|

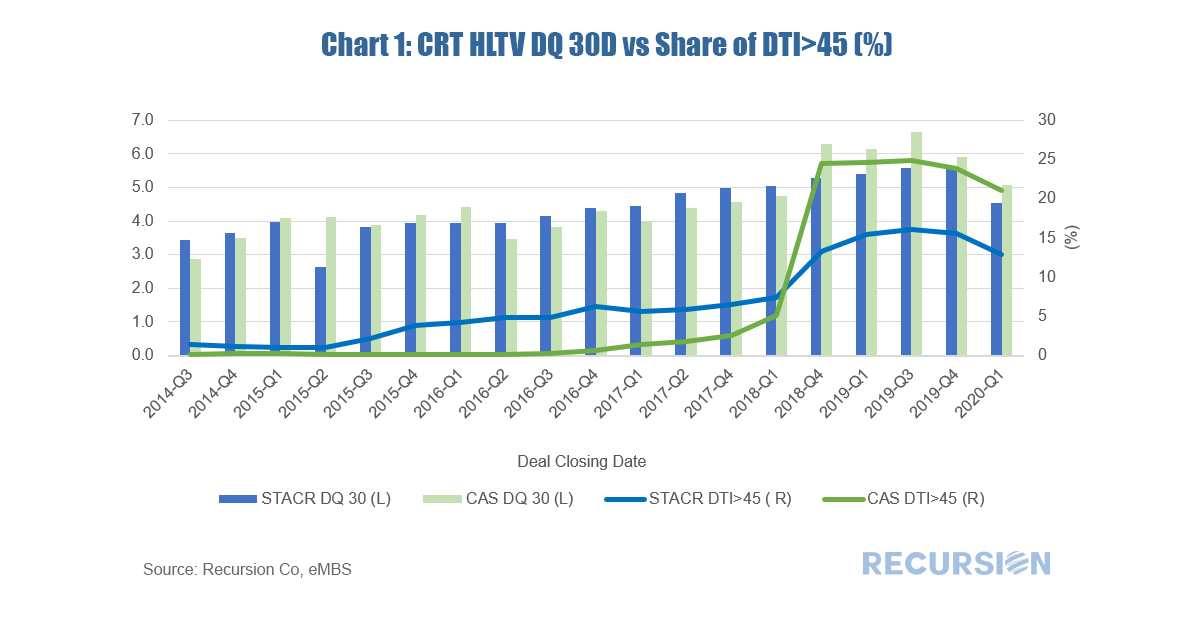

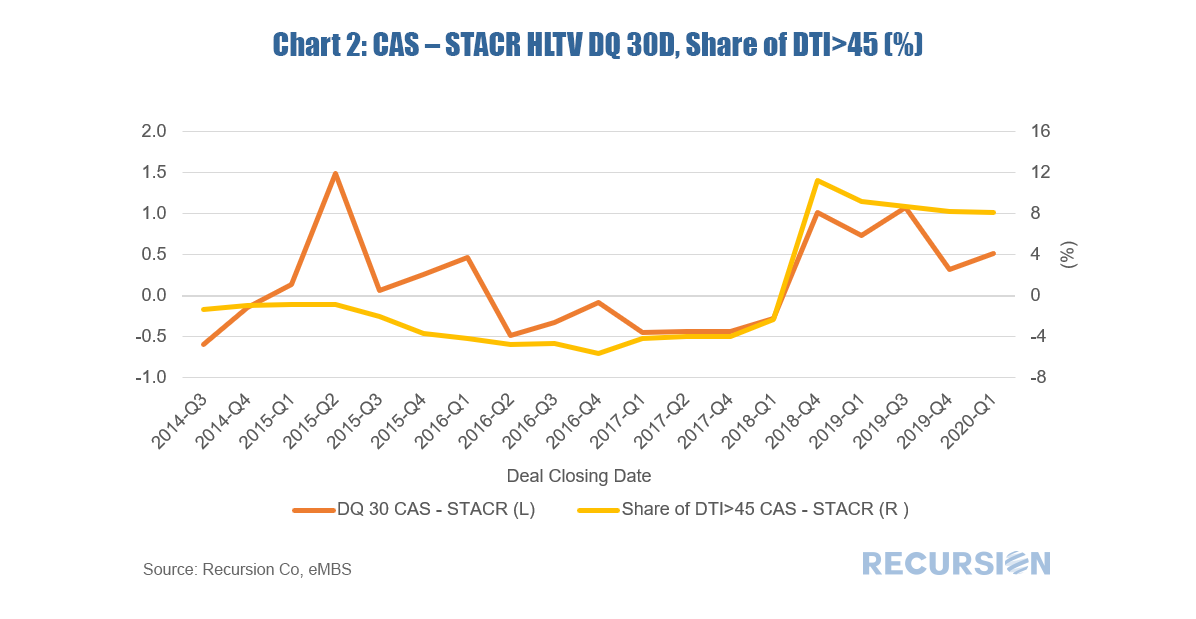

In a recent post we established a correlation between the 30 day dq rate of the loans in the reference pools for the Freddie Mac High LTV STACR CRT program and the share of these loans with high indebtedness as measured by DTI>45 for the month of May[1]. Recently Fannie Mae released the corresponding data for its CAS program and the results are striking. First, the pattern of results we saw for STACR is confirmed. This can be clearly seen if the results of the two programs are overlaid one over the other[2]. *The Chart 1 and Chart 2 can be duplicated using the following two queries Second, besides looking at the pattern over time we can compare the two programs directly by looking at the relative dq’s compared to the relative share of loans with DTI>45. As it turns out Fannie Mae started to widen its credit box with respect to DTI to a much greater extent beginning in 2018 relative to Freddie Mac, providing us with a natural experiment for the role of debt in delinquency independent of when the loans were issued. The correlation between the two lines is about 2/3 which is notable considering the many factors that drive a decision to stop making mortgage payments. This latter result goes a long way in moving the relationship between debt burdens and delinquency from correlation to causality. [1] https://www.recursionco.com/blog/crt-dqs-and-debt-ratios

[2] The x-axis is calendar quarters in which both Freddie Mac and Fannie Mae issued a high LTV |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed