|

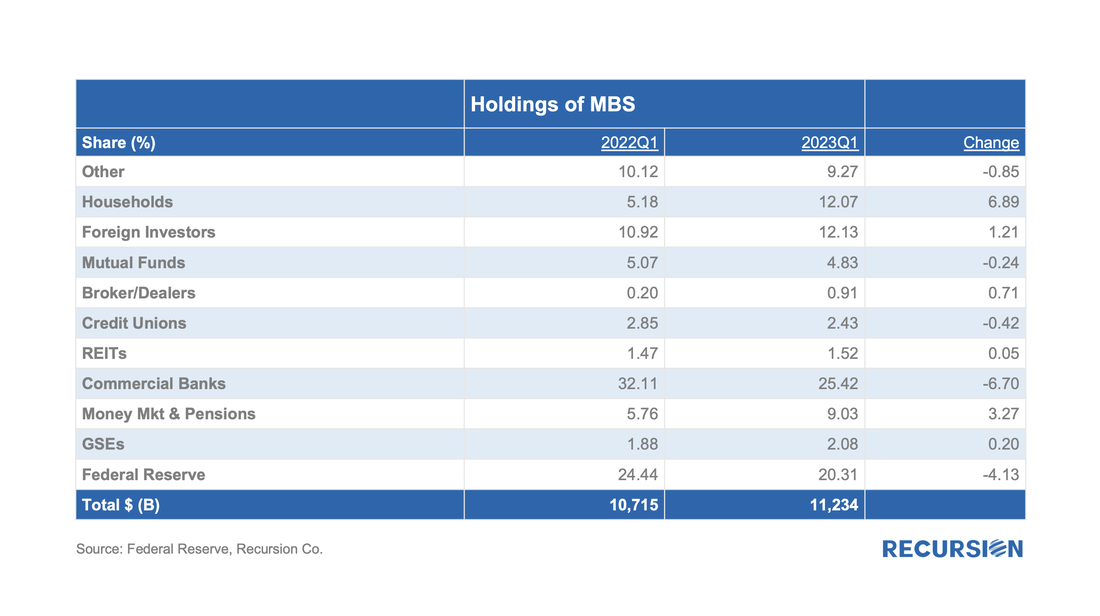

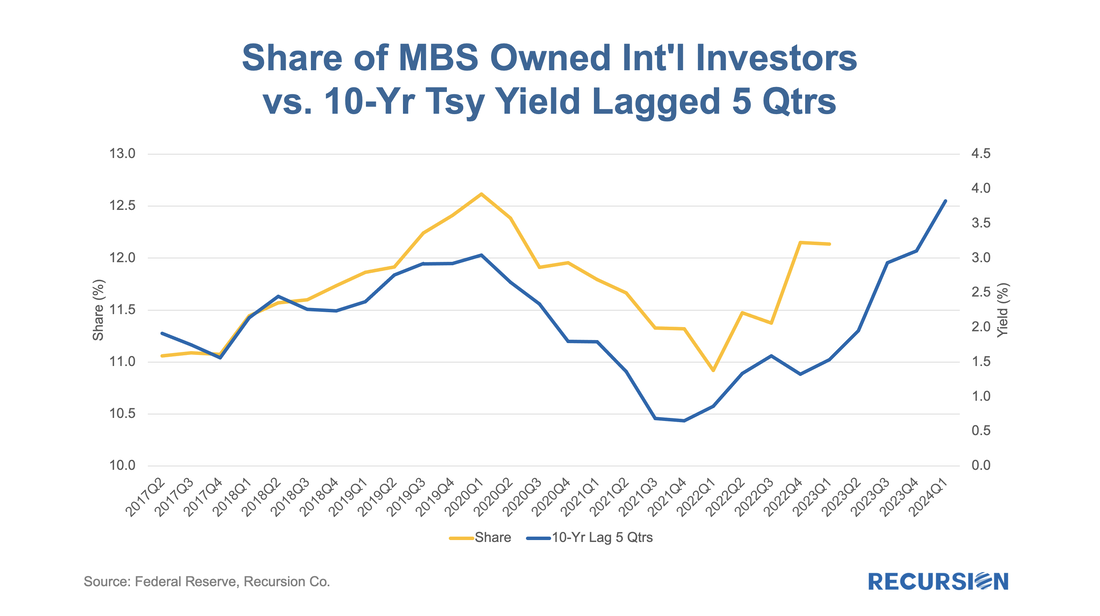

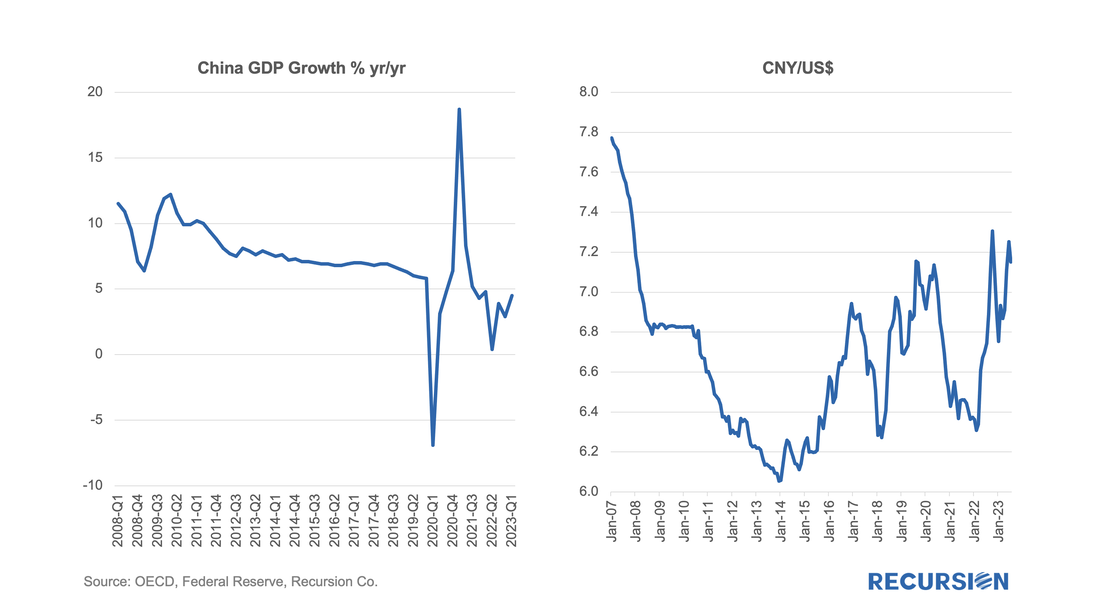

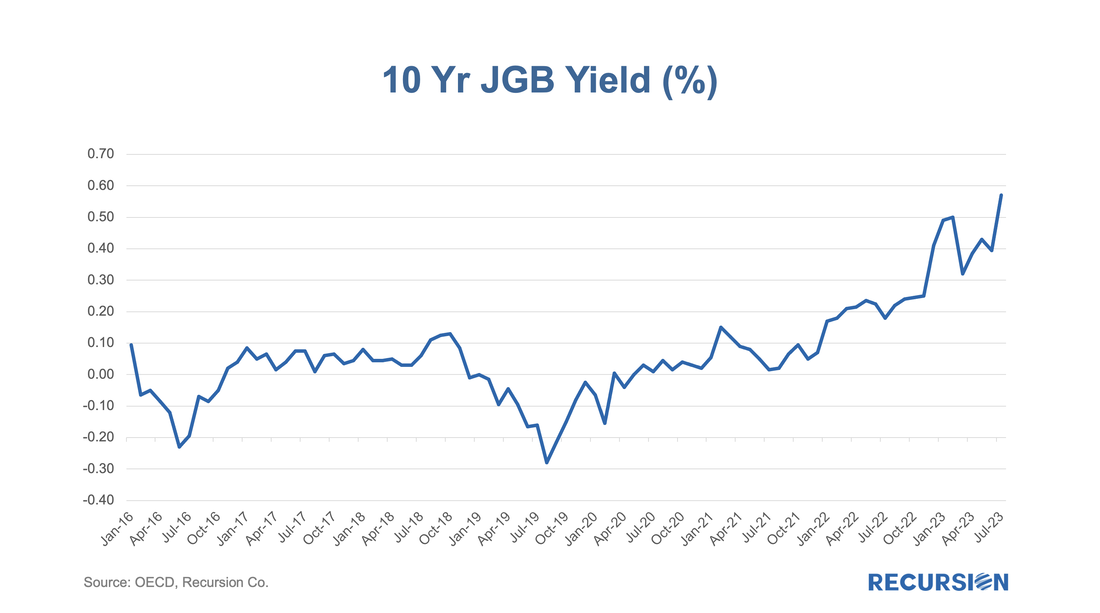

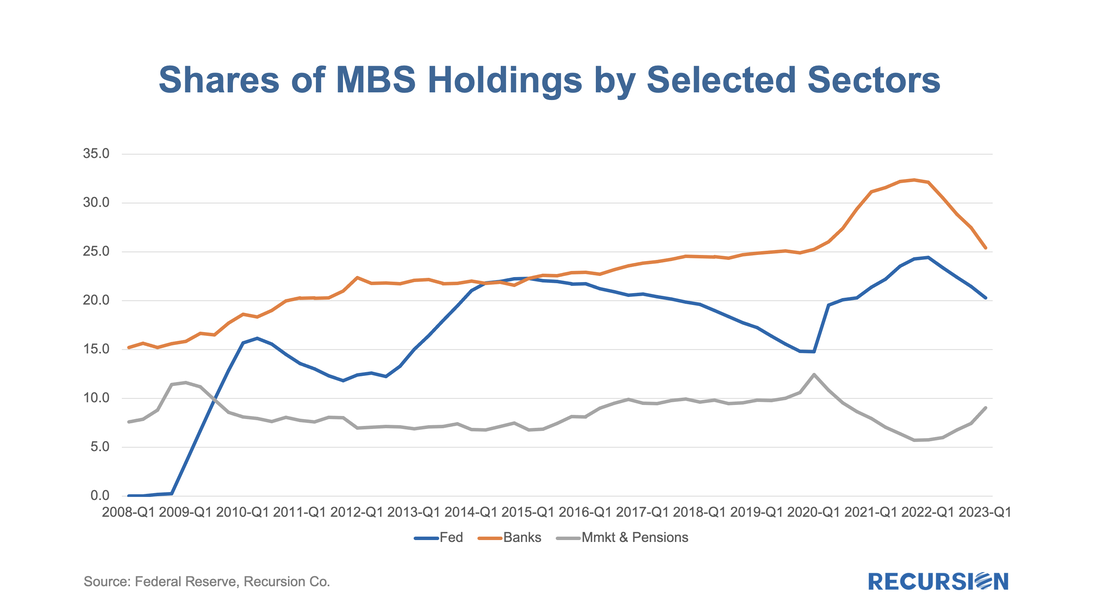

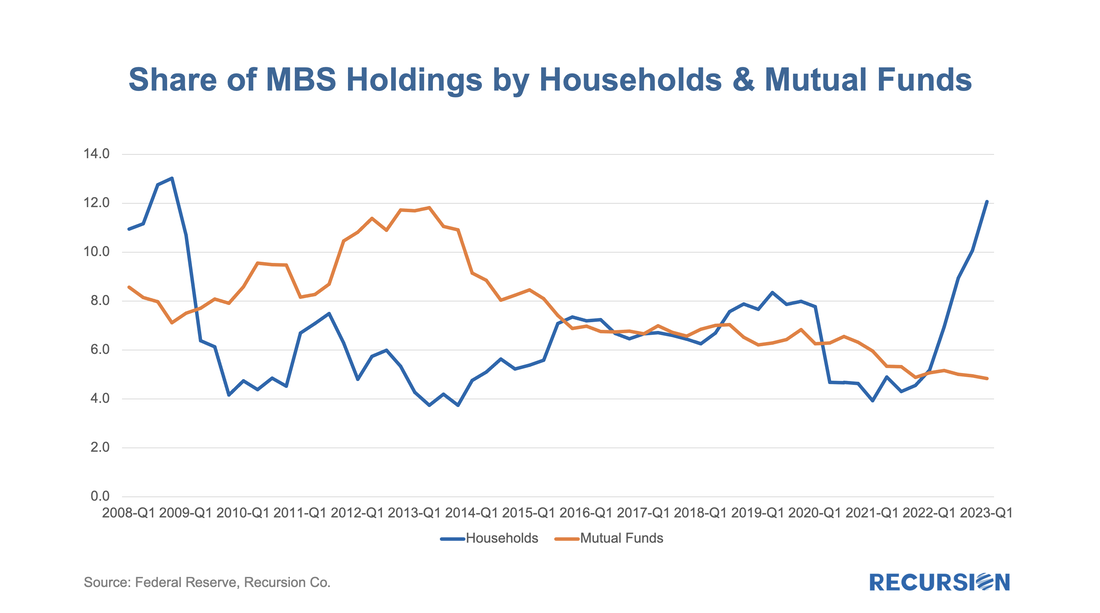

Back in April 2022, we asked the question: The Fed’s Holdings of MBS Holdings Will Decline, Who Will Buy?[1] The release of the Q1 2023 Z.1 data[2] gives us an opportunity to begin to formulate an answer. In fact, the Fed’s share of holdings of MBS peaked at just under a quarter of the market in Q1 2022 (24.4%) and stood at just over one-fifth of the market in 2023Q1 (20.3%). Below find a table breaking this down by major purchaser. There are two sectors that declined: the Fed and Banks, and two that rose: Money markets and households. There are a few comments below: International Sector The set of international investors in MBS is a complex web of public and private sector participants in developed and emerging markets. They are motivated to invest by a broad range of considerations ranging from short-term returns to currency stabilization. A lot of ink is spilled over these issues, but there is an interesting point to be made that their positions, in aggregate, are motivated to a reasonable first degree by the returns to be found in the market. Local stories matter, of course. China remains on a long-term path of decelerating growth, bordering on deflation, weighed down by debt and a slump in the real estate sector. The Yuan is near a 15-year low, and further easing measures could lead to additional currency weakness and associated trade tensions. In Japan, the Bank of Japan recently took another step in easing its Yield Curve Control policy that would allow the 10-yr JGB rate to rise. Market concerns are mounting that an acceleration in the yield could lead to widespread adverse market consequences globally, including MBS. For all this, the share of the international sector rose by just over 1% over the last year. Banks In the previous post, we noted that the shares of bank and Fed holdings are positively correlated. This is because as the Fed sells securities, the funds used by the investors that purchase them often come out of bank deposits. That remains true, but per the table above, the decline in the bank share over the last year exceeded that of the central bank by about 2.6%: The other factor responsible for the decline in the bank share is higher interest rates which act to draw funds out of depositories into private investment vehicles. Over the past year, the formula “Change in bank share = change in Fed share – change in money market & pension share” is accurate within 1%. Private Investors Most analysts, us included, have been looking for the private sector to pick up its MBS holdings as the Fed steps back. That has in fact occurred, but with an unexpected twist. Below find the shares of holdings over time for mutual funds and households[3]: The share of MBS held in mutual funds has declined steadily since 2014, with no evidence yet that higher yields are attracting more funds into this sector. The striking result is a surge in ownership by the household sector, now accounting for over 12% of the total, the highest level attained since the GFC was raging, and the integrity of the banking sector was widely questioned. In June 2022, CPI inflation was reported at 8.9% yr/yr, the highest rate since 1981. Along with ChatGPT and the metaverse, our younger readers can learn a new term: coupon clip. It was all the rage in the early ‘80s, along with “Indiana Jones”. Wait long enough and everything comes back. [1] https://www.recursionco.com/blog/the-feds-holdings-of-mbs-will-decline-who-will-buy

[2] https://www.federalreserve.gov/releases/z1/ [3] “The households and nonprofit organizations sector is the residual holder of agency- and GSE-backed securities.”https://www.federalreserve.gov/apps/fof/SeriesAnalyzer.aspx?s=LM153061705&t=L.101&suf=Q |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed