|

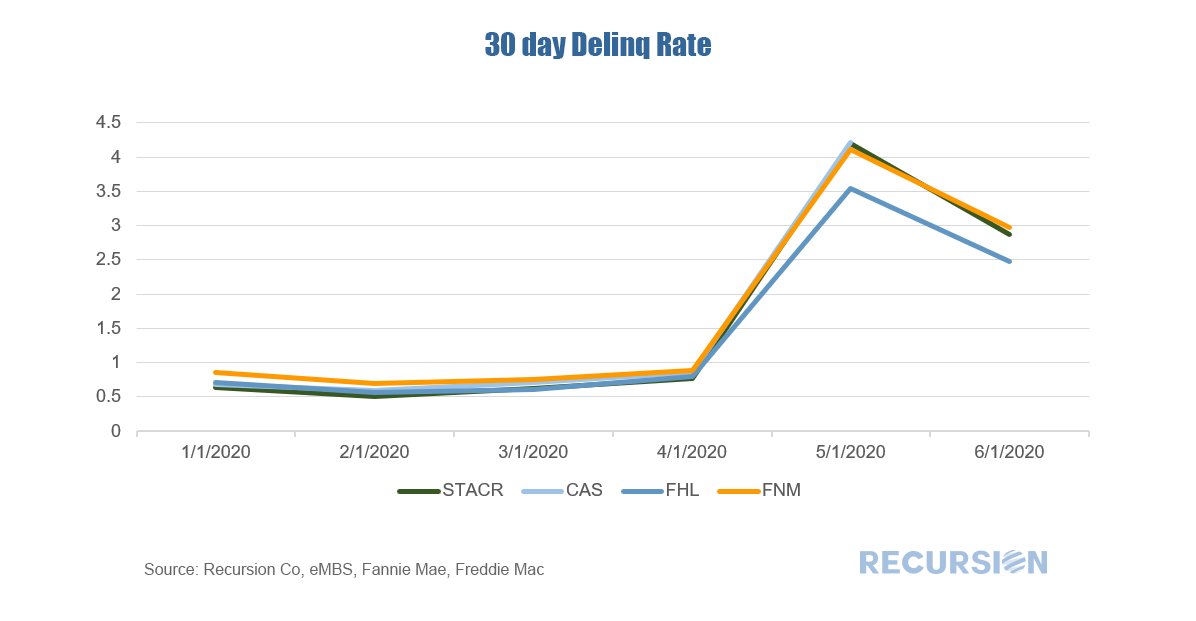

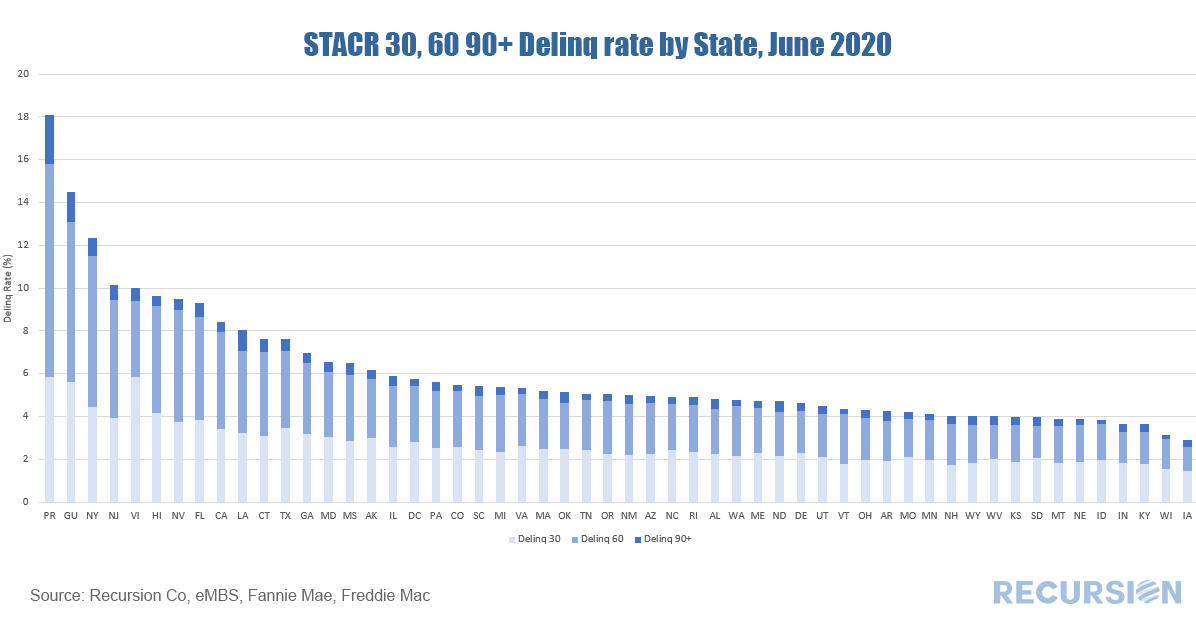

The loan level tapes, delivered by the GSEs each month, unfortunately only contain delinquency data (DQ’s) at the pool level, unlike the Ginnie Mae tape which is at the loan level. One implication of this discrepancy is that state-level DQ’s can be calculated for the Ginnie programs but not, in general, for the GSE’s. An alternative approach for tracking GSE DQ’s at the loan level is to examine the performance of the reference loans in their Credit Risk Transfer (CRT) deals. The sample of loans contained in the CRT tapes is a significant portion of the total deliveries to the entities but are not a complete sample. For CAS, the UPB represents 25%-30% of all FNM balances, while for STACR, it represents 50% of all FHL balances. The primary question here is whether the CRT reference loans are a representative sample of the total for delinquencies. The way to validate the assumption is to compute a national aggregate of delinquencies for the whole set of loans in the CRT pools and compare these to the DQ data contained in the GSE monthly summaries[1]. There are a couple of important technical points that should be addressed. First, loan level data for the GSE’s is delivered during the evening of the 4th business day. The CRT data are delivered on or after the 25th. In particular, the CAS program information is a month delayed from the STACR data. We conclude that using STACR data as the proxy to calculate the delinquency rate at the state level would be a good choice as STACR covers 50% of FHL loans with only about a 2-week delay from the regular data release. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed