|

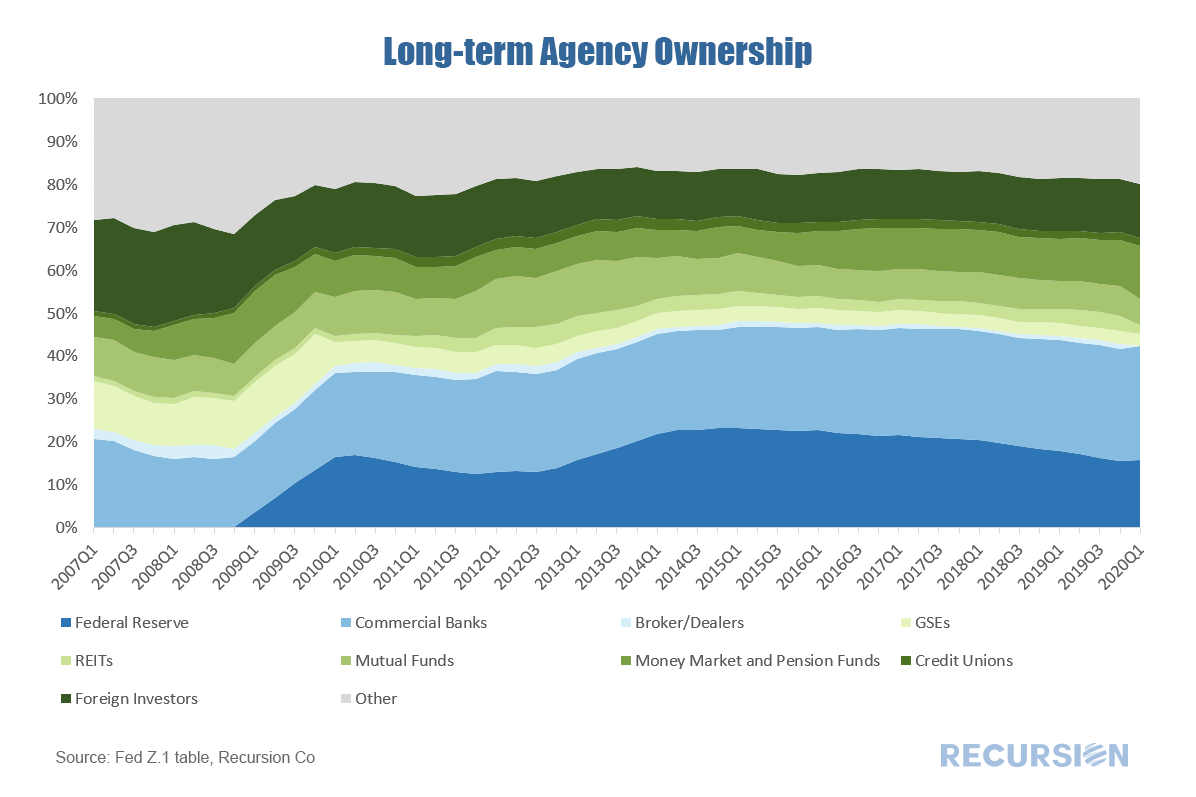

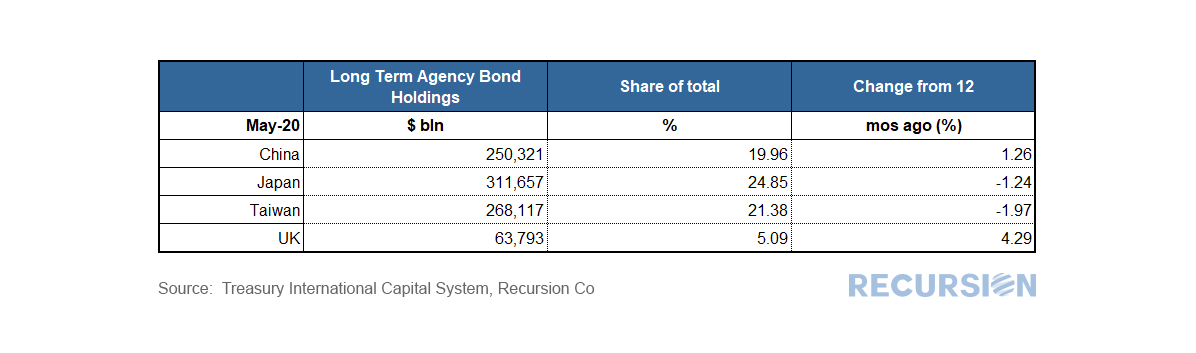

The MBS market is the second-most liquid market in the US after the Treasury market. The collateral for these securities is completely domestic but a significant share of the ownership is held by offshore entities. As such, investors need to be cognizant of the attitudes of overseas investors towards this market, particularly in the current highly charged geopolitical climate. The following chart shows total holdings of Agency and GSE-backed securities over time broken down by a broad category of investors. The most recent figure is as of Q1 2020; Q2 data will be released later in September. The share of International holders of these securities at 12.4% in Q1 2020 was below the 20+% share prior to the financial crisis, but at a 7-year high. Foreigners are clearly an important part of the demand picture for this market. A natural question to ask next is who in this category is buying? Some country data for international purchases is available on a monthly basis from the Treasury Department’s Treasury International System (TIC).[1] The TIC data form the backbone of the international holdings piece of the first chart, but a couple of caveats apply. The data cover holdings of “agency and GSE-backed securities” not just MBS. The bulk of this category is agency MBS but it also includes other agency securitized debt as well as the debt issued by the GSE’s themselves. There is unfortunately no breakdown available to extract MBS securities holdings alone by country in the TIC system. Second, the country data are not necessarily accurate as investors buying securities in, say, London, maybe agents for pools of funds domiciled in a different location, even the US. So, at best this data gives a broad overview of country coverage, not a precise measure. There are many motivations for foreign investors to hold MBS. Private investors can include these in their allocations to dollar fixed income portfolios based on the relative expected returns of this category relative to others, notably Treasuries and corporate debt. Public sector entities managing portfolios include central banks and sovereign wealth funds that can have quite different goals. Central banks manage dollar reserves and are interested in the liquidity of their assets more than expected returns as these may need to be liquidated in times of crisis. Sovereign wealth funds look to extremely long-duration horizons to support generational development objectives. International holdings of these securities are very concentrated, and it is exceedingly difficult to pull out a common theme. The most recent data for May show that the top 4 countries amounted to over 70% of all foreign holdings that month. Japan is first with almost a quarter of all offshore holdings and which represent a combination of public and private investors. China is second (20%), followed by Taiwan (21%) which are both large public sector holdings. Far back is the UK, but they have experienced the largest share increase compared to any other country (up from 5%, from less than 1% in 2019). There is an excellent chance that this surge came from somewhere outside the UK, but it is difficult to know. One theme that stands out here is the importance of Asian investors to this market. As it turns out, more about these investments can be learned from the examination of a second data set available through the TIC system, the purchase data. More about this in a future post. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed