|

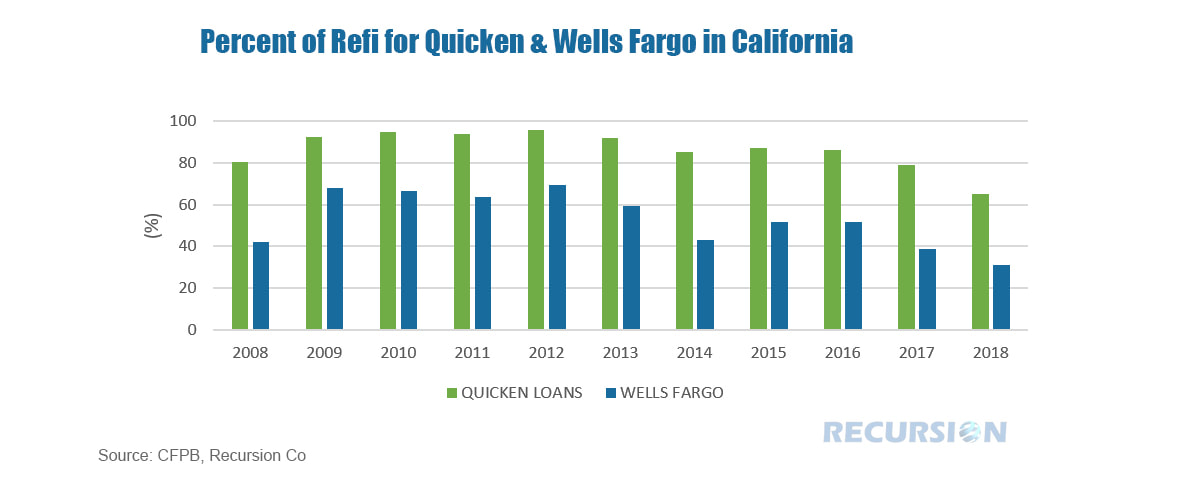

On April 7, 2020 our CEO Li Chang was invited to speak as an industry expert at a graduate-level finance class at the Gabelli School of Business at Fordham University. Students were also given free access to the Recursion Analyzers to help them monitor the current mortgage market trend using big data tools. Students were introduced to the problem of understanding the role of new mortgage fintech lending based on the use of loan-level data on U.S. mortgage applications and originations reported to their regulators according to the Home Mortgage Disclosure Act (HMDA). HMDA data is a truly big dataset. It has 500 million records, including data on 350 million originated or purchased loans. HMDA contains many comprehensive data points. For instance, it has the loan type and purpose, the borrowers’ race, income, loan amount, year, census tract, and the originating bank’s identity, among others. Our HMDA Analyzer not only has a user friendly and intuitive interface, but also has pre-calculated data points available that can benefit all users, such as data analysts, traders, regulators and academics for research and teaching purposes. An example application can be seen in the chart below comparing the refinance share of originations in the state of California between a traditional bank (Wells Fargo) and a fintech lending company (Quicken Loans). Quicken’s refinance share is consistently higher than that of Wells Fargo because of the ease of use and efficiency of fintech lenders. This advantage is less effective for purchase mortgage lending, which often involves more personal contact by its nature.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed