|

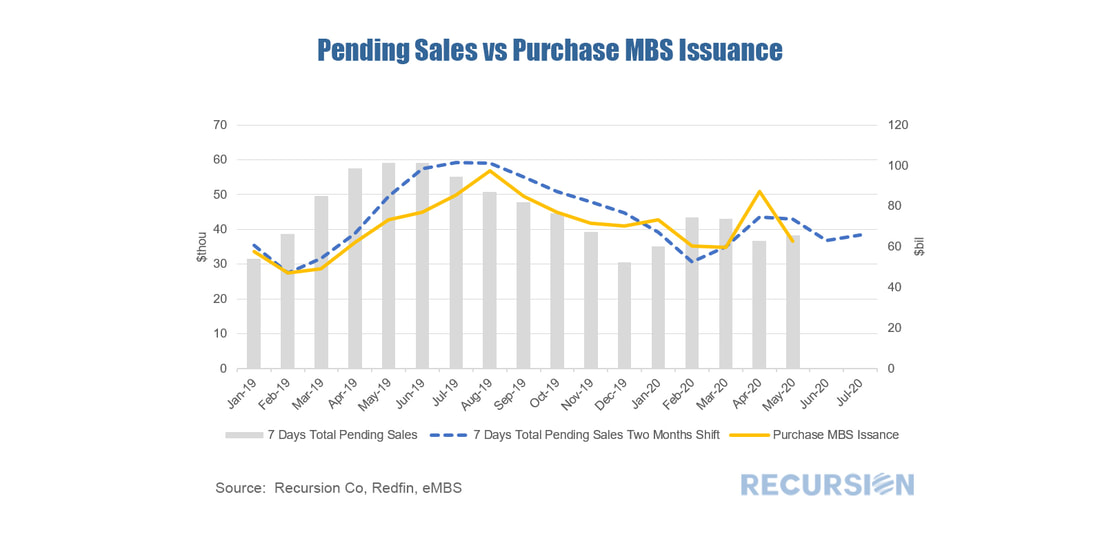

As stay-at-home orders commenced in most of states during the Covid-19 pandemic, home sales have been heavily impacted. A good timely indicator of home sales is Redfin pending sales. Monthly average seven-days total pending sales, which measure the number of total homes that went under contract in the prior seven days[1], show normal home sales seasonal patterns from Jan 2019 to Feb 2020. However, the number suddenly declined about 14% from 42,978 in Mar 2020 to 36,794 in Apr 2020[2], reflecting the big hit caused by the pandemic. What will MBS issuance look like in the near future? Using our powerful data analytics tool Cohort Analyzer, we easily summarized the Agency (GNM, FNM, FHL) MBS Issuance for home purchases from Jan. 2019 to May 2020(month to date as of the 15th business day of the month). The chart below shows the clear leading relationship between pending sales and over MBS purchase issurance. Thus, we can expect that the decline we observed in pending sales in April is likely to show somewhat softer MBS purchase issurance in the early summer. Continued record-low interest rates, perhaps combined with gradual reopening in some states, should we help to support purchase issuance as the summer progresses. However, given the uncertainty surrounding the reopening process, it is still to early to be confident that the impact of the Covid-19 virus on the housing market and purchase mortgage production has formed a bottom. [1] The number excludes homes that were on the market longer than 90 days.

[2] Data provided by Redfin, a national real estate brokerage. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed