|

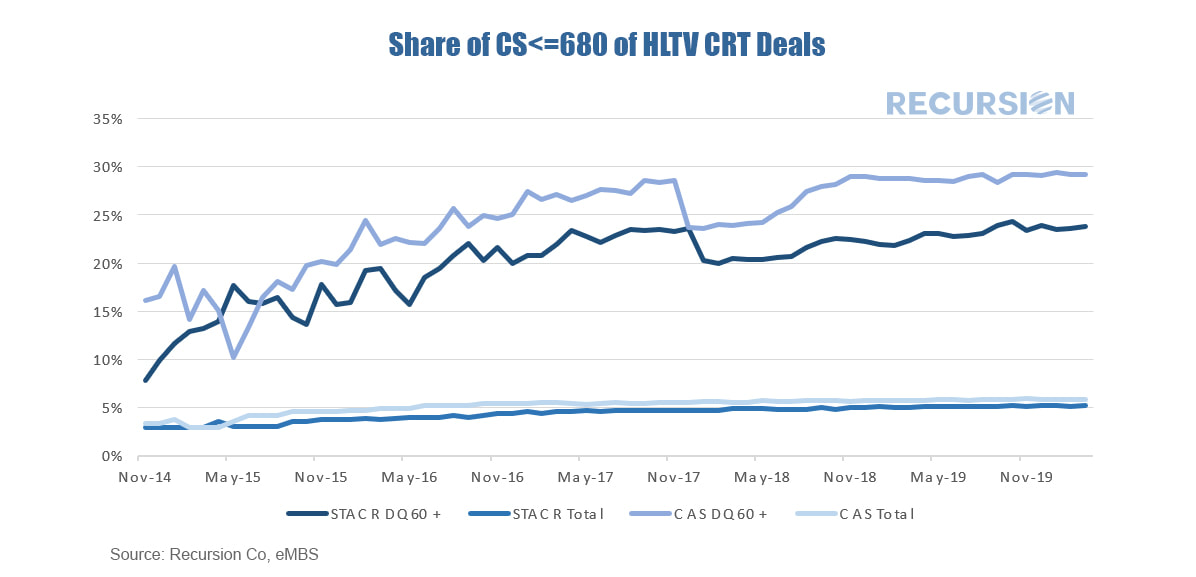

As noted in an earlier post[1] we discussed how the GSE’s have been sharing credit risk with private investors through the Credit Risk Transfer (CRT) [2]market. At that time, we discussed how losses tended to grow over time, and noted the significant geographical variation in default rates by state, reflecting local economic conditions. Another consideration noted along these lines is underwriting characteristics. This impact is particularly notable when comparing the performance of loans for lower-credit quality borrowers to others. The chart below looks at the relative performance in CRT high-LTV reference pools between those with FICO scores less and equal to 680 and those greater than that score:

During the 2008 global financial crisis, the agency multifamily CMBS (commercial mortgage backed securities) and the RMBS (residential mortgage backed securities) markets performed differently as measured by delinquency rates. For example, at the peak of the financial crisis in Feb. 2010, single family Fannie Mae loans had a 90+ day delinquency rate of 5.6% in Feb. 2010, compared with their multifamily 60+ day delinquency rate of just 0.8% in Jun. 2010. However, the historical performance cannot guarantee the same relationship will hold during the current Coronavirus pandemic. The huge surge in unemployment currently being experienced will fall equally on renters and homeowners alike. The CARES act provides forbearance to households with mortgages, but there is no such broad program for renters[1].

Recursion data featured in today's Commercial Mortgage Alert - Fed slows down purchasing siting market condition improves.

|

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed