|

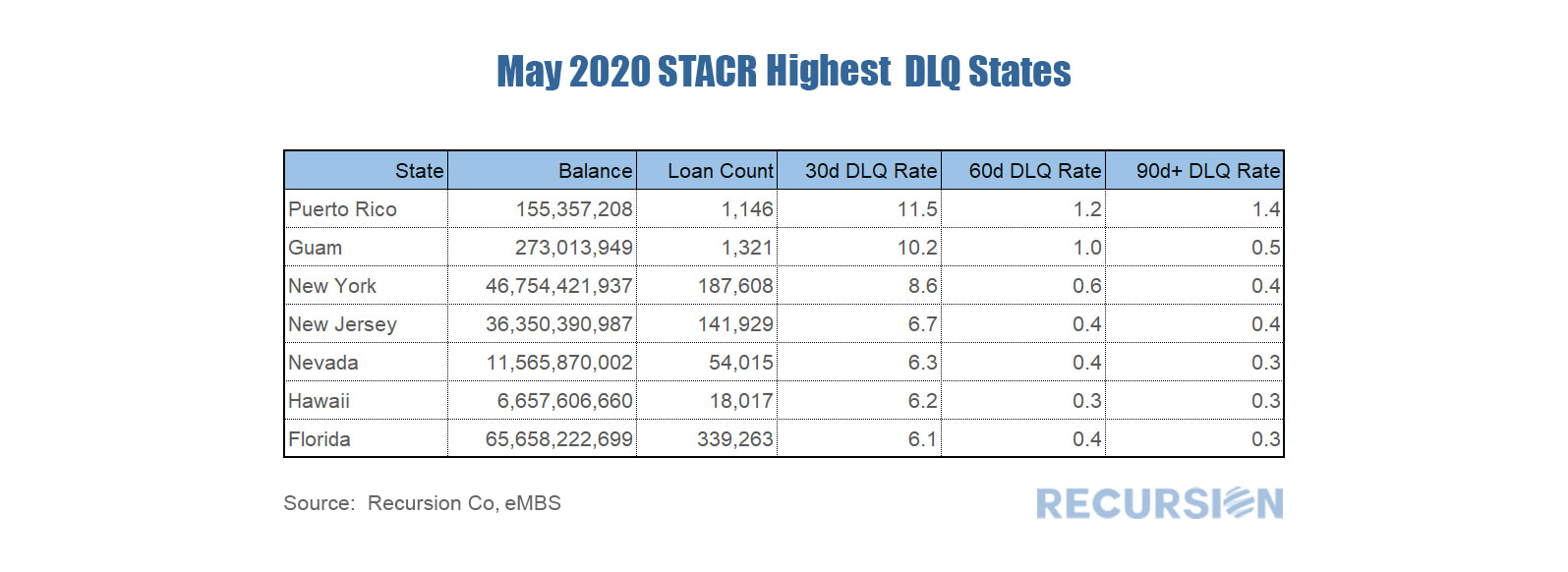

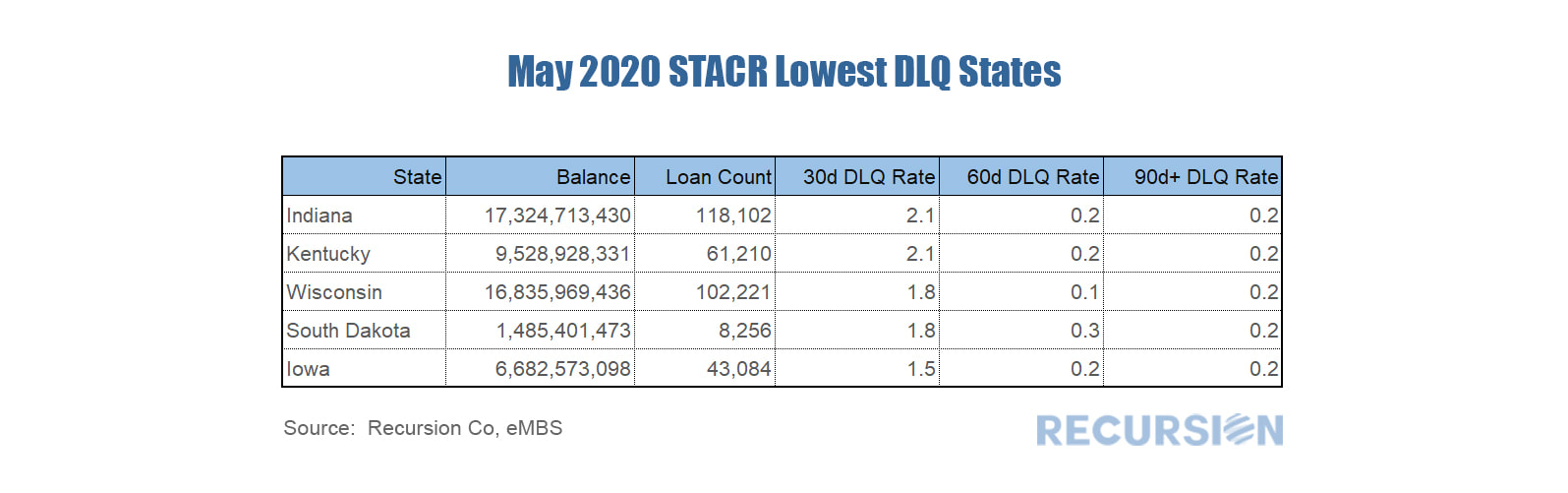

The loan-level data releases we receive early each month contain delinquency data for Government programs such as FHA and VA, but no such information is provided by the GSE’s. However, late in the month data is provided for the reference loans in the Credit Risk Sharing (CRT) programs. However, data for the most recent month is only provided by the Freddie Mac Structured Agency Credit Risk (STACR) program as the comparable Fannie Mae data is released with a 1-month lag. The latest STACR data shows the 30day delinquency rate for Freddie CRT pools went up from 0.76% in April to 4.20% this month. The states with the highest delinquency rates are: And the states with the lowest delinquency rates are: The state rankings are broadly in line with those observed in the Government data. For example, the top three states in terms of 30-day dq’s for the FHA program are New York (14.4%), NJ (13.9%) and Puerto Rico (13.2%). In general, DQ’s for FHA are higher than those for the GSE’s due to the broader credit criteria available in Government programs.

Delinquencies are important in the CRT program because they have the potential to turn into losses shared with private investors. The forbearance programs will delay but not completely prevent this transmission. The ultimate extent of investor losses depends on the duration of the Covid-19 crisis, and ensuing policy actions. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed