|

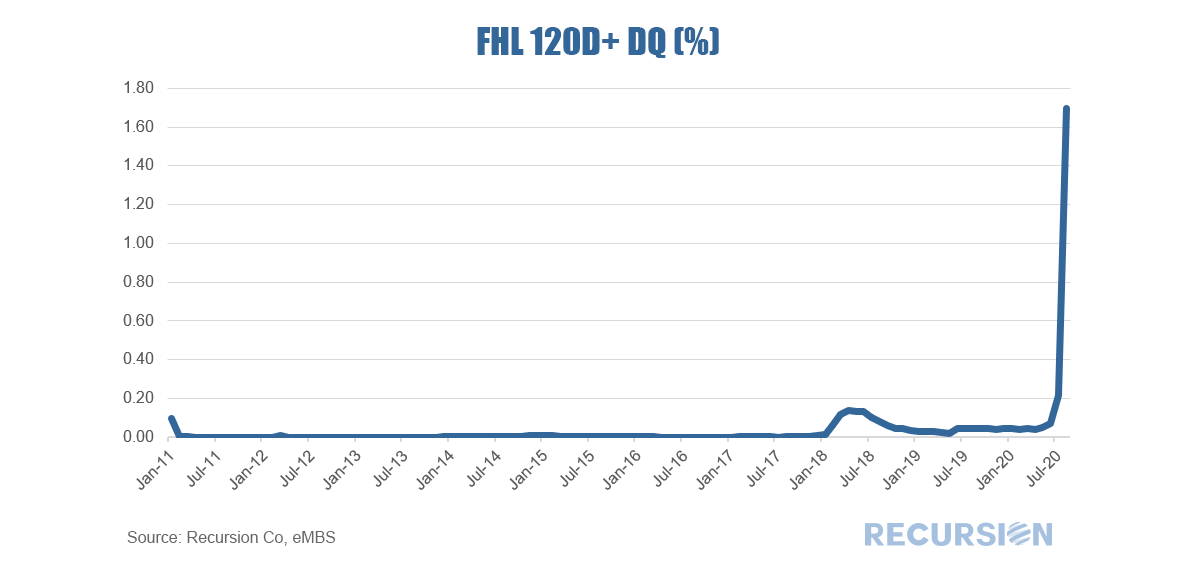

One ongoing theme from these notes is that the COVID-19 crisis is resulting in policy actions that impact behaviors across the MBS production pipeline. One of these has to do with a change in the loan buyout policy from pools issued by the GSEs. Previously, general policy was to purchase loans out of pools that had become four months delinquent[1]. However, with the onset of the crisis, delinquent loans in forbearance programs remain in pools as long as this status is maintained[2]. Consequently, last week’s release of pool data by Freddie Mac gives us the opportunity to look at the share of loans that are 120D+DQ (as April was the first month in which the impact of COVID-19 became significant). Besides allowing us to track the magnitude of loans that have been delinquent for an extended period, this data allows us to make inferences about shifts in the composition of the burden of covering P&I costs between sectors for loans in forbearance. As we have written previously[3], this cost burden shifts from the servicers to the GSEs after four months of missed payments. Consequently, starting next month servicers will see costs related to loans that have missed payments for such a period move off their plates and onto those of Fannie Mae and Freddie Mac. Insofar as the volume of loans beginning to miss payments is less than those which have missed more than four months payments, the aggregate cost burden on servicers may fall. Consequently, upward pressure on the mortgage spread over Treasuries may have scope to ease. Of course, these costs don’t disappear; they merely get transferred to the taxpayers. Another potential flashpoint in our volatile age. [1] See, for example, Appendix D, p. 3 http://www.freddiemac.com/mbs/docs/single_security_update.pdf

[2] See p. 8 http://www.freddiemac.com/mbs/docs/single_security_update.pdf [3] https://www.recursionco.com/blog/can-mortgage-rates-fall-below-3 |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed