|

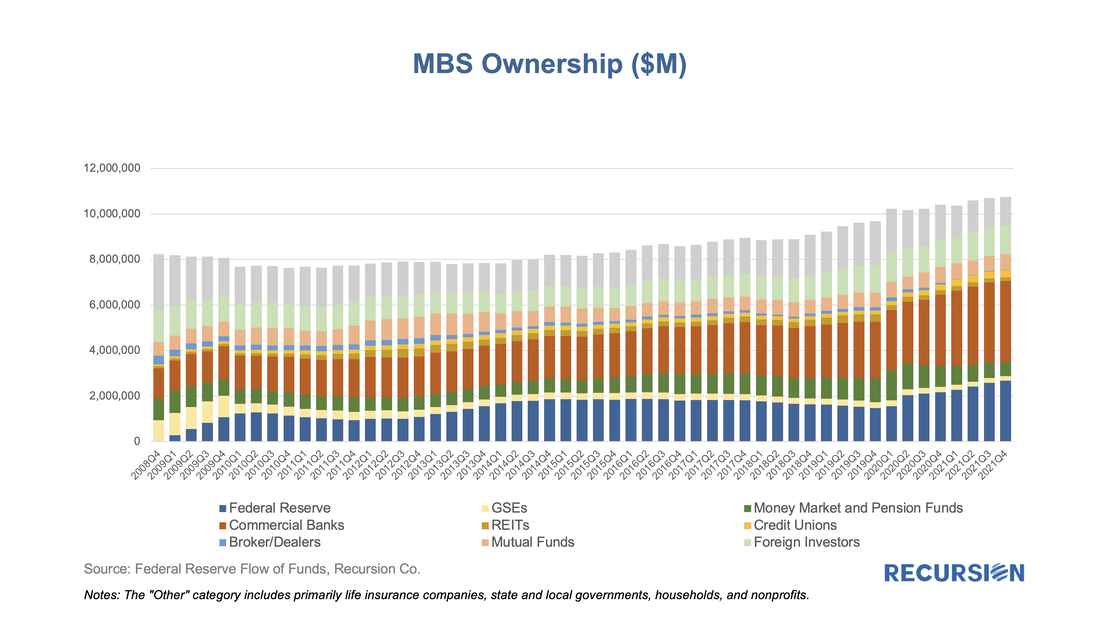

The fourth quarter of 2021 marked the 13th anniversary of the introduction of the Federal Reserve’s Quantitative Easing (QE) policy, whereby the central bank worked to push longer-term rates lower once short-term rates hit the zero lower bound. This activity largely took place via purchases of longer-dated Treasury securities and mortgage-backed securities. There were many nuances as the central bank bought securities in different proportions over time and occasionally let their balance sheet shrink as the securities they held paid off or matured. The purpose of this note is to take a big-picture view of the MBS market impact of a likely decline in Federal Reserve holdings in the Agency space as the central bank has recently indicated its intention to begin letting these securities run off its balance sheet. In particular, the FOMC statement of March 16 stated, “In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.[1]” Which we guess will be in May. What does this mean to valuations in the MBS market? Our analysis is based on the data collected on Agency MBS ownership broken down by major investor class by the Federal Reserve in the Financial Accounts of the United States[2]. This data is produced quarterly and is a broad measure of Agency securities, including not just single family Agency MBS but also Multifamily MBS and Agency Debt. Below find a chart of the progress of the Agency MBS market from Q4:2008, when the Fed launched QE, through Q4:2021. The chart nicely shows the ebb and flow of activity in this market on the part of the major players. The holdings controlled by the central bank is one example, starting at near-zero in Q4:2008 and cycling up and down, reaching a record high of almost 25% at the end of 2021. In terms of aggregate performance, when the Fed launched its program in Q4:2008, total agency MBS and agency debt outstandings stood at $8.24 trillion. The volume went into a long period of stagnation after that time due largely to the impact of the Global Financial Crisis on lender risk appetites. Total volume troughed at $7.63 trillion in Q4:2010 and did not exceed the Q4:2008 number until Q3:2015. The agency MBS and debt market grew by almost exactly $2.0 trillion over the 40-quarter period between Q1:2010 and Q4:2019. In the subsequent eight quarters, the market grew by about $1.1 trillion, testimony to the impact of the Covid-19 pandemic on household living preferences and the broad response on the part of all types of policymakers. This framework provides the basis for answering the question: who will step up as the Fed pulls back? There are endless stories to tell here, but in this note, we look into the impact of Federal Reserve purchase activity on four large investor categories:

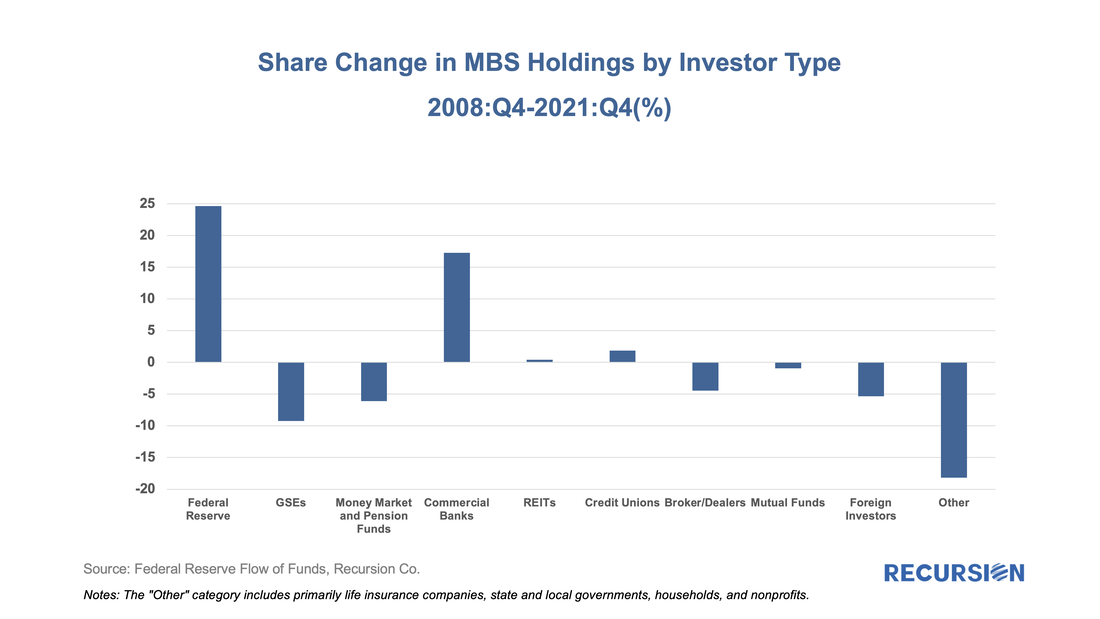

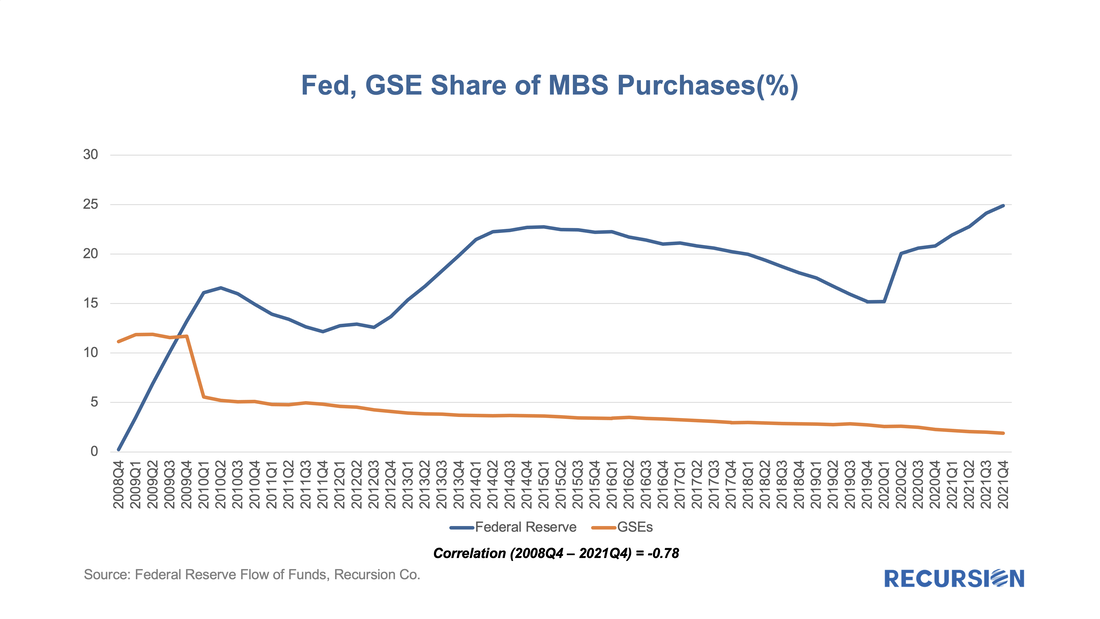

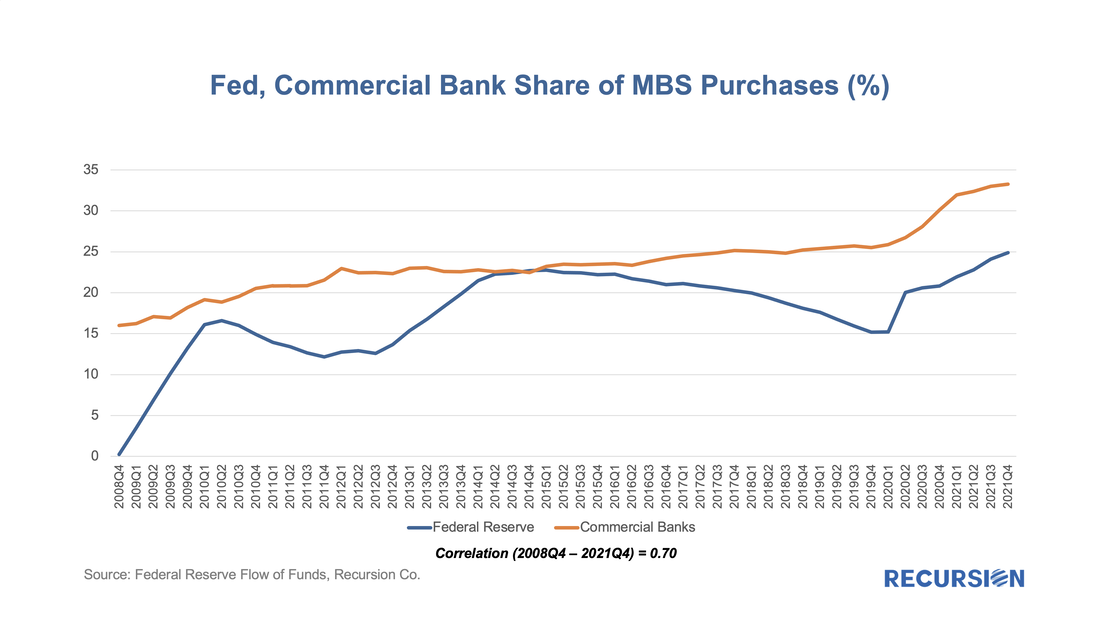

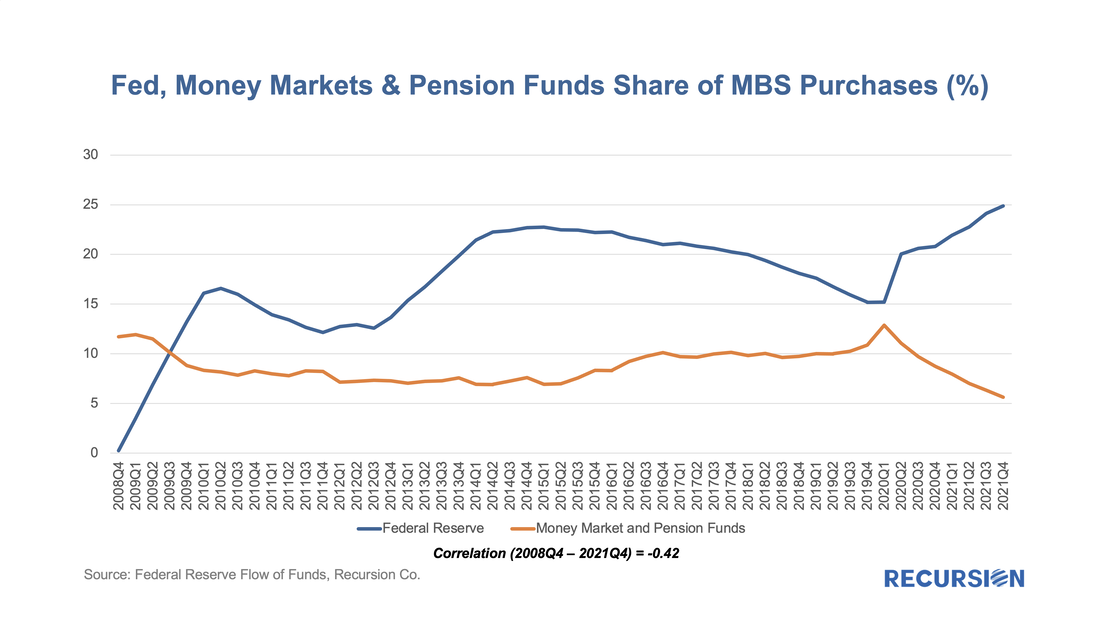

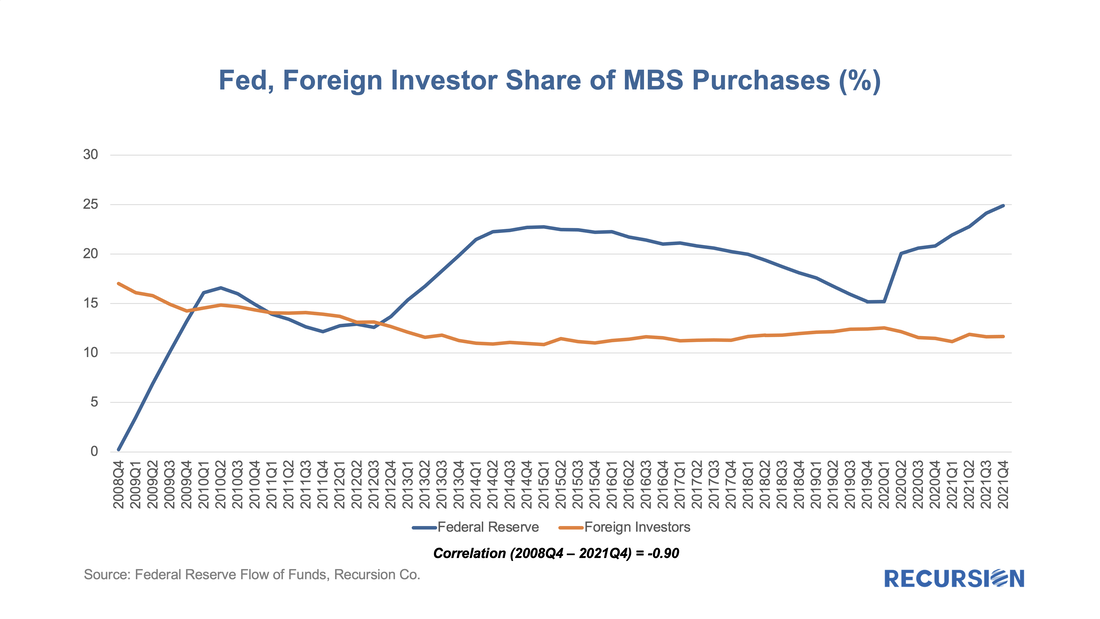

To begin, below find the cumulative change in share of holdings by category: We will now proceed to assess the potential scope of four major investor categories to increase share as the Fed steps away from the market. 1) The GSE’s In 2008Q4, The GSE share of the MBS market was 11.2%, and remained elevated at 11.7% a year later before plunging to 5.6% in 2010Q1. About half of this decline was picked up by the Fed with the rest distributed across other categories. From 2010 to 2021, the GSE share declined gradually further to its most recent reading of 1.9%. This occurred under the auspices of the terms of conservatorship and subsequent amendments to the Preferred Stock Purchase Agreements that govern the financial aspects of their relationship with Treasury and FHFA[3]. It is possible that the caps will rise temporarily as the Enterprises buy out loans associated with the expiration of forbearance programs, but there is virtually no chance that this will account for more than a tiny amount of the upcoming decline in Fed holdings in this Administration. 2) Commercial Banks The most important private market segment of Agency MBS holdings is Commercial Banks. This is the only segment whose share in Q4:2021 was bigger than the Fed’s. The analysis of the behavior of this group is extremely nuanced. The reasons behind this complexity include the fact that banks represent both supply and demand in the Agency MBS market, and that demand for mortgages can take the form either of whole loans or MBS[4]. For all this, the macro feature of the behavior of banks that stands out the most is the strong positive correlation between their MBS holdings and those of the central bank. The fact that banks tend to follow their regulator in their MBS purchase activity may seem unintuitive at first since the stated policy goal of the Fed is to lower the yield on these assets. However, the dominant channel through which monetary policy works on bank activity in MBS is via trends in bank deposits. Fed purchases of longer-dated Treasuries and MBS tend to increase liquidity in financial markets, some of which are deposited in banks and reinvested in MBS. In particular, bank deposits over the period Q1:2020 – Q4:2021 grew by over 27%[5]. The outlook for bank activity in the new monetary policy regime of a shrinking Fed balance sheet is highly uncertain, particularly given the volatile market environment for the pricing of risky assets. Nonetheless, a policy environment of draining liquidity should weigh to some degree on the purchases of MBS on the part of banks. 3) Money Market and Pension Funds This investor class is primarily driven by absolute returns, and as a result, it is not surprising that the holdings share in this class is negatively correlated with that of the Fed. In particular, about three quarters of the 9.7% increase of the Fed share from Q1 2020 to Q4 2021 was taken out of the share held by money markets and pension funds. Many market commentators point to this sector as a potential source of buying as the Fed backs out, given the sharp jump in Treasury yields. However, this is by no means assured. Given the experience of the market during the “taper tantrum” period of 2013 (when long-term interest rates rose sharply when the central bank first slowed its pace of purchases of MBS assets), there is little reason for “real money” investors such as these to catch a falling knife while the new policy regime unfolds. 4) Foreign Investors Foreign investors are often a wild card in many markets. Compared to domestic investors, international investors face many unique considerations when investing their assets. These include their local economic and market conditions, foreign exchange rates and geopolitical risks. It’s interesting to note that, in Q4:2008, foreign investors held 17% of the outstanding MBS, greater than commercial banks, money market and pension funds, and the GSE’s. It seems that foreigners had deep participation in the US housing bubble. When the bubble burst, the share gradually fell to 10.9% in Q1: 2015 and has stayed in a narrow 11.0%-12.5% range ever since. Looking forward, a strong dollar in high interest rate environment obviously would encourage foreign investment into agency MBS. However, the outlook here is particularly murky given fundamental factors such as the reworking of global supply chains as well as the current heightened state of geopolitical risk. Looking across these major asset classes, the most likely purchasers of MBS are real money investors, but it is far from certain that they will make up for falling holdings on the part of the Fed and commercial banks. In terms of the potential impact on mortgage rates, the other factor to take into account is likely falling demand as rate hikes deter buyers and slow the pace of refinancings. The magnitude of this factor is beyond the scope of this analysis, but investors and analysts cannot simply assume that the handoff from the central bank to private investors will be smooth. [1] https://www.federalreserve.gov/newsevents/pressreleases/monetary20220316a.htm

[2] See table L.211 in https://www.federalreserve.gov/releases/z1/ [3] https://www.fhfa.gov/Conservatorship/Pages/Senior-Preferred-Stock-Purchase-Agreements.aspx [4] See https://www.recursionco.com/blog/banks-are-important-to-the-mortgage-market-part-1 and https://www.recursionco.com/blog/banks-hang-on-to-mortgages-but-reduce-risk [5] https://fred.stlouisfed.org/series/DPSACBW027SBOG#0 |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed