|

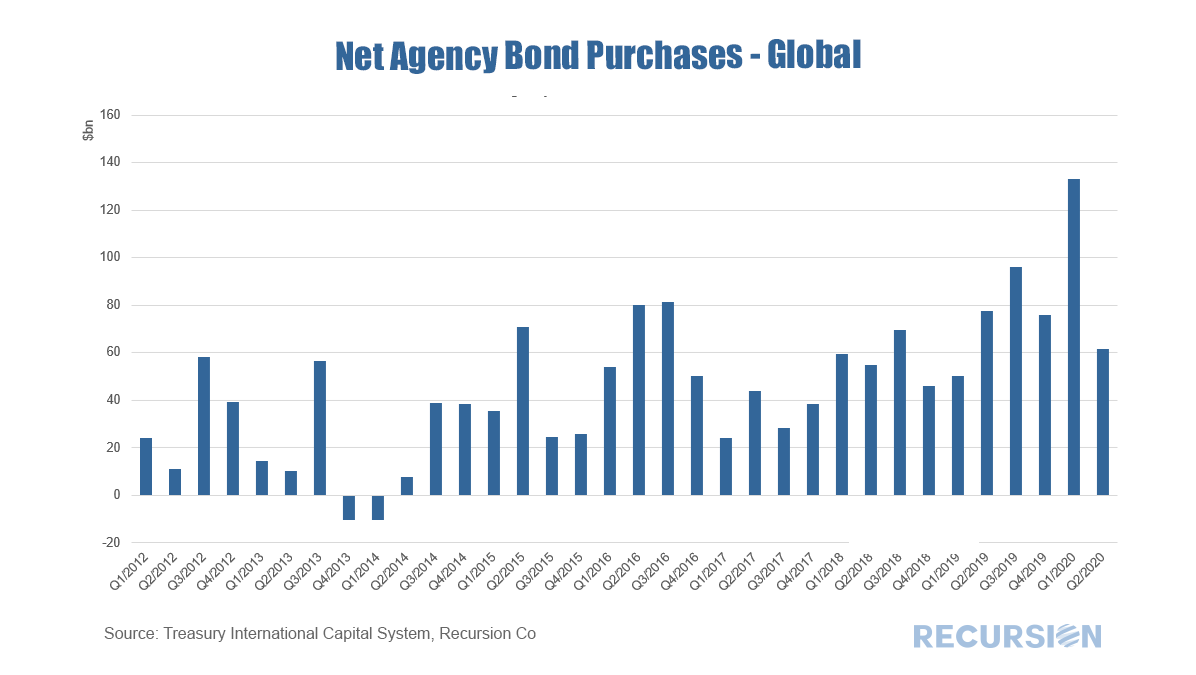

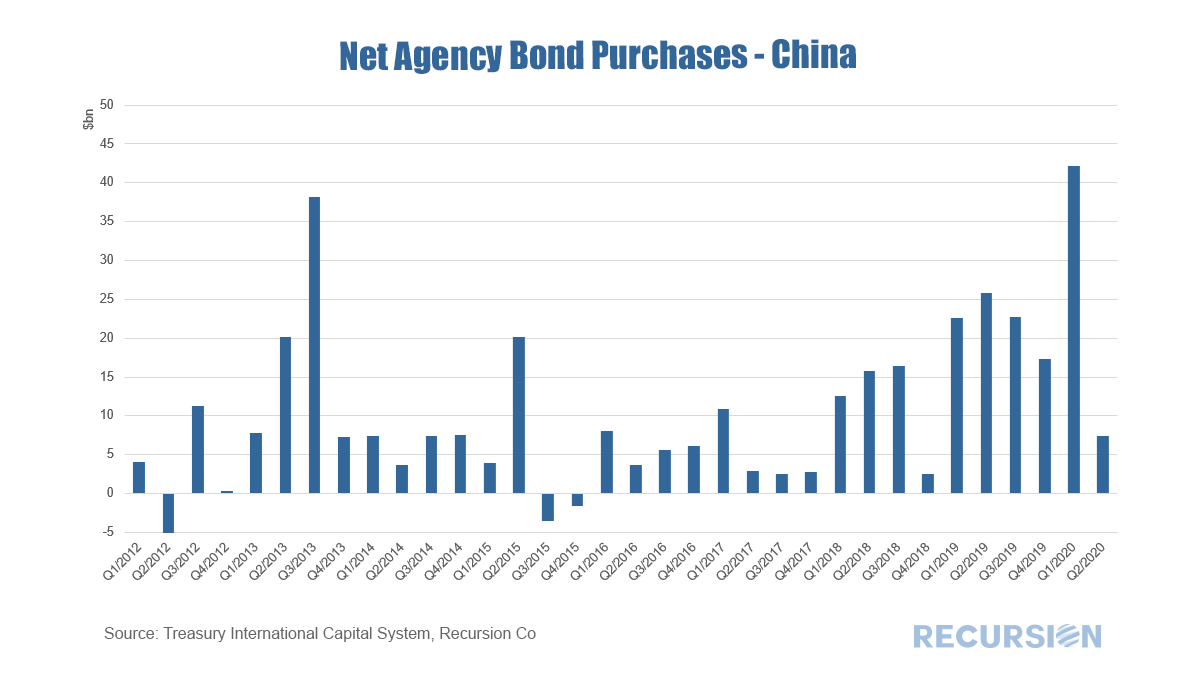

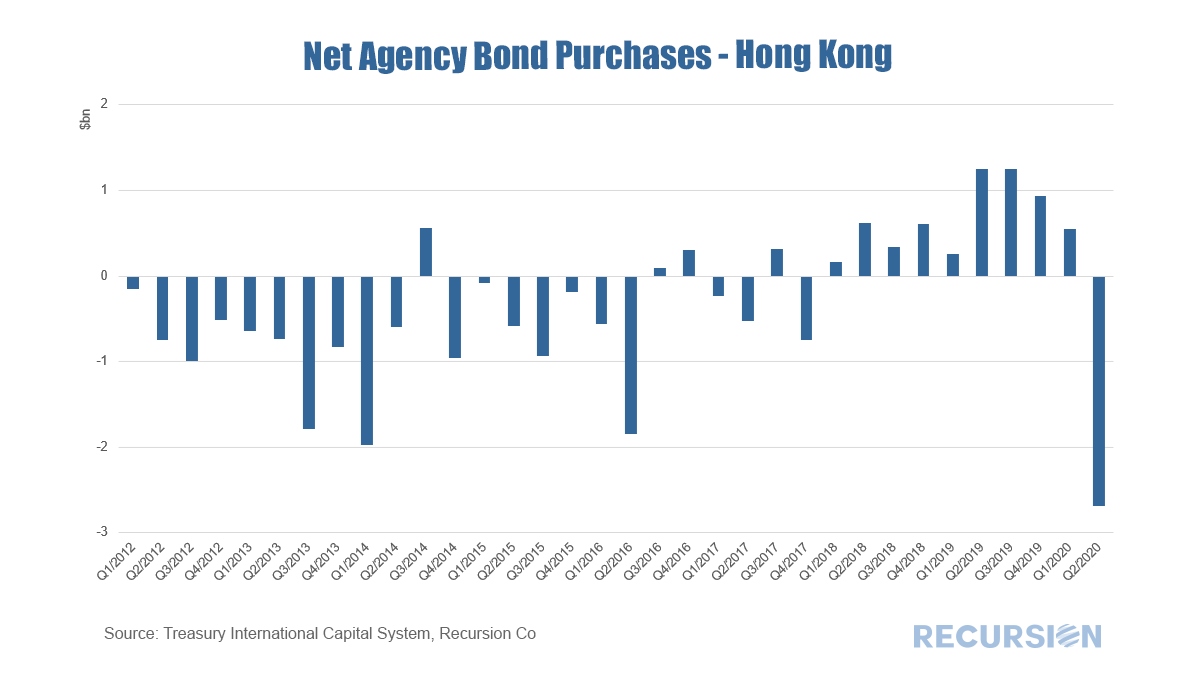

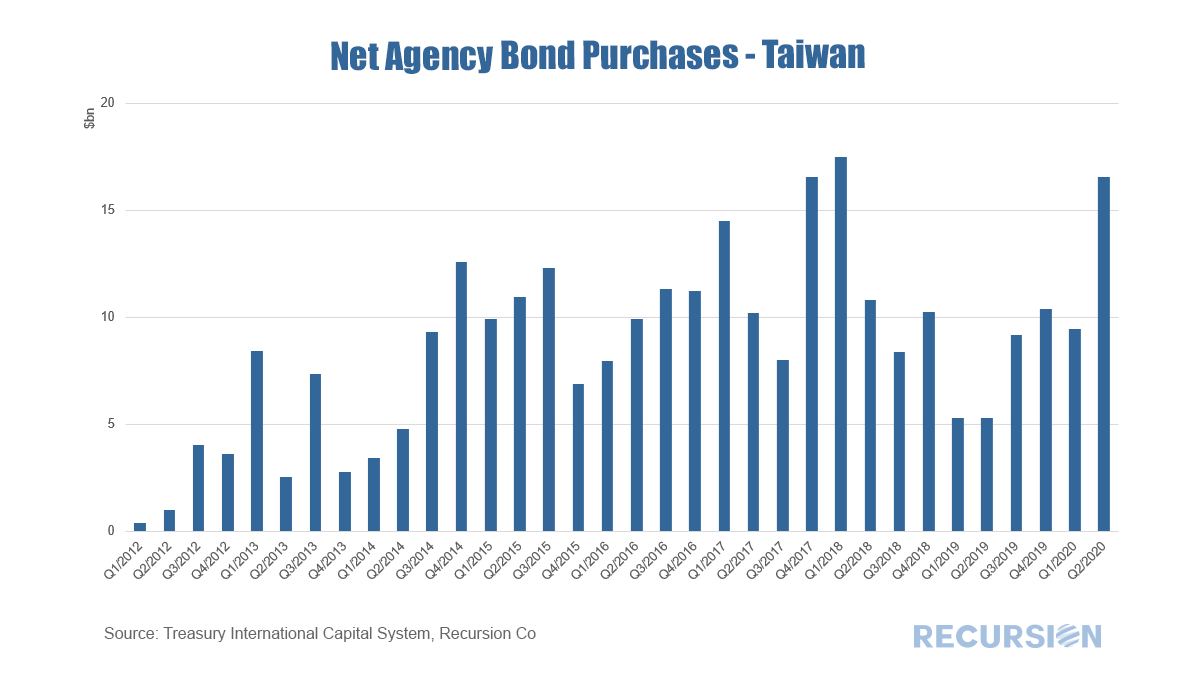

In a previous blog, we pointed out the importance of overseas investors to the mortgage market.[1] We looked at the share of holdings from this sector, as well as on the country breakdown within the sector. These shares tend to move somewhat smoothly over time as they represent very large portfolios of assets. There is, however, a second data set released in the TIC system every month, namely net capital flows. These data are purchases (or sales) and can be quite volatile in the short term. But they may provide a picture of emerging trends that will not show up in the holdings data for some time. The same important caveat that applies to the holdings data applies as well to the flow data: the data on purchases and sales of assets reported for a country may be on behalf of agents domiciled in a different location, even the US. We also noted in that post the many motivations behind foreign holdings of stocks of long-term agency assets and these apply to the flow data as well. There is another caveat for the flow data, however. A key characteristic of MBS is prepayment. That is, homeowners have the right at any time to prepay their mortgage if rates fall. Also, if a homeowner sells the home the mortgage is typically prepaid and a new mortgage obtained if a new home is purchased. So if an investor faces prepayments, but wants to hold their stock of MBS steady, they may purchase new securities. Such purchases are not based on any assessment of near-term returns in various asset classes, but is rather an automatic flow based on longer-term considerations. This phenomenon is particularly notable in an environment of falling interest rates, as prepayments would be expected to rise. An interesting group of countries to look at in this regard is Asia ex-Japan. The bulk of these holdings are maintained by official entities looking to maintain portfolio liquidity and generate favorable long-term returns. The issue of country of the beneficial owner is less important here. Yet, they are not immune to conditions in the current investment environment. The charts below show net purchases in total and for three Asian entities: China, Hong Kong and Taiwan. As we have been in a declining rate environment since the start of 2019, it is not surprising that purchases of long-term agency securities have been generally strong from the point of view of asset replacement over that time. But Q2 2020 marked a break in the pattern with the onset of the Covid-19 crisis. Flows were smaller than in Q1, notably so for China, but markedly so for Hong Kong which engaged in outright sales of assets. Interestingly, Taiwan bucked the trend and added substantially to its holdings in Q2 compared to the prior quarter. In the background, the economic and financial environment remains highly uncertain. Added to that is the increasing factor of rising geopolitical uncertainty as we head into the US election. Following these flows may provide useful insights into how different agents assess these considerations. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed