|

Financial support for rural communities has been a feature of US economic policy since the Farm Credit System was established as the first GSE in 1916[1], sixteen years before the Federal Home Loan Banks were established in 1932[2]. This support continues to this day and has expanded to encompass additional programs. Ginnie Mae Program While the best-known collateral for Ginnie Mae securities is loans underwritten through the FHA and VA programs, another form is loans underwritten by the US Department of Agriculture Rural Development (RD) Program, launched in 1990 as part of the Farm Bill passed that year[3]. The Single-Family Direct Home Loan Program[4] in particular is designed to provide payment assistance to low- and very-low-income households in rural communities. Of course, FHA and VA provide loans in rural areas under the terms of their programs as well. GSE Rural Lending Single-family lending at Fannie Mae and Freddie Mac was handed a mandate to provide liquidity to rural communities through the adoption of the Duty-to-Serve provision of the HERA Act enacted in 2008[5]. This program requires the GSE’s to engage in activities to facilitate liquidity in three underserved markets:

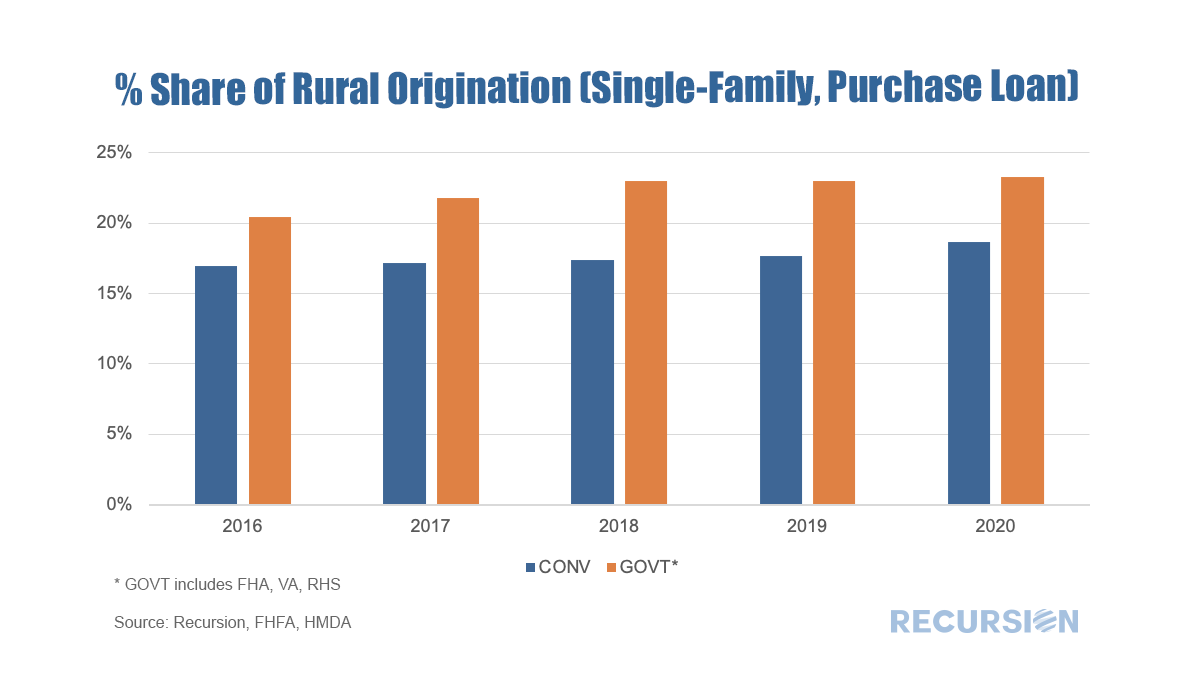

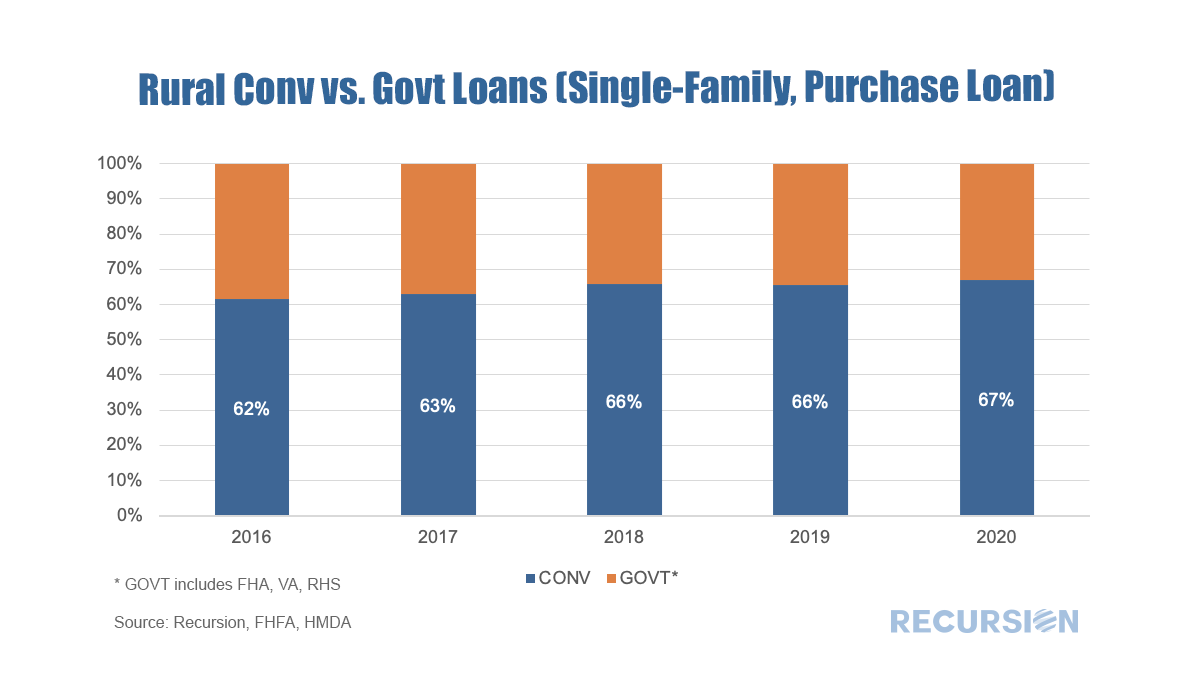

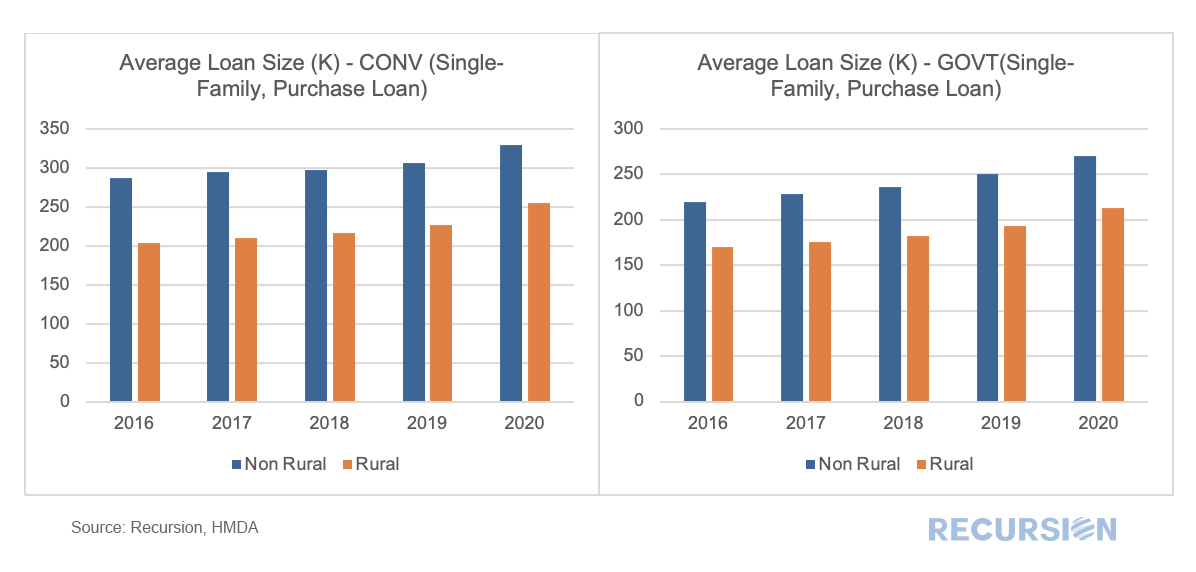

A key feature of this regulation is that FHFA has provided new datasets and tools to enhance the analysis of these markets[6]. In particular, Rural Areas FHFA's Duty to Serve regulation defines "rural area" as: (1) a census tract outside of a metropolitan statistical area, as designated by the Office of Management and Budget; or (2) a census tract in a metropolitan statistical area, as designated by the Office of Management and Budget, that is outside of the metropolitan statistical area's Urbanized Areas as designated by the U.S. Department of Agriculture's Rural-Urban Commuting Area Code #1, and outside of tracts with a housing density of over 64 housing units per square mile for USDA's RUCA Code #2. Below is a link to the specific geographies which meet the Rural Areas definition. Using this segmentation, we are now in a position to load their definition into our databases and look at trends in this market segment. Using HMDA data as a base, we produce the following chart[7]: In general, the shares of rural origination for both conventional and government loans are growing steadily. Looking at the share of the rural market: Similar to the pattern we have seen in recent posts about the overall FHA share declining [8], we see the GSE’s making inroads in the purchase market in rural areas. Finally, we can look at trends in loan sizes by category: Loan sizes in rural and non-rural areas have been increasing, but while the ratio between rural and non-rural loan sizes was relatively steady from 2016-2019, in 2020 we saw the ratio increase by 1.4% for GNM programs, and 3.4% for the GSE’s. Another sign of the pandemic sparking a flight to less congested areas, and more testimony to the analytic power of big data, even for lending programs that have received public support for more than a century. [1] https://farmcredit.com/about

[2] https://fhlbanks.com/about-us/ [3] https://www.rd.usda.gov/programs-services/all-programs/single-family-housing-programs [4] https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-direct-home-loans [5] https://www.fhfa.gov/PolicyProgramsResearch/Programs/Pages/Duty-to-Serve.aspx [6] https://www.fhfa.gov/DataTools/Downloads/Pages/Duty-to-Serve-Data.aspx [7] Shares in this post are calculated using loan count. [8] https://www.recursionco.com/blog/the-underwriting-dynamics-behind-the-fha-purchase-market-share |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed