|

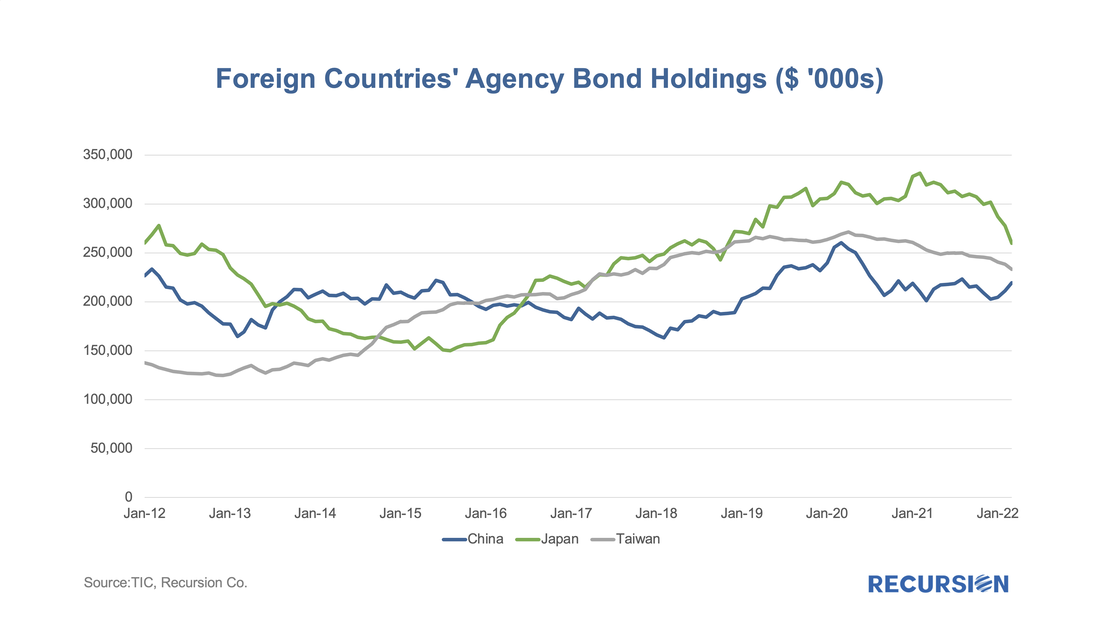

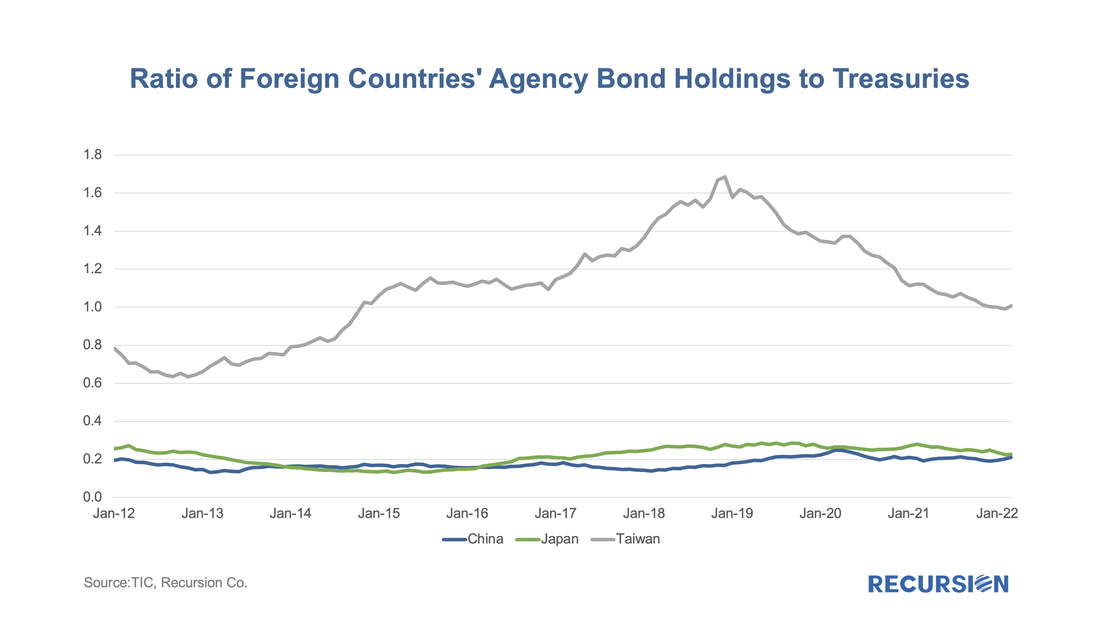

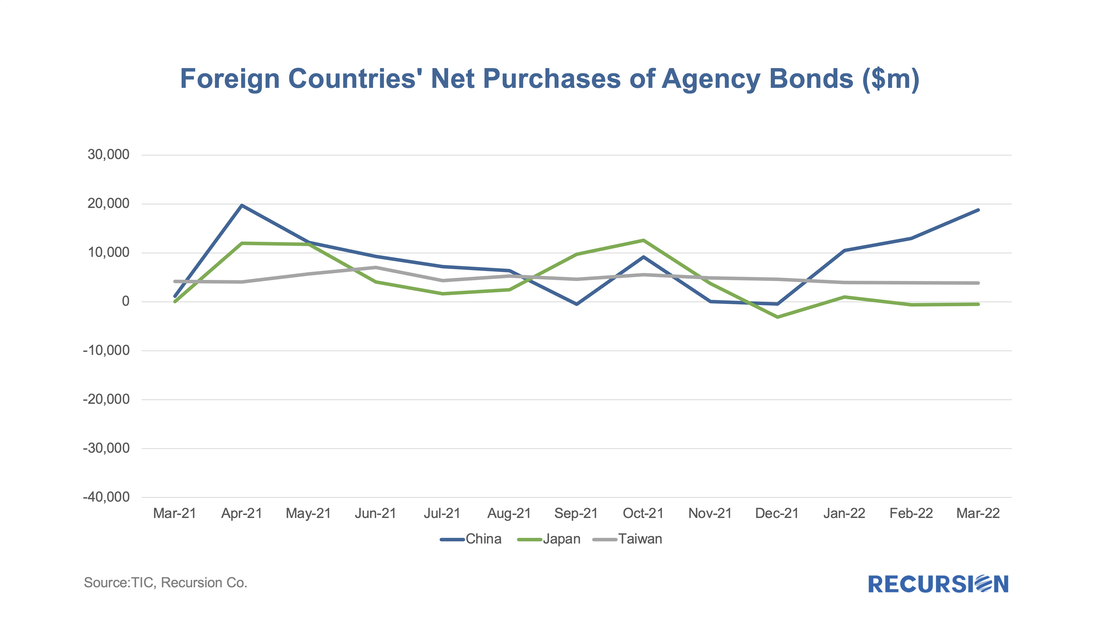

Recently we commented on the potential for various investor market segments to increase their holdings of MBS as the Federal Reserve winds down its portfolio[1]. An interesting category is foreign investors. At the end of 2018, when the Fed initiated its QE program, foreign investors held about 17% of outstanding MBS, and this has fallen to a little less than 12% at present. Most of the decline occurred in the wake of the global financial crisis when mortgage-related securities were revealed to be riskier than generally believed. As noted in that post, there are many considerations facing foreign investors in US securities that do not weigh as heavily on domestic money managers. These include foreign exchange risk, local market conditions, and geopolitical risk. To gain a better understanding of the underlying behavior behind the trends in overseas asset holdings, we turn to another data set, the Treasury International Capital (TIC) data. This data provides balances and transactions of overseas holdings and transactions by country and asset class, including MBS[2]. This note looks at recent developments in this regard for three key Asian economies: China, Japan and Taiwan. The following chart provides a picture of the value of MBS holdings for each of these three countries back to 2012: The ebb and flow in the value reflect both the changes in the valuation of the portfolios over time due to financial factors such as interest rates, as well as to security transactions over time. The way that fundamental factors impact portfolio valuations may differ between countries due to differences in portfolio characteristics such as durations of holdings. A remarkable observation is that the biggest holder of MBS among these countries is Taiwan, a country with a population of just under 24 million. One way to scale these holdings is to look at the multipliers of MBS holdings to Treasuries, which serve as a benchmark in the fixed income space. Here we see that Taiwan has held a greater value of MBS in its portfolio than Treasuries for most of the last seven years, compared to just 20% of the Treasury holdings for both Japan and China. To complete the picture, we look at transactions in MBS by country over the past year: The standout here is China, which has been adding to its MBS portfolio over the past few months, while Japan and Taiwan have posted few transactions. A tentative conclusion is that so far, neither inflation risk or house price risk or heightened geopolitical risk is leading to a wholesale exit from the MBS market on the part of foreign investors. In fact, China is adding. Watching how this plays out over time is a key factor for investors and policymakers to consider as the Fed begins its portfolio reduction program this month. [1] https://www.recursionco.com/blog/the-feds-holdings-of-mbs-will-decline-who-will-buy [2] https://home.treasury.gov/data/treasury-international-capital-tic-system Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed