|

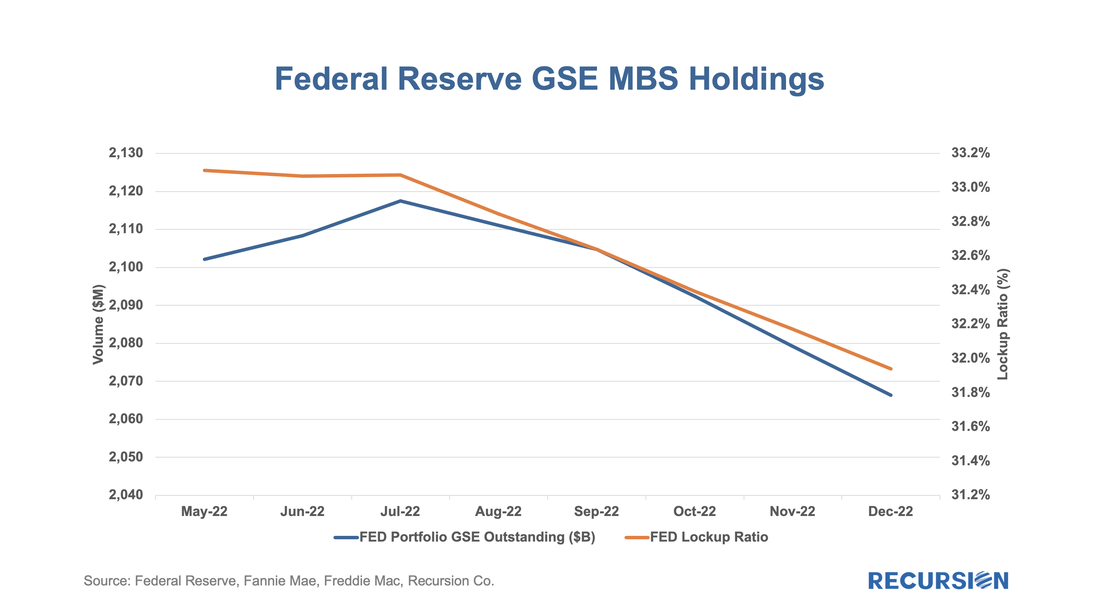

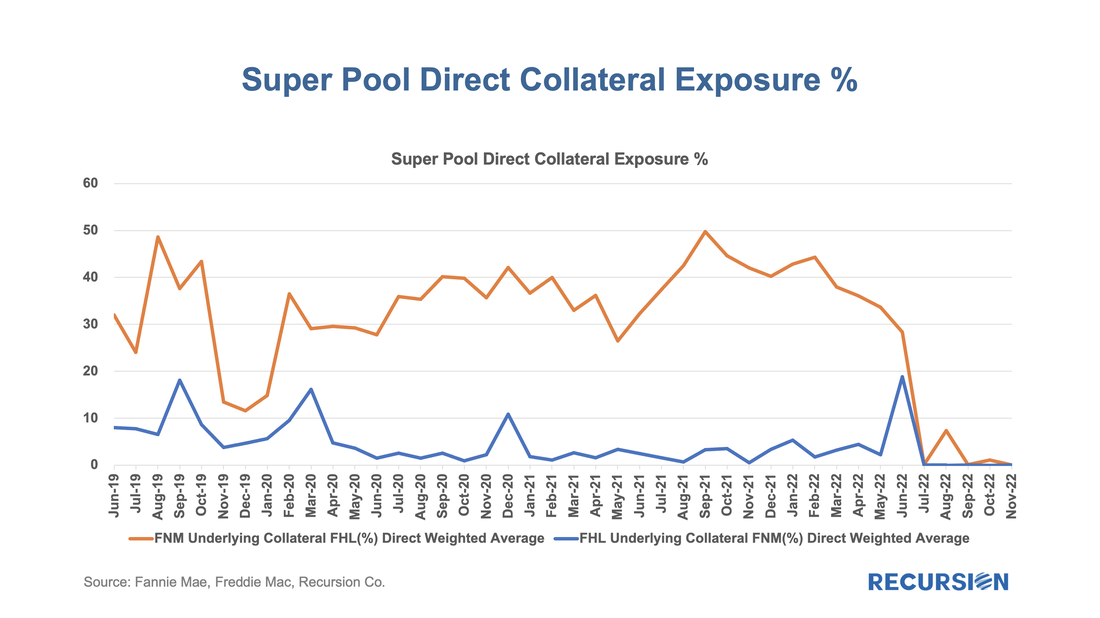

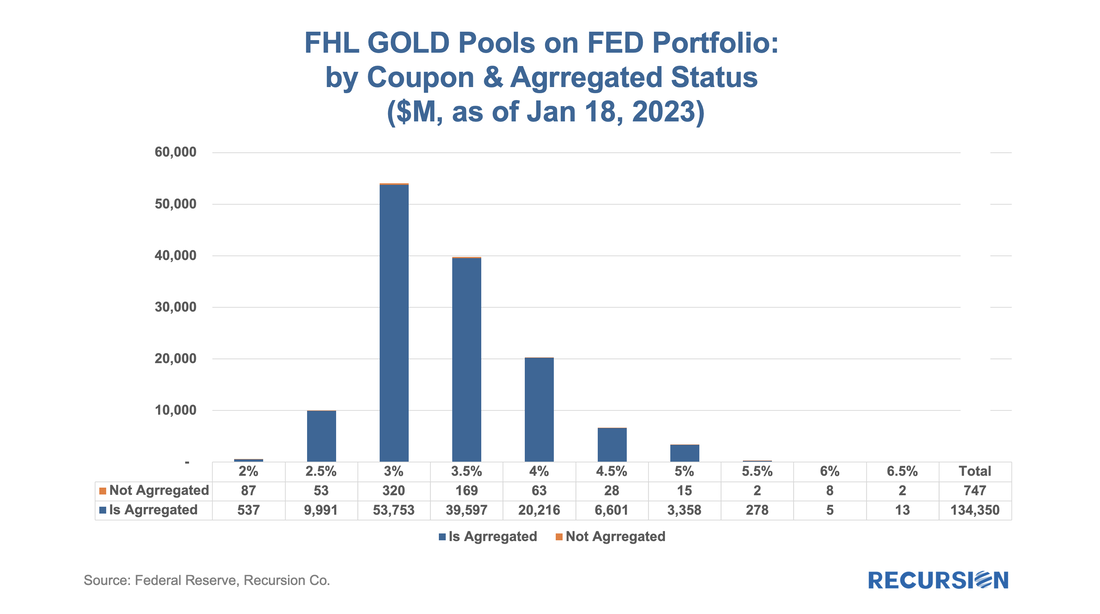

It is well known that since June 1, 2022, the Federal Reserve has allowed MBS to mature off its balance sheet without replacement[1]. Consequently, the portfolio has declined, but at a very modest pace since high-interest rates have eliminated most of refinance activities: As can be seen, the Fed's GSE holdings have declined, with the share of balances held by the central bank falling by a modest 1.2% from May 31, 2022, to 31.2% at the end of 2022. Shortly after the policy was implemented, the two Enterprises announced that they would impose a 50-basis point fee on Supers and REMIC securities that commingle Fannie Mae and Freddie Mac UMBS collateral[2] as of July 1, 2022. As one might expect, the volume of such transactions declined. The chart below looks at this from the perspective of direct exposures. The chart for exploded exposures looks quite similar and is therefore not included: Previously, we have written about the characteristics of the MBS Fed holdings and how these compare to the overall market[3]. In October, the Fed announced that it would be consolidating its holdings in order to "reduce administrative costs and operational complexity"[4]. They call this process "CUSIP consolidation." There is this interesting statement: "The Desk will aggregate the Freddie Mac MBS held in the SOMA that were issued prior to June 2019 and have a 45-day payment delay. These Freddie Mac MBS are not eligible to be commingled with 55-day payment delay UMBS in an aggregated CUSIP. Fannie Mae securities issued prior to June 2019, and both Fannie Mae and Freddie Mac securities issued after June 2019 have 55-day payment delays and are eligible for commingling and will not be aggregated at this time." Note that as these legacy securities are not UMBS eligible, this commingling activity is not subject to the 50 basis point fee. Below find a summary table of how this activity has impacted the central bank's portfolio: So far, the central bank has aggregated $134.3 billion in Freddie Gold securities, leaving just $747 million available. So the new pools are just about 6.5% of the entire central bank’s GSE portfolio. We note that the coupon distribution of the new securities is very close to the underlying pools. The question we are facing at the present moment is: what now? As it turns out, on January 19, FHFA announced it will be cutting the commingling fee from 0.50% to 0.09375% beginning April 1, 2023[5]. In its original statement, the Fed stated that once it had depleted the supply of Freddie Golds to aggregate that "…decisions about any additional aggregations will be communicated at a future date.[6]" Indeed. Any such communication will be very interesting. Will the Fed just go ahead commingling other securities and pay a 0.5% tax to the GSE regulator? Will it wait until April when the fee goes down? Or something else altogether? It's interesting to read the statements of the two entities and realize they are talking about similar topics while never mentioning the other. Again, in its original statement[7], the Fed tells us that "No inferences should be drawn about future monetary policy actions from these aggregations." We have no reason to doubt this statement, but it is certainly the case that should the Fed decide to someday outright sell its holdings of MBS it will be much easier to implement starting from a position of a large portfolio with few CUSIPs. [1] https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm

[2] https://capitalmarkets.fanniemae.com/mortgage-backed-securities/new-fee-structure-certain-structured-transactions and https://capitalmarkets.freddiemac.com/mbs/docs/f411news.pdf [3] https://www.recursionco.com/blog/rolling-vs-selling-off-the-feds-portfolio [4] https://www.newyorkfed.org/markets/opolicy/operating_policy_221006 [5] https://www.fhfa.gov/Media/PublicAffairs/Pages/Statement-from-FHFA-Director-Sandra-Thompson-on-Reduced-Upfront-Fee-for-Commingled-Enterprise-Securities.aspx [6] Ibid, footnote 4 [7] Ibid, footnote 4 |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed