|

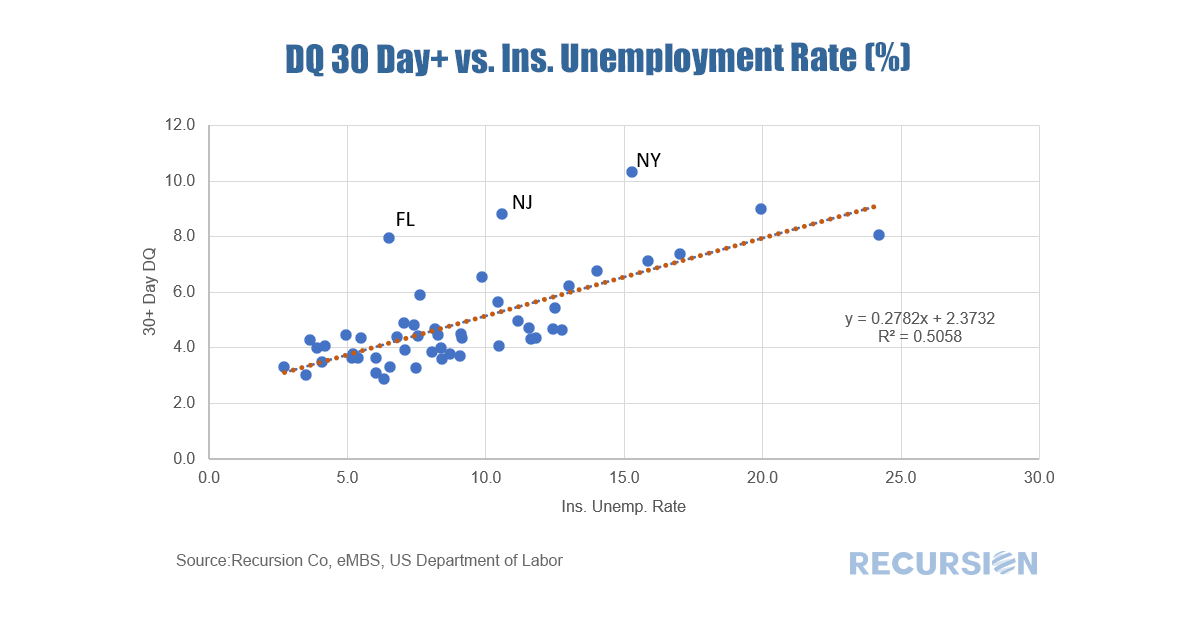

In a prior post, we demonstrated how the loan-level data for the CRT reference pools could produce a good estimate for delinquency rates by state in the conforming mortgage market[1]. One way to confirm this would be to compare these to the unemployment rates by state. In fact, a scatter plot of 30+ day dq’s from the Freddie Mac STACR program vs unemployment rates reveal a striking correlation: The connection is notable given the quite different sectoral compositions of the local economies in different parts of the US. There are three distinct outliers: New York, New Jersey and Florida. In each case, delinquencies are higher than would be expected from local unemployment data. Given the strict restrictions that the New York area has implemented in the wake of the tragic surge in cases of the Covid-19 crisis last spring, the region has experienced great economic dislocation. Florida’s housing market has a high proportion of second homes, so developments in the local housing market do not necessarily reflect local labor market conditions. An interesting additional point is that a snapshot taken of labor market conditions and delinquencies during the Covid-19 crisis and the Global Financial Crisis look broadly similar. However, the picture for house prices is completely different. Collapsing house prices were the signature issue of the Global Financial Crisis while they have held up quite well during the time of Covid-19. During the Global Financial Crisis there was a debate over what factors were the most important drivers of mortgage delinquencies, and the current episode supports those who believed that labor market conditions are paramount. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed