates. *The Chart can be duplicated using the above two queries This is not a surprise as we noted in an earlier post that Freddie Mac servicers are not required to report loans in forbearance if loans are current [3]. In fact, for STACR data, only 0.95% of current loans are in a forbearance plan, but the forbearance rate for loans in 30 day delinquency, 60 day delinquency, and 90+day delinquency are 30.64%, 92.98%, and 92.12 % respectively. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed