|

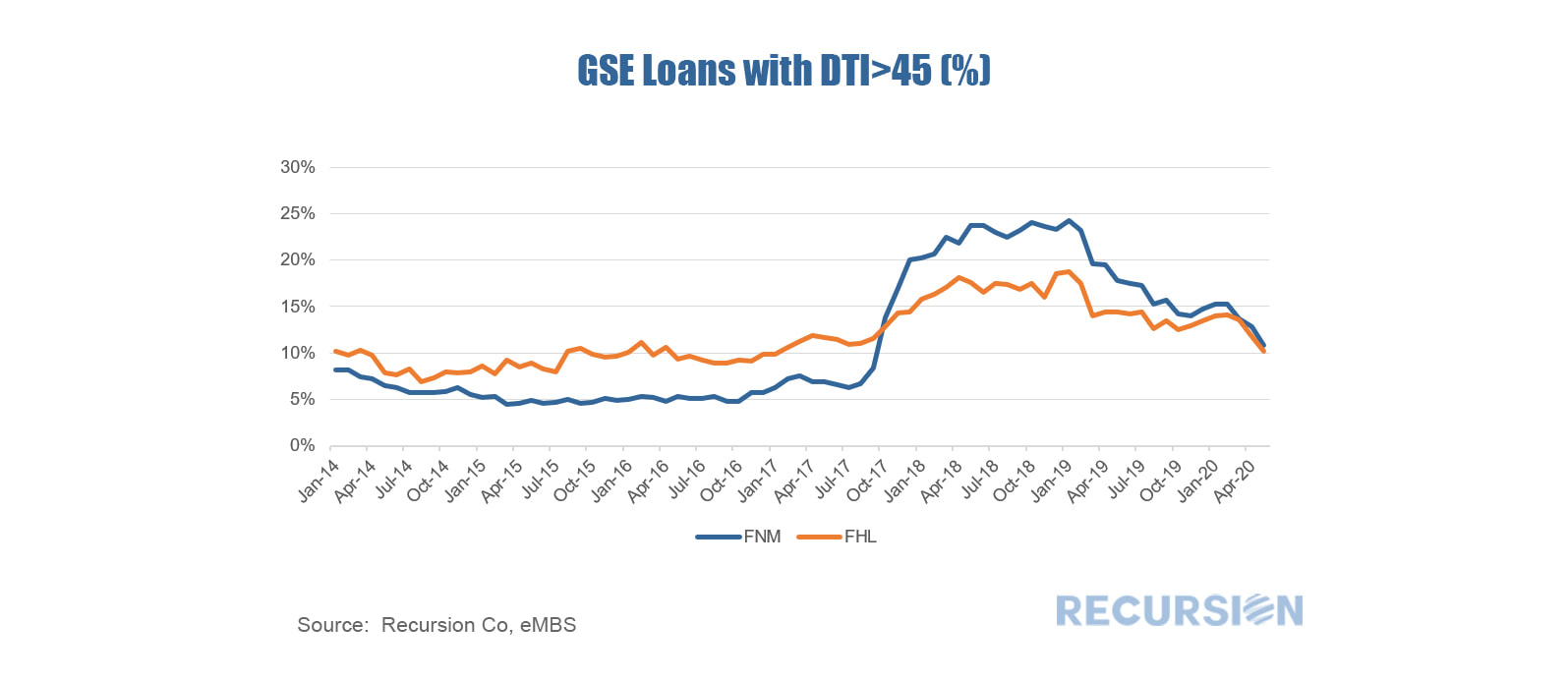

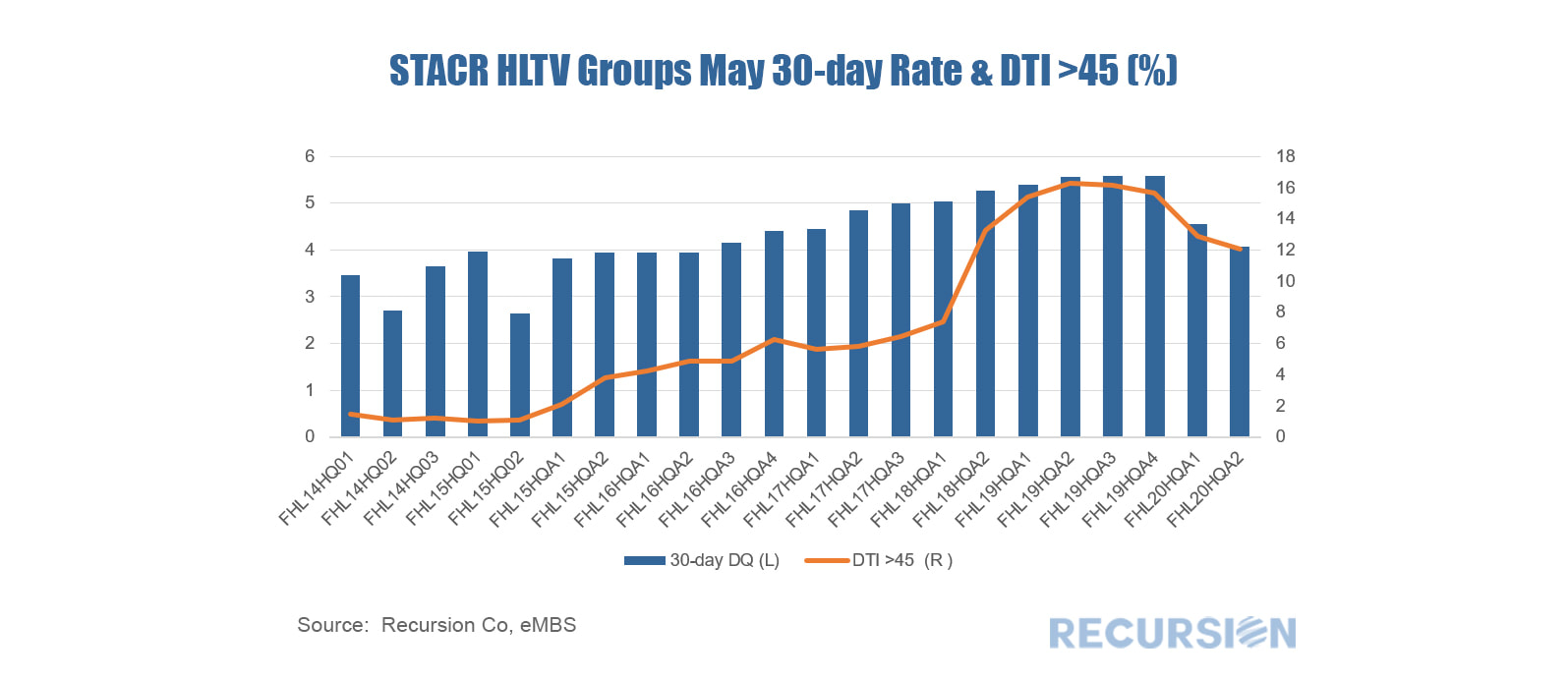

We have written extensively on the mortgage market impact of the Covid-19 crisis, most recently on the first signs of delinquencies in the loans in the reference pools of the Freddie Mac Structured Agency Credit Risk (STACR) program[1]. In that post we noted the dispersion in 30-day average loan delinquencies by state for May 2020. In this note we look at the distribution of delinquencies in the same month across each of the 28 deals issued to date. We can see a distinct increase in the rate of delinquencies from the onset of the program through 2019, before falling early this year. What can account for this pattern? In the five-year period from early 2013 to early 2019, we notice that there was a trend loosening in credit standards as measured by the share of loans in Agency securitized pools with debt-to-income ratios in excess of 45. The trend was exacerbated in 2018 due to rising mortgage rates weighing on mortgage production volumes. As rates fell back during the course of 2019, pressure to keep lending standards so loose eased, and fewer high-LTV loans were delivered to the Agencies. It seems natural to ask if this pattern spills over to the loans in the STACR pools. The chart below shows the share of such loans in high-LTV STACR issues since 2013, plotted against the 30-day May DQ rate for each. A clear correlation between high dq’s and high DTI’s can be readily observed. While the Covid-19 crisis is the main contributor to rising mortgage delinquencies, underwriting standards in the form of debt ratios have an important role to play in the extent of the impact. We are not able to do the same exercise for CAS this month due to the fact CAS performance reporting has one-month delay. We will revisit this topic towards the end of June. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed