|

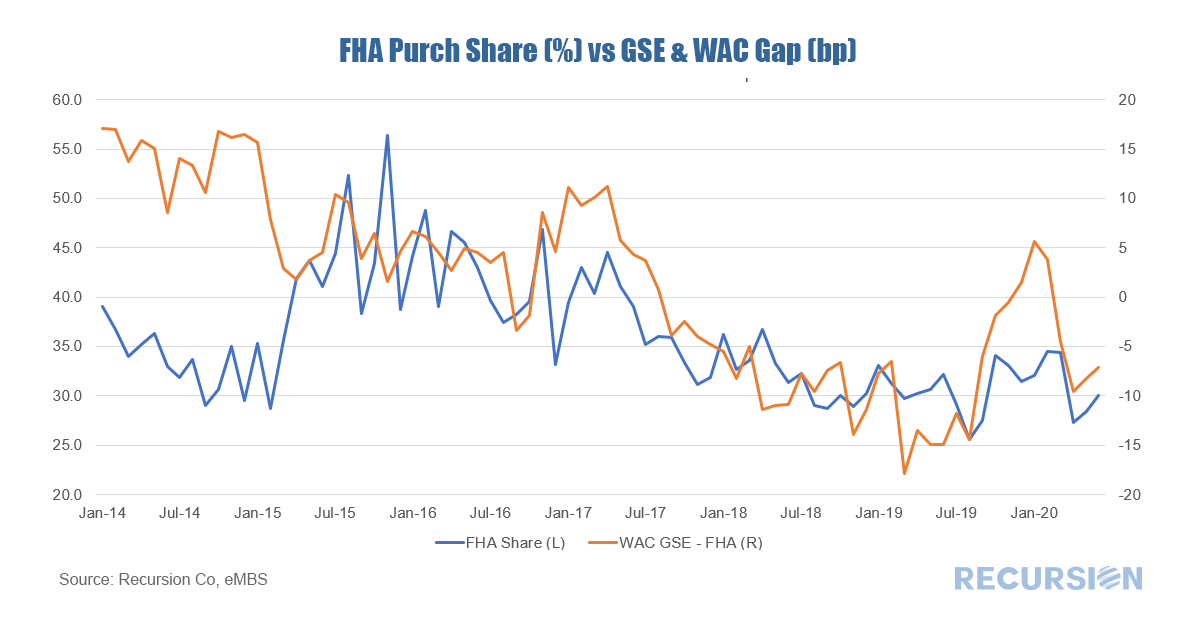

The long-raging and complex debate about housing finance policy basically boils down to two issues: first, how much risk should there be in the system, and second, who should bear it? Previous posts have addressed the use of big data in looking at the first issue by examining the trade-off between credit standards and delinquencies[1]. With regards to the distribution of risk, the topmost issue is the breakdown between the public and private sectors. This note approaches the second question by looking at the market shares of a government agency, FHA, vs that of the GSEs, which represent a mixture of public and private risk[2]. The competitiveness of one agency vs another is a multifaceted subject, as there are multiple aspects to their interaction. Among other approaches, they may compete via price (insurance fees) or via loan underwriting standards or product innovation. To launch this analysis, we just look at relative prices for purchase loans. As a proxy for price, we compare the weighted average coupon (WAC) between FHA and conforming loans in this category: [1] https://www.recursionco.com/blog/crt-dqs-and-debt-ratios

[2] It’s important to note that FHA is one of several guarantors for loans that are securitized in Ginnie Mae pools. The other major such guarantor is the Veterans Administration, which so far this year has insured about 2/3 of the dollar volume of purchase loans as FHA. The VA program has a very different structure than that of FHA, and is excluded from this analysis. Fannie Mae and Freddie Mac are both guarantor and securitizer of loans delivered to them. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed