|

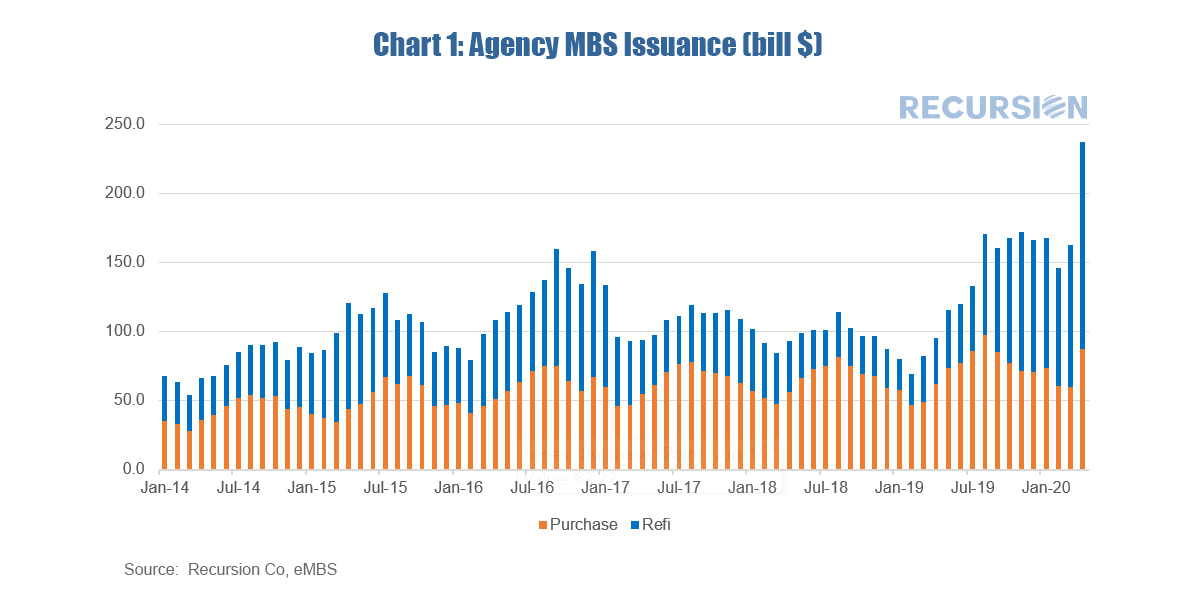

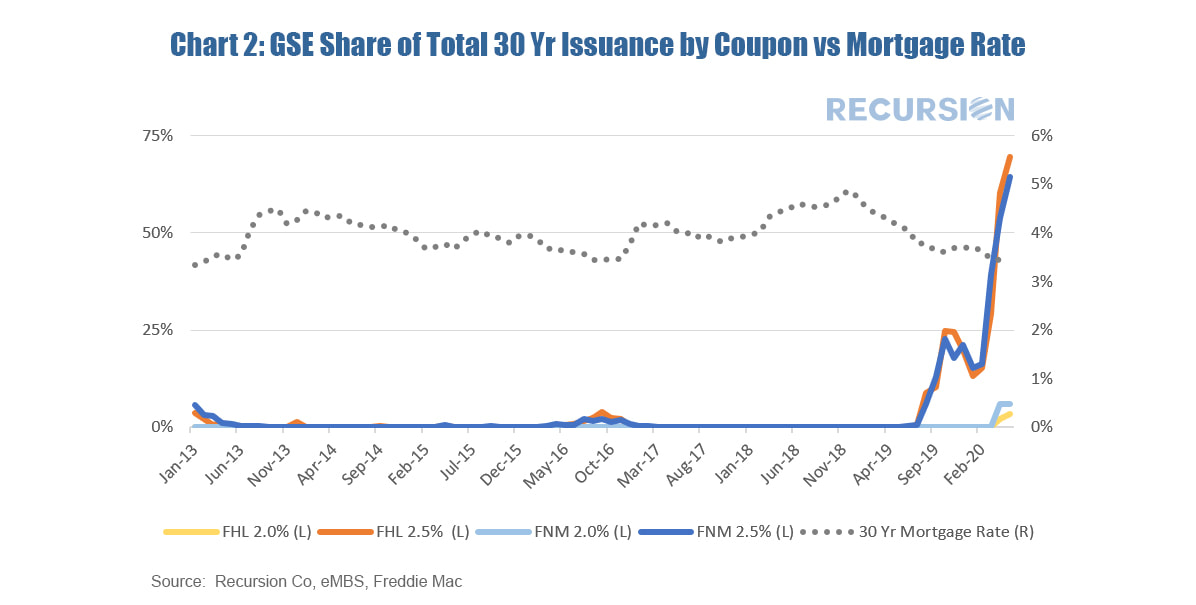

April mortgage deliveries by the agencies Fannie Mae, Freddie Mac and Ginnie Mae showed a rise in deliveries of mortgages to the two agencies for both home purchases and refinances. Purchase mortgage volumes reflect a normal seasonal pattern, while refinances experienced a sharp spike upwards in response to low levels of interest rates. Given normal (and possibly growing) lags related to closing times, many of these contracts were signed in March when rates had already dropped sharply but the full impact of the Covid-19 virus on stay-at-home policies was not yet fully felt. Going forward, will this level of activity persist? As stay-at home policies have been more widely implemented, purchase mortgage applications have recently declined and stand about 20% above year-ago levels. A backlog in refinances implies that there is more activity in the pipeline, but the volume of new deliveries in this category cannot persist indefinitely with rates at current levels. Persistent reports of tightening of lending standards also act as a potential headwind. As previously noted, while mortgage rates have declined to record lows, they have lagged declines in Treasury yields[1]. There are many possible explanations for this, but one possible reason is the difficulty of establishing new liquid benchmarks of mortgage backed securities (MBS). Coupons of MBS come in 50 basis point[2] increments; that is, they are 3.0%, 3.5% etc. As rates decline, investors looking to maintain yields resist purchasing new lower coupons. After a false start in 2016, the current most liquid coupon, the 2.5% coupon, only became firmly established towards the end of 2019. To get mortgage rates lower still, it is important to establish the 2.0% coupon as a liquid trading vehicle. In that regard, it is interesting to note that the Federal Reserve intends for the first time to purchase MBS with a 2% coupon in the week starting May 11, 2020. If this effort is successful, it will be an important step in the policy effort to combat the economic impact of the Covid-19 virus. [1] https://www.recursionco.com/blog/the-new-normal-in-mortgage-rates

[2] A basis point is .01% |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed